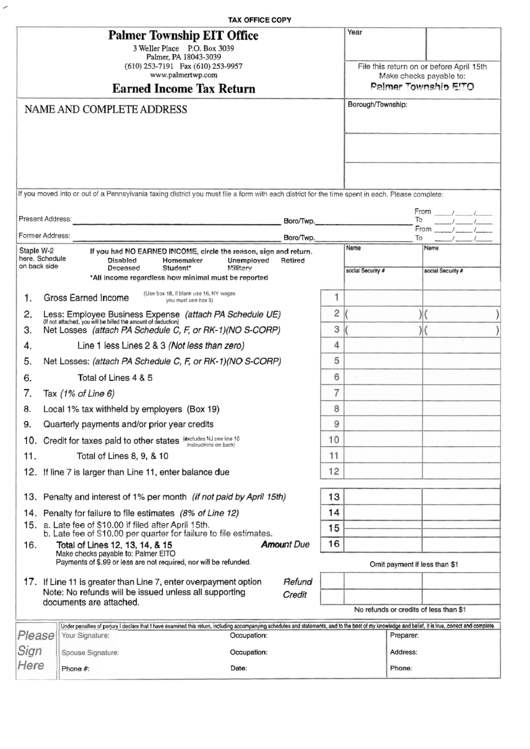

Earned Income Tax Return Form - Palmer Township Eit Office

ADVERTISEMENT

,

TAX OFFICE COPY

Palmer Township EIT Office

3

Weller Place

P.O.

Box

3039

Palmer,

PA

18043-3039

(610) 253-7191

Fax

(610) 253-9957

Earned Income Tax Return

NAME AND COMPLETE ADDRESS

Year

File this return on or before April 15th

Make checks payable to:

Palmer

% ~ V E S F ~ P ~

E!TO

BoroughTTownship:

If you moved into or out of a Pennsylvania taxing district you must file a form with each district for the time spentin each. Please comptete:

From

I

I

Present Address:

BoroTTwp.

TO

- I p p

1

From

- 1

- I -

Former Address:

BoroTTwp.

To

- I

- 1 -

Staple W-2

If you had NO EARNED INCOME, circle the reason, sign and return.

here, Schedule

Disabled

Homemaker

Unemployed

Retired

on back side

Deceased

Student*

hi?ili:epr

'All income regardless how minimal must be reported

Name

social Security #

Name

social Security

#

1.

Gross Earned Income

(Use b3x

18. if

blank use

16.

NY ivages

you must use box 5 j

2.

Less: Employee Business Expense (attach PA Schedule UE)

(If not attached, you will be billed the amount of deduction)

3.

Net Losses (attach PA Schedule C, F; or RK-1)(NO S-CORP)

4.

Line

1

less Lines

2 & 3 (Not less than zero)

5.

Net Losses: (attach PA Schedule C,

F; or RK-1)(NO S-CORP)

6.

Total of Lines

4 & 5

7.

Tax (1

% of Line 6)

8.

Local

1%

tax withheld by employers (Box

19)

9.

Quarterly payments andlor prior year credits

excludes

NJ

see line

10

10. Credit for taxes paid to other states

(

.

~nslruclinns an back!

11.

Total of Lines

8, 9, & 10

12. If line 7 is larger than Line 11, enter balance due

13. Penalty and interest of

1 %

per month (if not paid by April

15th)

14. Penalty for failure to file estimates

(8% of Line 12)

15. a. Late fee of

$1 0.00

if filed after April 15th.

b.

Late fee of

$1 0.00

per quarter for failure to file estimates.

16.

Total of Lines

12, 13, 14, & 15

Amount Due

1 3

1 4

15

1 6

Make checks payable to: Palmer ElTO

Payments of $.99 or less

are not required, nor will be refunded.

Omit payment if less than $1

17. If Line

11

is greater than Line

7,

enter overpayment option

Refund

Note: No refunds will be issued unless all supporting

Credit

documents are attached.

No refunds or credits of less than

$1

Under penalties of perjury I declare that

I

have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct

and

complete.

Occupation:

Occupation:

Phone #:

Date:

Preparer:

Address:

Phone:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1