Instructions For Preparation Of Personal Property Tax Return Form - City Of Philadelphia, Pennsylvania

ADVERTISEMENT

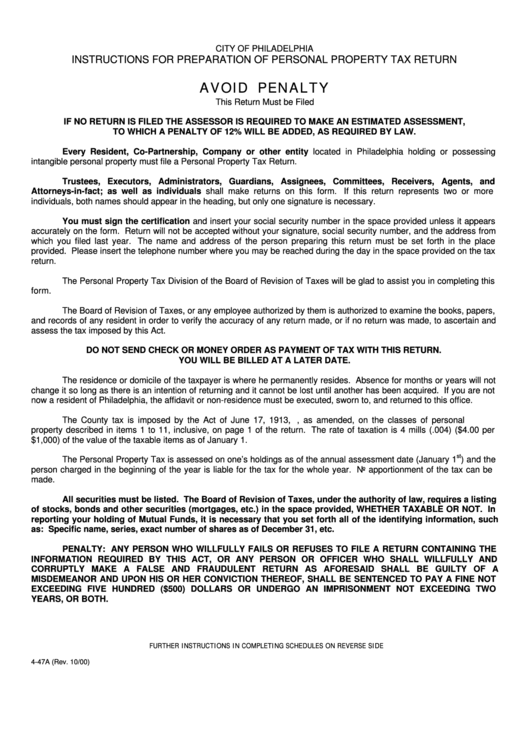

CITY OF PHILADELPHIA

INSTRUCTIONS FOR PREPARATION OF PERSONAL PROPERTY TAX RETURN

AVOID PENALTY

This Return Must be Filed

IF NO RETURN IS FILED THE ASSESSOR IS REQUIRED TO MAKE AN ESTIMATED ASSESSMENT,

TO WHICH A PENALTY OF 12% WILL BE ADDED, AS REQUIRED BY LAW.

Every Resident, Co-Partnership, Company or other entity located in Philadelphia holding or possessing

intangible personal property must file a Personal Property Tax Return.

Trustees, Executors, Administrators, Guardians, Assignees, Committees, Receivers, Agents, and

Attorneys-in-fact; as well as individuals shall make returns on this form.

If this return represents two or more

individuals, both names should appear in the heading, but only one signature is necessary.

You must sign the certification and insert your social security number in the space provided unless it appears

accurately on the form. Return will not be accepted without your signature, social security number, and the address from

which you filed last year. The name and address of the person preparing this return must be set forth in the place

provided. Please insert the telephone number where you may be reached during the day in the space provided on the tax

return.

The Personal Property Tax Division of the Board of Revision of Taxes will be glad to assist you in completing this

form.

The Board of Revision of Taxes, or any employee authorized by them is authorized to examine the books, papers,

and records of any resident in order to verify the accuracy of any return made, or if no return was made, to ascertain and

assess the tax imposed by this Act.

DO NOT SEND CHECK OR MONEY ORDER AS PAYMENT OF TAX WITH THIS RETURN.

YOU WILL BE BILLED AT A LATER DATE.

The residence or domicile of the taxpayer is where he permanently resides. Absence for months or years will not

change it so long as there is an intention of returning and it cannot be lost until another has been acquired. If you are not

now a resident of Philadelphia, the affidavit or non-residence must be executed, sworn to, and returned to this office.

The County tax is imposed by the Act of June 17, 1913, P.L. 507, as amended, on the classes of personal

property described in items 1 to 11, inclusive, on page 1 of the return. The rate of taxation is 4 mills (.004) ($4.00 per

$1,000) of the value of the taxable items as of January 1.

st

The Personal Property Tax is assessed on one’s holdings as of the annual assessment date (January 1

) and the

person charged in the beginning of the year is liable for the tax for the whole year. No apportionment of the tax can be

made.

All securities must be listed. The Board of Revision of Taxes, under the authority of law, requires a listing

of stocks, bonds and other securities (mortgages, etc.) in the space provided, WHETHER TAXABLE OR NOT. In

reporting your holding of Mutual Funds, it is necessary that you set forth all of the identifying information, such

as: Specific name, series, exact number of shares as of December 31, etc.

PENALTY: ANY PERSON WHO WILLFULLY FAILS OR REFUSES TO FILE A RETURN CONTAINING THE

INFORMATION REQUIRED BY THIS ACT, OR ANY PERSON OR OFFICER WHO SHALL WILLFULLY AND

CORRUPTLY MAKE A FALSE AND FRAUDULENT RETURN AS AFORESAID SHALL BE GUILTY OF A

MISDEMEANOR AND UPON HIS OR HER CONVICTION THEREOF, SHALL BE SENTENCED TO PAY A FINE NOT

EXCEEDING FIVE HUNDRED ($500) DOLLARS OR UNDERGO AN IMPRISONMENT NOT EXCEEDING TWO

YEARS, OR BOTH.

FURTHER INSTRUCTIONS IN COMPLETING SCHEDULES ON REVERSE SIDE

4-47A (Rev. 10/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2