Form Pt-102 - Tax On Diesel Motor Fuel

ADVERTISEMENT

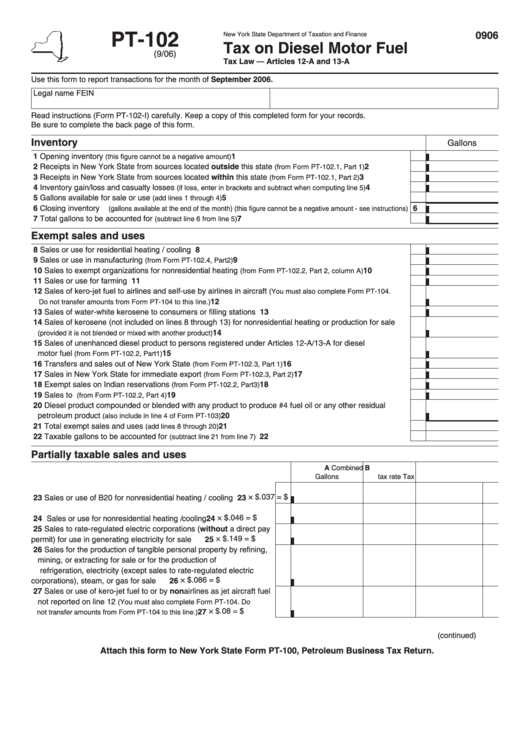

PT-102

0906

New York State Department of Taxation and Finance

Tax on Diesel Motor Fuel

(9/06)

Tax Law — Articles 12-A and 13-A

Use this form to report transactions for the month of September 2006.

Legal name

FEIN

Read instructions (Form PT-102-I) carefully. Keep a copy of this completed form for your records.

Be sure to complete the back page of this form.

Inventory

Gallons

1 Opening inventory

.............................................................................

1

(this figure cannot be a negative amount)

2 Receipts in New York State from sources located outside this state

.................

2

(from Form PT-102.1, Part 1)

3 Receipts in New York State from sources located within this state

3

...................

(from Form PT-102.1, Part 2)

4 Inventory gain/loss and casualty losses

...............

4

(if loss, enter in brackets and subtract when computing line 5)

5 Gallons available for sale or use

.................................................................................

5

(add lines 1 through 4)

6 Closing inventory

6

(gallons available at the end of the month) (this figure cannot be a negative amount - see instructions)

7 Total gallons to be accounted for

7

..........................................................................

(subtract line 6 from line 5)

Exempt sales and uses

8 Sales or use for residential heating / cooling .................................................................................................

8

9 Sales or use in manufacturing

............................................................................

9

(from Form PT-102.4, Part 2)

10 Sales to exempt organizations for nonresidential heating

...................

10

(from Form PT-102.2, Part 2, column A)

11 Sales or use for farming ...............................................................................................................................

11

12 Sales of kero-jet fuel to airlines and self-use by airlines in aircraft

(You must also complete Form PT-104.

....................................................................................

12

Do not transfer amounts from Form PT-104 to this line.)

13 Sales of water-white kerosene to consumers or filling stations ....................................................................

13

14 Sales of kerosene (not included on lines 8 through 13) for nonresidential heating or production for sale

.................................................................................

14

(provided it is not blended or mixed with another product)

15 Sales of unenhanced diesel product to persons registered under Articles 12-A/13-A for diesel

15

motor fuel

........................................................................................................

(from Form PT-102.2, Part 1)

16 Transfers and sales out of New York State

.........................................................

16

(from Form PT-102.3, Part 1)

17 Sales in New York State for immediate export

...................................................

17

(from Form PT-102.3, Part 2)

18 Exempt sales on Indian reservations

18

.................................................................

(from Form PT-102.2, Part 3)

19 Sales to U.S. government and to New York State and its municipalities

............

19

(from Form PT-102.2, Part 4)

20 Diesel product compounded or blended with any product to produce #4 fuel oil or any other residual

20

petroleum product

..............................................................................

(also include in line 4 of Form PT-103)

21 Total exempt sales and uses

21

.....................................................................................

(add lines 8 through 20)

22 Taxable gallons to be accounted for

22

(subtract line 21 from line 7) .............................................................................

Partially taxable sales and uses

A

B

Combined

Gallons

tax rate

Tax

×

$.037 = $

23 Sales or use of B20 for nonresidential heating / cooling ................. 23

×

$.046 = $

24 Sales or use for nonresidential heating / cooling.............................. 24

25 Sales to rate-regulated electric corporations (without a direct pay

×

$.149 = $

permit) for use in generating electricity for sale ......................... 25

26 Sales for the production of tangible personal property by refining,

mining, or extracting for sale or for the production of

refrigeration, electricity (except sales to rate-regulated electric

×

$.086 = $

corporations), steam, or gas for sale .......................................... 26

27 Sales or use of kero-jet fuel to or by nonairlines as jet aircraft fuel

not reported on line 12

(You must also complete Form PT-104. Do

×

$.08

= $

........................... 27

not transfer amounts from Form PT-104 to this line.)

(continued)

Attach this form to New York State Form PT-100, Petroleum Business Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2