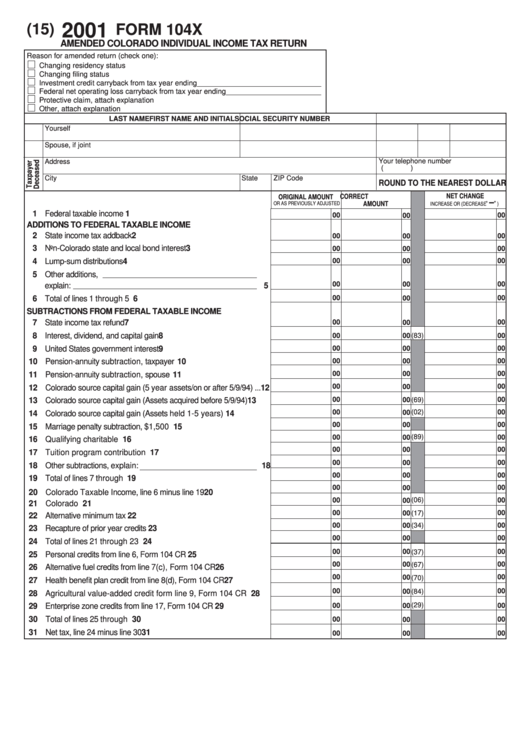

Form 104x - Amended Colorado Individual Income Tax Return - 2001

ADVERTISEMENT

2001

(15)

FORM 104X

AMENDED COLORADO INDIVIDUAL INCOME TAX RETURN

Reason for amended return (check one):

Changing residency status

Changing filing status

Investment credit carryback from tax year ending ______________________________

Federal net operating loss carryback from tax year ending _______________________

Protective claim, attach explanation

Other, attach explanation

LAST NAME

FIRST NAME AND INITIAL

SOCIAL SECURITY NUMBER

Yourself

Spouse, if joint

Your telephone number

Address

(

)

City

State

ZIP Code

ROUND TO THE NEAREST DOLLAR

NET CHANGE

CORRECT

ORIGINAL AMOUNT

–

OR AS PREVIOUSLY ADJUSTED

AMOUNT

“

”

INCREASE OR (DECREASE

)

1 Federal taxable income ............................................................. 1

00

00

00

ADDITIONS TO FEDERAL TAXABLE INCOME

2 State income tax addback ......................................................... 2

00

00

00

3 Non-Colorado state and local bond interest ................................ 3

00

00

00

00

00

4 Lump-sum distributions ............................................................. 4

00

5 Other additions,

00

00

00

explain:

5

00

00

6 Total of lines 1 through 5 .......................................................... 6

00

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

7 State income tax refund ............................................................ 7

00

00

00

8 Interest, dividend, and capital gain ............................................ 8

00

(83)

00

00

9 United States government interest ............................................. 9

00

00

00

10 Pension-annuity subtraction, taxpayer ...................................... 10

00

00

00

00

00

00

11 Pension-annuity subtraction, spouse ........................................ 11

00

00

00

12 Colorado source capital gain (5 year assets/on or after 5/9/94) ... 12

00

00

(69)

00

13 Colorado source capital gain (Assets acquired before 5/9/94) ..... 13

(02)

00

00

00

14 Colorado source capital gain (Assets held 1-5 years) ................ 14

00

00

00

15 Marriage penalty subtraction, $1,500 maximum ........................ 15

(89)

00

00

00

16 Qualifying charitable contribution ............................................ 16

00

00

00

17 Tuition program contribution ................................................... 17

00

00

00

18 Other subtractions, explain:

18

00

00

00

19 Total of lines 7 through 18 ........................................................ 19

00

00

00

20 Colorado Taxable Income, line 6 minus line 19 ......................... 20

(06)

00

00

00

21 Colorado Tax ........................................................................... 21

00

00

00

(17)

22 Alternative minimum tax ............................................................ 22

00

00

(34)

00

23 Recapture of prior year credits ................................................... 23

00

00

00

24 Total of lines 21 through 23 ...................................................... 24

00

00

00

(37)

25 Personal credits from line 6, Form 104 CR ................................. 25

00

00

00

(67)

26 Alternative fuel credits from line 7(c), Form 104 CR .................... 26

00

00

00

(70)

27 Health benefit plan credit from line 8(d), Form 104 CR ................ 27

00

00

00

(84)

28 Agricultural value-added credit form line 9, Form 104 CR ...... 28

(29)

00

00

00

29 Enterprise zone credits from line 17, Form 104 CR ..................... 29

30 Total of lines 25 through 29 ...................................................... 30

00

00

00

31 Net tax, line 24 minus line 30 ..................................................... 31

00

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2