Notice Of Residential Property Tax Relief Confirmation Form

ADVERTISEMENT

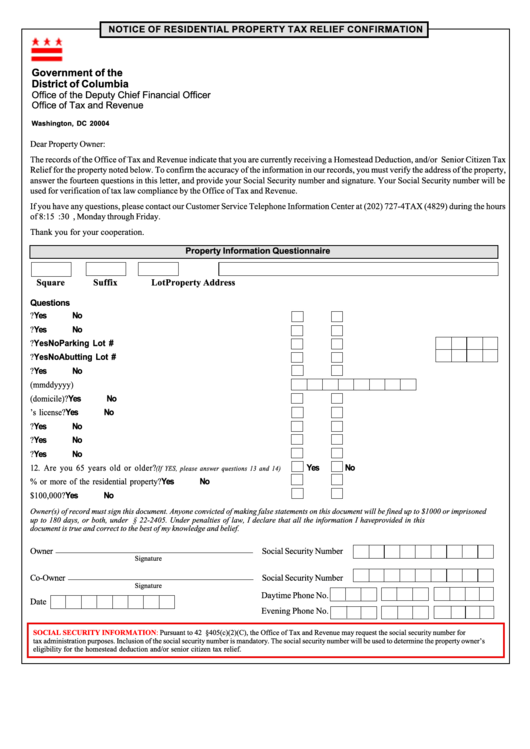

NOTICE OF RESIDENTIAL PROPERTY TAX RELIEF CONFIRMATION

Government of the

District of Columbia

Office of the Deputy Chief Financial Officer

Office of Tax and Revenue

P.O. Box 176

Washington, DC 20004

Dear Property Owner:

The records of the Office of Tax and Revenue indicate that you are currently receiving a Homestead Deduction, and/or Senior Citizen Tax

Relief for the property noted below. To confirm the accuracy of the information in our records, you must verify the address of the property,

answer the fourteen questions in this letter, and provide your Social Security number and signature. Your Social Security number will be

used for verification of tax law compliance by the Office of Tax and Revenue.

If you have any questions, please contact our Customer Service Telephone Information Center at (202) 727-4TAX (4829) during the hours

of 8:15 a.m. and 4:30 p.m., Monday through Friday.

Thank you for your cooperation.

Property Information Questionnaire

Square

Suffix

Lot

Property Address

Questions

1. Do you own this residential property?

Yes

No

Yes

No

2. Do you occupy this residential property?

3. Do you own a condominium parking space in the condominium?

Yes

No

Parking Lot #

4. Do you own an additional lot abutting this property?

Yes

No

Abutting Lot #

5. Does the abutting lot continue to share the same ownership?

Yes

No

6. Please provide the date you moved into the property. (mmddyyyy)

Yes

No

7. Is the property your principle place of residence (domicile)?

8. Do you have a District of Columbia driver’s license?

Yes

No

Yes

No

9. Do you have a motor vehicle registered in the District of Columbia?

10. Are you registered to vote in the District of Columbia?

Yes

No

Yes

No

11. Do you file District of Columbia individual income tax?

12. Are you 65 years old or older?

Yes

No

(If YES, please answer questions 13 and 14)

13. Do you own 50% or more of the residential property?

Yes

No

14. Is your total adjusted gross household income less than $100,000?

Yes

No

Owner(s) of record must sign this document. Anyone convicted of making false statements on this document will be fined up to $1000 or imprisoned

up to 180 days, or both, under D.C. Official Code § 22-2405. Under penalties of law, I declare that all the information I have provided in this

document is true and correct to the best of my knowledge and belief.

Owner

Social Security Number

Signature

Co-Owner

Social Security Number

Signature

Daytime Phone No.

Date

Evening Phone No.

SOCIAL SECURITY INFORMATION:

Pursuant to 42 U.S.C. §405(c)(2)(C), the Office of Tax and Revenue may request the social security number for

tax administration purposes. Inclusion of the social security number is mandatory. The social security number will be used to determine the property owner’s

eligibility for the homestead deduction and/or senior citizen tax relief.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1