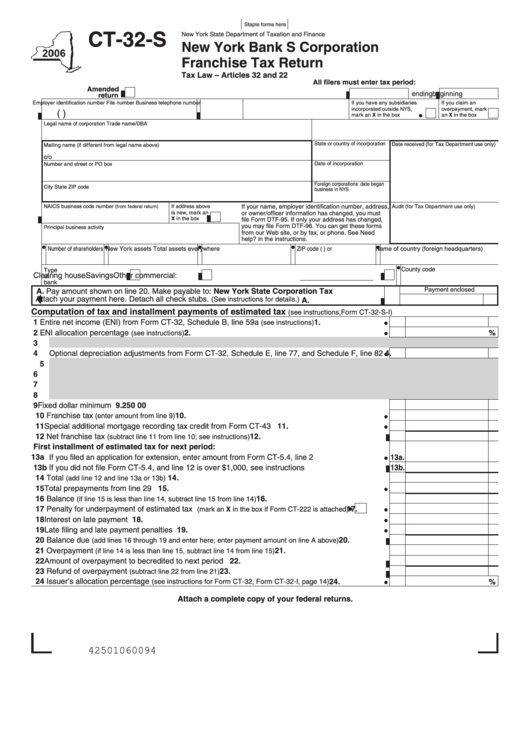

Form Ct-32-S - New York Bank S Corporation Franchise Tax Return

ADVERTISEMENT

Staple forms here

CT-32-S

New York State Department of Taxation and Finance

New York Bank S Corporation

Franchise Tax Return

Tax Law – Articles 32 and 22

All filers must enter tax period:

Amended

beginning

ending

return

Employer identification number

File number

Business telephone number

If you have any subsidiaries

If you claim an

incorporated outside NYS,

overpayment, mark

(

)

mark an X in the box

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address above

If your name, employer identification number, address,

Audit (for Tax Department use only)

(from federal return)

is new, mark an

or owner/officer information has changed, you must

X in the box

file Form DTF-95. If only your address has changed,

you may file Form DTF-96. You can get these forms

Principal business activity

from our Web site, or by fax, or phone. See Need

help? in the instructions.

Number of shareholders

New York assets

Total assets everywhere

ZIP code (U.S. headquarters) or

Name of country (foreign headquarters)

County code

Type

of

Clearing house

Savings

Other commercial:

bank

Payment enclosed

A. Pay amount shown on line 20. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A.

Computation of tax and installment payments of estimated tax

(see instructions, Form CT-32-S-I)

1 Entire net income (ENI) from Form CT-32, Schedule B, line 59a

1.

...........................

(see instructions)

2 ENI allocation percentage

......................................................................................

2.

%

(see instructions)

3

4 Optional depreciation adjustments from Form CT-32, Schedule E, line 77, and Schedule F, line 82

4.

5

6

7

8

9 Fixed dollar minimum .........................................................................................................................

9.

250 00

10 Franchise tax

10.

..............................................................................................

(enter amount from line 9)

11 Special additional mortgage recording tax credit from Form CT-43 ................................................. 11.

12 Net franchise tax

12.

...........................................................

(subtract line 11 from line 10; see instructions)

First installment of estimated tax for next period:

13a If you filed an application for extension, enter amount from Form CT-5.4, line 2 ................................ 13a.

1 3b If you did not file Form CT-5.4, and line 12 is over $1,000, see instructions .................................... 13b.

14 Total

.................................................................................................... 14.

(add line 12 and line 13a or 13b)

15 Total prepayments from line 29 ........................................................................................................ 15.

16 Balance

.......................................................... 16.

(if line 15 is less than line 14, subtract line 15 from line 14)

17 Penalty for underpayment of estimated tax

......

17.

(mark an X in the box if Form CT-222 is attached)

18 Interest on late payment ...................................................................................................................

18.

19 Late filing and late payment penalties ..............................................................................................

19.

20 Balance due

20.

..................

(add lines 16 through 19 and enter here; enter payment amount on line A above)

21 Overpayment

.................................................. 21.

(if line 14 is less than line 15, subtract line 14 from line 15)

22 Amount of overpayment to be credited to next period .....................................................................

22.

23 Refund of overpayment

.........................................................................

23.

(subtract line 22 from line 21)

24 Issuer’s allocation percentage

........................

24.

%

(see instructions for Form CT-32, Form CT-32-I, page 14)

Attach a complete copy of your federal returns.

42501060094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2