Form Dr-7n - Instructions

ADVERTISEMENT

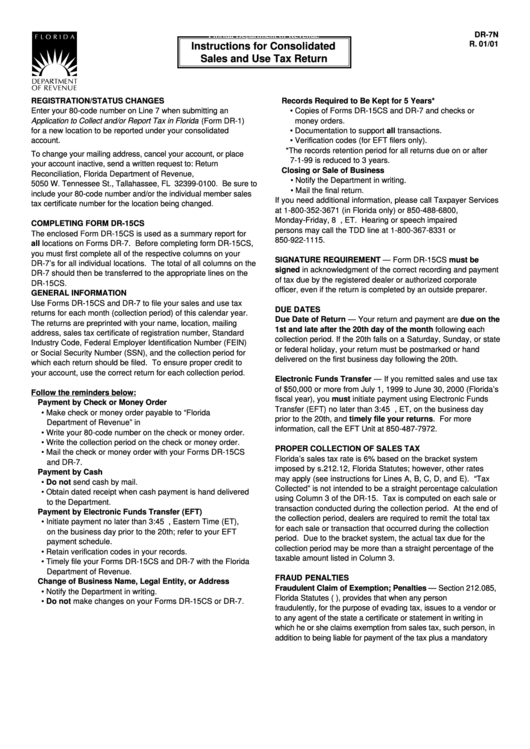

DR-7N

Florida Department of Revenue

R. 01/01

Instructions for Consolidated

Sales and Use Tax Return

REGISTRATION/STATUS CHANGES

Records Required to Be Kept for 5 Years*

Enter your 80-code number on Line 7 when submitting an

• Copies of Forms DR-15CS and DR-7 and checks or

Application to Collect and/or Report Tax in Florida (Form DR-1)

money orders.

for a new location to be reported under your consolidated

• Documentation to support all transactions.

account.

• Verification codes (for EFT filers only).

*The records retention period for all returns due on or after

To change your mailing address, cancel your account, or place

7-1-99 is reduced to 3 years.

your account inactive, send a written request to: Return

Closing or Sale of Business

Reconciliation, Florida Department of Revenue,

• Notify the Department in writing.

5050 W. Tennessee St., Tallahassee, FL 32399-0100. Be sure to

• Mail the final return.

include your 80-code number and/or the individual member sales

If you need additional information, please call Taxpayer Services

tax certificate number for the location being changed.

at 1-800-352-3671 (in Florida only) or 850-488-6800,

Monday-Friday, 8 a.m. - 7 p.m., ET. Hearing or speech impaired

COMPLETING FORM DR-15CS

persons may call the TDD line at 1-800-367-8331 or

The enclosed Form DR-15CS is used as a summary report for

850-922-1115.

all locations on Forms DR-7. Before completing form DR-15CS,

you must first complete all of the respective columns on your

SIGNATURE REQUIREMENT — Form DR-15CS must be

DR-7’s for all individual locations. The total of all columns on the

signed in acknowledgment of the correct recording and payment

DR-7 should then be transferred to the appropriate lines on the

of tax due by the registered dealer or authorized corporate

DR-15CS.

officer, even if the return is completed by an outside preparer.

GENERAL INFORMATION

Use Forms DR-15CS and DR-7 to file your sales and use tax

DUE DATES

returns for each month (collection period) of this calendar year.

Due Date of Return — Your return and payment are due on the

The returns are preprinted with your name, location, mailing

1st and late after the 20th day of the month following each

address, sales tax certificate of registration number, Standard

collection period. If the 20th falls on a Saturday, Sunday, or state

Industry Code, Federal Employer Identification Number (FEIN)

or federal holiday, your return must be postmarked or hand

or Social Security Number (SSN), and the collection period for

delivered on the first business day following the 20th.

which each return should be filed. To ensure proper credit to

your account, use the correct return for each collection period.

Electronic Funds Transfer — If you remitted sales and use tax

of $50,000 or more from July 1, 1999 to June 30, 2000 (Florida’s

Follow the reminders below:

fiscal year), you must initiate payment using Electronic Funds

Payment by Check or Money Order

Transfer (EFT) no later than 3:45 p.m., ET, on the business day

• Make check or money order payable to “Florida

prior to the 20th, and timely file your returns. For more

Department of Revenue” in U.S. FUNDS ONLY.

information, call the EFT Unit at 850-487-7972.

• Write your 80-code number on the check or money order.

• Write the collection period on the check or money order.

PROPER COLLECTION OF SALES TAX

• Mail the check or money order with your Forms DR-15CS

Florida’s sales tax rate is 6% based on the bracket system

and DR-7.

imposed by s. 212.12, Florida Statutes; however, other rates

Payment by Cash

may apply (see instructions for Lines A, B, C, D, and E). “Tax

• Do not send cash by mail.

Collected” is not intended to be a straight percentage calculation

• Obtain dated receipt when cash payment is hand delivered

using Column 3 of the DR-15. Tax is computed on each sale or

to the Department.

transaction conducted during the collection period. At the end of

Payment by Electronic Funds Transfer (EFT)

the collection period, dealers are required to remit the total tax

• Initiate payment no later than 3:45 p.m., Eastern Time (ET),

for each sale or transaction that occurred during the collection

on the business day prior to the 20th; refer to your EFT

period. Due to the bracket system, the actual tax due for the

payment schedule.

collection period may be more than a straight percentage of the

• Retain verification codes in your records.

taxable amount listed in Column 3.

• Timely file your Forms DR-15CS and DR-7 with the Florida

Department of Revenue.

FRAUD PENALTIES

Change of Business Name, Legal Entity, or Address

Fraudulent Claim of Exemption; Penalties — Section 212.085,

• Notify the Department in writing.

Florida Statutes (F.S.), provides that when any person

• Do not make changes on your Forms DR-15CS or DR-7.

fraudulently, for the purpose of evading tax, issues to a vendor or

to any agent of the state a certificate or statement in writing in

which he or she claims exemption from sales tax, such person, in

addition to being liable for payment of the tax plus a mandatory

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6