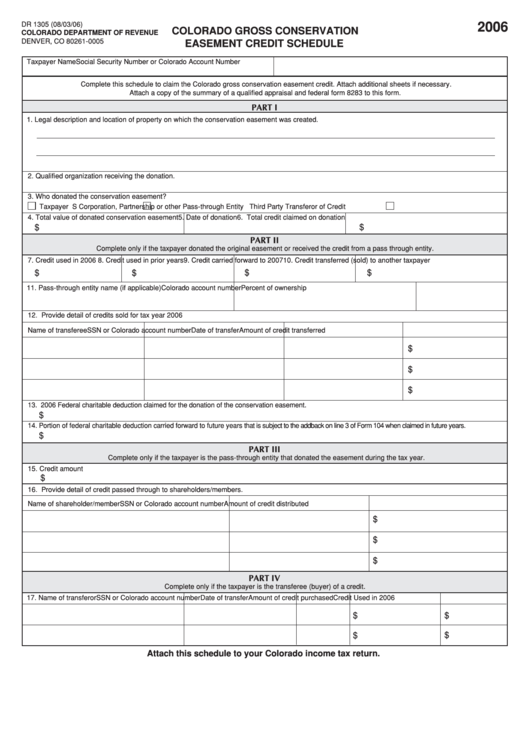

DR 1305 (08/03/06)

2006

COLORADO GROSS CONSERVATION

COLORADO DEPARTMENT OF REVENUE

DENVER, CO 80261-0005

EASEMENT CREDIT SCHEDULE

Taxpayer Name

Social Security Number or Colorado Account Number

Complete this schedule to claim the Colorado gross conservation easement credit. Attach additional sheets if necessary.

Attach a copy of the summary of a qualified appraisal and federal form 8283 to this form.

PART I

1. Legal description and location of property on which the conservation easement was created.

2. Qualified organization receiving the donation.

3. Who donated the conservation easement?

Taxpayer

S Corporation, Partnership or other Pass-through Entity

Third Party Transferor of Credit

4. Total value of donated conservation easement

5. Date of donation

6. Total credit claimed on donation

$

$

PART II

Complete only if the taxpayer donated the original easement or received the credit from a pass through entity.

7. Credit used in 2006

8. Credit used in prior years

9. Credit carried forward to 2007

10. Credit transferred (sold) to another taxpayer

$

$

$

$

11. Pass-through entity name (if applicable)

Colorado account number

Percent of ownership

12. Provide detail of credits sold for tax year 2006

Name of transferee

SSN or Colorado account number

Date of transfer

Amount of credit transferred

$

$

$

13. 2006 Federal charitable deduction claimed for the donation of the conservation easement.

$

14. Portion of federal charitable deduction carried forward to future years that is subject to the addback on line 3 of Form 104 when claimed in future years.

$

PART III

Complete only if the taxpayer is the pass-through entity that donated the easement during the tax year.

15. Credit amount

$

16. Provide detail of credit passed through to shareholders/members.

Name of shareholder/member

SSN or Colorado account number

Amount of credit distributed

$

$

$

PART IV

Complete only if the taxpayer is the transferee (buyer) of a credit.

17. Name of transferor

SSN or Colorado account number

Date of transfer Amount of credit purchased Credit Used in 2006

$

$

$

$

Attach this schedule to your Colorado income tax return.

1

1