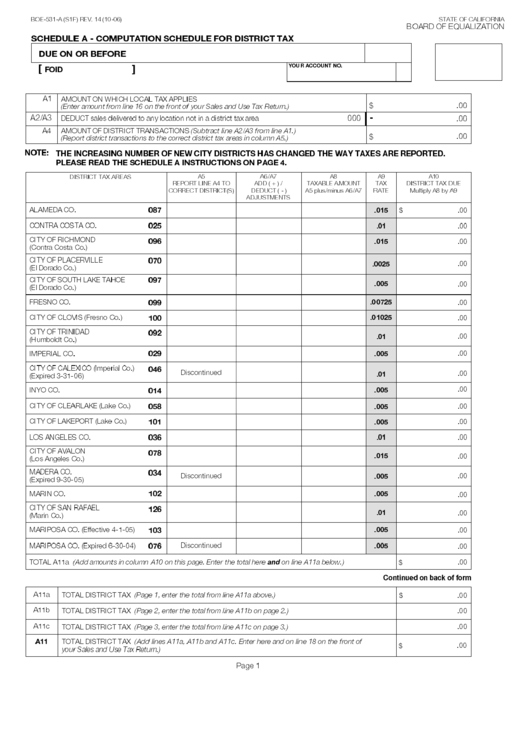

BOE-531-A (S1F) REV. 14 (10-06)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SCHEDULE A - COMPUTATION SCHEDULE FOR DISTRICT TAX

DUE ON OR BEFORE

YOUR ACCOUNT NO.

FOID

[

]

A1 AMOUNT ON WHICH LOCAL TAX APPLIES

$

.00

(Enter amount from line 16 on the front of your Sales and Use Tax Return.)

-

A2/A3 DEDUCT sales delivered to any location not in a district tax area

000

.00

A4

AMOUNT OF DISTRICT TRANSACTIONS (Subtract line A2/A3 from line A1.)

.00

$

(Report district transactions to the correct district tax areas in column A5.)

NOTE: THE INCREASING NUMBER OF NEW CITY DISTRICTS HAS CHANGED THE WAY TAXES ARE REPORTED.

PLEASE READ THE SCHEDULE A INSTRUCTIONS ON PAGE 4.

A5

A6/A7

A8

A9

A10

DISTRICT TAX AREAS

REPORT LINE A4 TO

ADD ( + ) /

TAXABLE AMOUNT

TAX

DISTRICT TAX DUE

CORRECT DISTRICT(S)

DEDUCT ( - )

A5 plus/minus A6/A7

RATE

Multiply A8 by A9

ADJUSTMENTS

087

ALAMEDA CO.

.015

$

.00

025

.01

CONTRA COSTA CO.

.00

CITY OF RICHMOND

096

.015

.00

(Contra Costa Co.)

CITY OF PLACERVILLE

070

.0025

.00

(El Dorado Co.)

097

CITY OF SOUTH LAKE TAHOE

.005

.00

(El Dorado Co.)

099

.00725

FRESNO CO.

.00

.01025

CITY OF CLOVIS (Fresno Co.)

100

.00

CITY OF TRINIDAD

092

.01

.00

(Humboldt Co.)

029

.005

.00

IMPERIAL CO.

CITY OF CALEXICO (Imperial Co.)

046

Discontinued

.01

.00

(Expired 3-31-06)

.005

.00

INYO CO.

014

CITY OF CLEARLAKE (Lake Co.)

058

.005

.00

CITY OF LAKEPORT (Lake Co.)

101

.005

.00

036

.01

LOS ANGELES CO.

.00

CITY OF AVALON

078

.015

.00

(Los Angeles Co.)

MADERA CO.

034

.005

Discontinued

.00

(Expired 9-30-05)

102

.005

MARIN CO.

.00

CITY OF SAN RAFAEL

126

.01

.00

(Marin Co.)

.005

103

MARIPOSA CO. (Effective 4-1-05)

.00

076

Discontinued

.005

MARIPOSA CO. (Expired 6-30-04)

.00

TOTAL A11a (Add amounts in column A10 on this page. Enter the total here

on line A11a below.)

$

.00

and

Continued on back of form

A11a

TOTAL DISTRICT TAX (Page 1, enter the total from line A11a above.)

$

.00

A11b

TOTAL DISTRICT TAX (Page 2, enter the total from line A11b on page 2.)

.00

A11c

.00

TOTAL DISTRICT TAX (Page 3, enter the total from line A11c on page 3.)

A11

TOTAL DISTRICT TAX (Add lines A11a, A11b and A11c. Enter here and on line 18 on the front of

.00

$

your Sales and Use Tax Return.)

Page 1

1

1 2

2 3

3