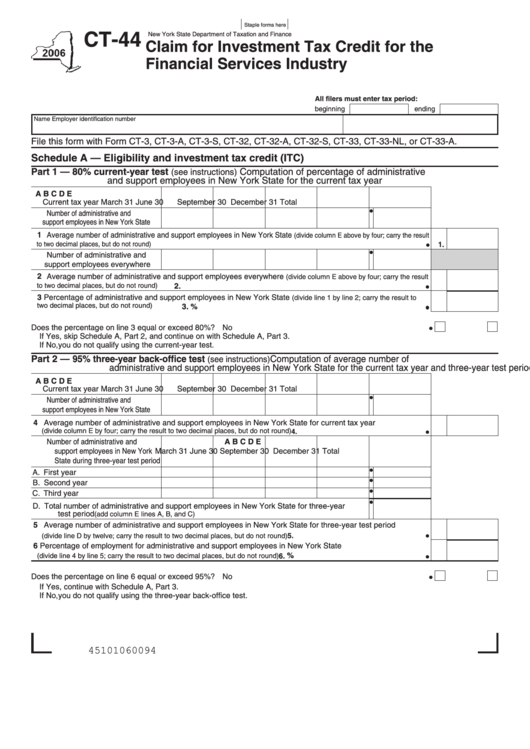

Form Ct-44 - Claim For Investment Tax Credit For The Financial Services Industry - State Of New York

ADVERTISEMENT

Staple forms here

CT-44

New York State Department of Taxation and Finance

Claim for Investment Tax Credit for the

Financial Services Industry

All filers must enter tax period:

beginning

ending

Name

Employer identification number

File this form with Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-NL, or CT-33-A.

Schedule A — Eligibility and investment tax credit (ITC)

Part 1 — 80% current-year test

Computation of percentage of administrative

(see instructions)

and support employees in New York State for the current tax year

A

B

C

D

E

Current tax year

March 31

June 30

September 30 December 31

Total

Number of administrative and

support employees in New York State

1 Average number of administrative and support employees in New York State

(divide column E above by four; carry the result

to two decimal places, but do not round)

1.

Number of administrative and

support employees everywhere

2 Average number of administrative and support employees everywhere

(divide column E above by four; carry the result

..................................................................................................................

to two decimal places, but do not round)

2.

3 Percentage of administrative and support employees in New York State

(divide line 1 by line 2; carry the result to

. ....................................................................................................................

3.

%

two decimal places, but do not round)

Does the percentage on line 3 equal or exceed 80%? . ....................................................................................Yes

No

If Yes, skip Schedule A, Part 2, and continue on with Schedule A, Part 3.

If No, you do not qualify using the current-year test.

Part 2 — 95% three-year back-office test

Computation of average number of

(see instructions)

administrative and support employees in New York State for the current tax year and three-year test period

A

B

C

D

E

Current tax year

March 31

June 30

September 30 December 31

Total

Number of administrative and

support employees in New York State

4 Average number of administrative and support employees in New York State for current tax year

.......................................................

(divide column E by four; carry the result to two decimal places, but do not round)

4.

Number of administrative and

A

B

C

D

E

support employees in New York

March 31

June 30

September 30 December 31

Total

State during three-year test period

A. First year

B. Second year

C. Third year

D. Total number of administrative and support employees in New York State for three-year

test period

. .....................................................................

(add column E lines A, B, and C)

5 Average number of administrative and support employees in New York State for three-year test period

........................................................

5.

(divide line D by twelve; carry the result to two decimal places, but do not round)

6 Percentage of employment for administrative and support employees in New York State

%

. ..........................................................

(divide line 4 by line 5; carry the result to two decimal places, but do not round)

6.

Does the percentage on line 6 equal or exceed 95%? . ....................................................................................Yes

No

If Yes, continue with Schedule A, Part 3.

If No, you do not qualify using the three-year back-office test.

45101060094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4