Form 76ext - Application For Filing Extension Of Estate Tax Return - State Of Arizona

ADVERTISEMENT

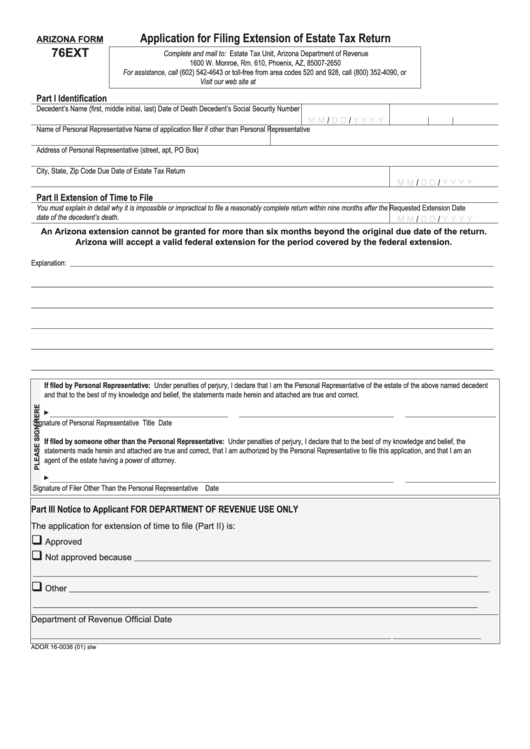

Application for Filing Extension of Estate Tax Return

ARIZONA FORM

76EXT

Complete and mail to: Estate Tax Unit, Arizona Department of Revenue

1600 W. Monroe, Rm. 610, Phoenix, AZ, 85007-2650

For assistance, call (602) 542-4643 or toll-free from area codes 520 and 928, call (800) 352-4090, or

Visit our web site at www. revenue.state.az.us

Part I

Identication

Decedent’s Name (rst, middle initial, last)

Date of Death

Decedent’s Social Security Number

M M

/

D D

/

Y Y Y Y

Name of Personal Representative

Name of application ler if other than Personal Representative

Address of Personal Representative (street, apt, PO Box)

City, State, Zip Code

Due Date of Estate Tax Return

M M

/

D D

/

Y Y Y Y

Part II Extension of Time to File

You must explain in detail why it is impossible or impractical to le a reasonably complete return within nine months after the

Requested Extension Date

date of the decedent’s death.

M M

/

D D

/

Y Y Y Y

An Arizona extension cannot be granted for more than six months beyond the original due date of the return.

Arizona will accept a valid federal extension for the period covered by the federal extension.

Explanation: ________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

If led by Personal Representative: Under penalties of perjury, I declare that I am the Personal Representative of the estate of the above named decedent

and that to the best of my knowledge and belief, the statements made herein and attached are true and correct.

►

Signature of Personal Representative

Title

Date

If led by someone other than the Personal Representative: Under penalties of perjury, I declare that to the best of my knowledge and belief, the

statements made herein and attached are true and correct, that I am authorized by the Personal Representative to le this application, and that I am an

agent of the estate having a power of attorney.

►

Signature of Filer Other Than the Personal Representative

Date

Part III Notice to Applicant

FOR DEPARTMENT OF REVENUE USE ONLY

The application for extension of time to le (Part II) is:

q

Approved

q

Not approved because

_____________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

q

Other

_______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

Department of Revenue Ofcial

Date

______________________________________________________________________________________________________

_________________________

ADOR 16-0036 (01) slw

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1