Reset Form

Print Form

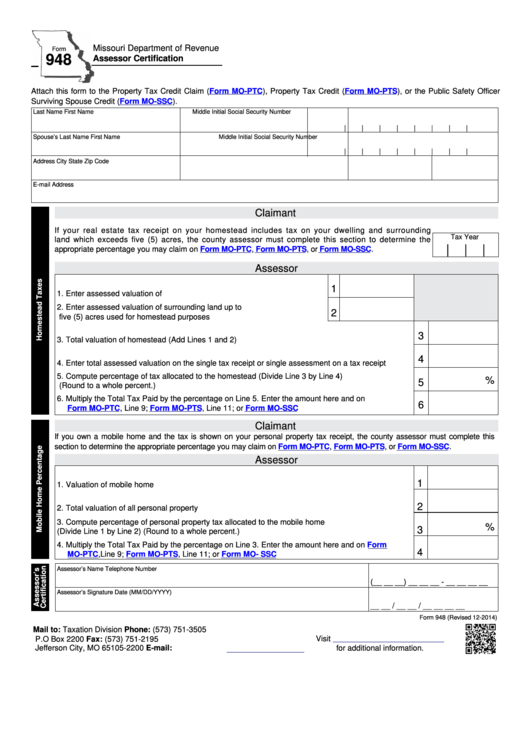

Missouri Department of Revenue

Form

948

Assessor Certification

Attach this form to the Property Tax Credit Claim

(Form

MO-PTC), Property Tax Credit

(Form

MO-PTS), or the Public Safety Officer

Surviving Spouse Credit

(Form

MO-SSC).

Last Name

First Name

Middle Initial

Social Security Number

|

|

|

|

|

|

|

|

Spouse’s Last Name

First Name

Middle Initial

Social Security Number

|

|

|

|

|

|

|

|

Address

City

State

Zip Code

E-mail Address

Claimant

If your real estate tax receipt on your homestead includes tax on your dwelling and surrounding

Tax Year

land which exceeds five (5) acres, the county assessor must complete this section to determine the

|

|

|

appropriate percentage you may claim on

Form

MO-PTC,

Form

MO-PTS, or

Form

MO-SSC.

Assessor

1

1. Enter assessed valuation of dwelling.............................................................

2. Enter assessed valuation of surrounding land up to

2

five (5) acres used for homestead purposes .................................................

3

3. Total valuation of homestead (Add Lines 1 and 2) ................................................................................

4

4. Enter total assessed valuation on the single tax receipt or single assessment on a tax receipt ...........

5. Compute percentage of tax allocated to the homestead (Divide Line 3 by Line 4)

%

5

(Round to a whole percent.) ..................................................................................................................

6. Multiply the Total Tax Paid by the percentage on Line 5. Enter the amount here and on

6

Form

MO-PTC, Line 9;

Form

MO-PTS, Line 11; or

Form MO-SSC

....................................................

Claimant

If you own a mobile home and the tax is shown on your personal property tax receipt, the county assessor must complete this

section to determine the appropriate percentage you may claim on

Form

MO-PTC,

Form

MO-PTS, or

Form

MO-SSC.

Assessor

1

1. Valuation of mobile home only...............................................................................................................

2

2. Total valuation of all personal property ..................................................................................................

3. Compute percentage of personal property tax allocated to the mobile home

%

3

(Divide Line 1 by Line 2) (Round to a whole percent.)..........................................................................

4. Multiply the Total Tax Paid by the percentage on Line 3. Enter the amount here and on

Form

4

MO-PTC,Line 9;

Form

MO-PTS, Line 11; or

Form MO- SSC

.............................................................

Assessor’s Name

Telephone Number

(__ __ __) __ __ __ - __ __ __ __

Assessor’s Signature

Date (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

Form 948 (Revised 12-2014)

Mail to:

Taxation Division

Phone: (573) 751-3505

Visit

P.O Box 2200

Fax: (573) 751-2195

for additional information.

Jefferson City, MO 65105-2200

E-mail:

income@dor.mo.gov

1

1