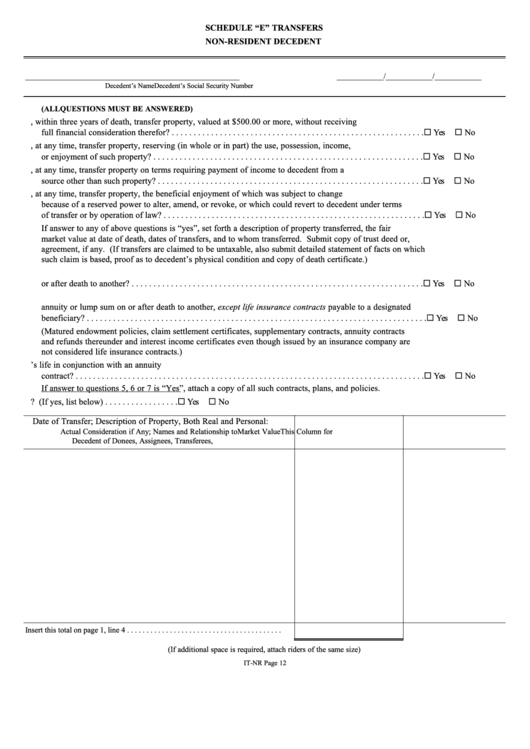

SCHEDULE “E” TRANSFERS

NON-RESIDENT DECEDENT

_______________________________________________________

____________/____________/____________

Decedent’s Name

Decedent’s Social Security Number

(ALL QUESTIONS MUST BE ANSWERED)

1. Did decedent, within three years of death, transfer property, valued at $500.00 or more, without receiving

full financial consideration therefor? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

2. Did decedent, at any time, transfer property, reserving (in whole or in part) the use, possession, income,

or enjoyment of such property? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3. Did decedent, at any time, transfer property on terms requiring payment of income to decedent from a

source other than such property? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

4. Did decedent, at any time, transfer property, the beneficial enjoyment of which was subject to change

because of a reserved power to alter, amend, or revoke, or which could revert to decedent under terms

of transfer or by operation of law? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If answer to any of above questions is “yes”, set forth a description of property transferred, the fair

market value at date of death, dates of transfers, and to whom transferred. Submit copy of trust deed or,

agreement, if any. (If transfers are claimed to be untaxable, also submit detailed statement of facts on which

such claim is based, proof as to decedent’s physical condition and copy of death certificate.)

5. Was decedent a participant in any pension plan that provided for payment of an annuity or lump sum on

or after death to another? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

6. Did decedent purchase or in any manner participate in any contract or plan providing for payment of an

annuity or lump sum on or after death to another, except life insurance contracts payable to a designated

beneficiary? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(Matured endowment policies, claim settlement certificates, supplementary contracts, annuity contracts

and refunds thereunder and interest income certificates even though issued by an insurance company are

not considered life insurance contracts.)

7. Was a single premium life insurance policy issued on decedent’s life in conjunction with an annuity

contract? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If answer to questions 5, 6 or 7 is “Yes”, attach a copy of all such contracts, plans, and policies.

8. Were any accumulated dividends due on any contract of insurance? (If yes, list below) . . . . . . . . . . . . . . . . .

Yes

No

Date of Transfer; Description of Property, Both Real and Personal:

Actual Consideration if Any; Names and Relationship to

Market Value

This Column for

Decedent of Donees, Assignees, Transferees, etc.

at Date of Death

Division Use

Insert this total on page 1, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(If additional space is required, attach riders of the same size)

IT-NR Page 12

1

1