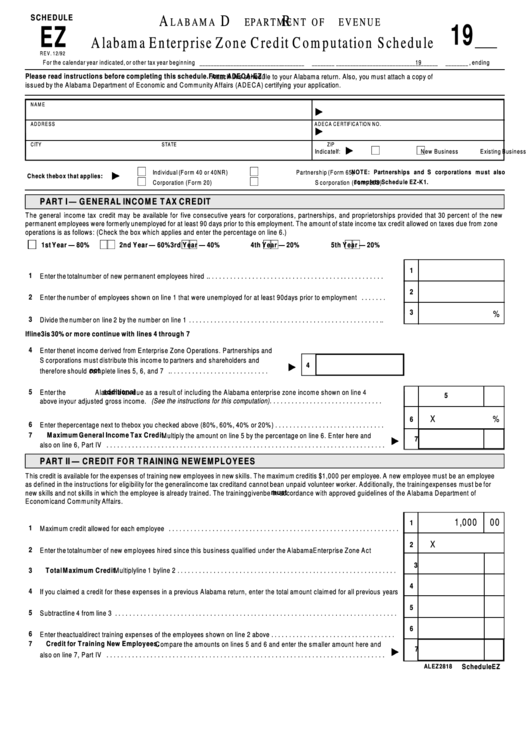

Schedule Ez - Alabama Enterprise Zone Credit Computation Schedule

ADVERTISEMENT

SC H EDULE

For Tax Year

A

D

R

L A B A M A

EPA R T M E N T O F

E V E N U E

19

EZ

A labam a E n terp rise Z on e C red it C o m p utatio n S ch ed u le

R E V . 1 2 /9 2

F or the calendar year indicated, or other tax year beginning

19

, ending

19

_ _ _ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _

Please read instructions before completing this schedule.

Form ADECA-EZ 1

Attach this schedule to your Alabam a return. Also, you m ust attach a copy of

issued by the Alabam a D epartm ent of Econom ic and C om m unity Affairs (AD EC A) certifying your application.

^

N A M E

F E IN /S S N

^

A D D R E S S

A D E C A C E RTIF IC A TIO N N O .

^

7

7

C ITY

S TA TE

Z IP

Indicate If:

N ew B usiness

Existing Business

7

7

^

Individual (F orm 4 0 or 40N R )

Partnership (F orm 65)

NOTE: Partnerships and S corporations m ust also

7

7

Check the box that applies:

com plete Schedule EZ-K1.

C orporation (F orm 20)

S c orporation (F orm 20 S)

PART I — G ENERAL INCO M E T AX CREDIT

T he general incom e tax credit m ay be available for five consecutive years for corporations, partnerships, and proprietorships provided that 30 percent of the new

perm anent em ployees were form erly unem ployed for at least 90 days prior to this em ploym ent. T he am ount of state incom e tax credit allowed on taxes due from zone

operations is as follows: (C heck the box which applies and enter the percentage on line 6.)

7 7

77

77

77

77

1st Y ear — 80%

2nd Y ear — 60%

3rd Y ear — 40%

4th Y ear — 20%

5th Y ear — 20%

1

1

Enter the total num ber of new perm anent em ployees hired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

Enter the num ber of em ployees shown on line 1 that were unem ployed for at least 90 days prior to em ploym ent . . . . . . .

3

%

3

D ivide the num ber on line 2 by the num ber on line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If line 3 is 30% or more continue with lines 4 through 7

4

Enter the net incom e derived from Enterprise Zone O perations. Partnerships and

^

S corporations m ust distribute this incom e to partners and shareholders and

4

not

therefore should

com plete lines 5, 6, and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

additional

Enter the

Alabam a tax due as a result of including the Alabam a enterprise zone incom e shown on line 4

5

(See the instructions for this computation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

above in your adjusted gross incom e.

X

%

6

6

Enter the percentage next to the box you checked above (80% , 60%, 40% or 20% ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

^

7

M aximum G eneral Income Tax Credit.

M ultiply the am ount on line 5 by the percentage on line 6. Enter here and

7

also on line 6, Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART II — CRED IT FO R T RAINING NEW EM PLOYEES

T his credit is available for the expenses of training new em ployees in new skills. T he maxim um credit is $1,000 per em ployee. A new em ployee m ust be an em ployee

as defined in the instructions for eligibility for the general incom e tax credit and cannot be an unpaid volunteer worker. Additionally, the training expenses m ust be for

must

new skills and not skills in which the em ployee is already trained. The training given

be in accordance with approved guidelines of the Alabam a D epartm ent of

Econom ic and C om m unity Affairs.

1,000

00

1

1

M axim um credit allowed for each em ployee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X

2

2

Enter the total num ber of new em ployees hired since this business qualified under the Alabam a Enterprise Zone Act . . . . . .

3

3

Total M aximum Credit.

M ultiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

If you claim ed a credit for these expenses in a previous Alabam a return, enter the total am ount claim ed for all previous years

5

5

Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

Enter the actual direct training expenses of the em ployees shown on line 2 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

^

7

Credit for Training New Employees.

C om pare the am ounts on lines 5 and 6 and enter the sm aller am ount here and

7

also on line 7, Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ALEZ2818

Schedule EZ

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2