Form Dp-2848 - Instructions For Power Of Attorney Form - New Hampshire Department Of Revenue Administration

ADVERTISEMENT

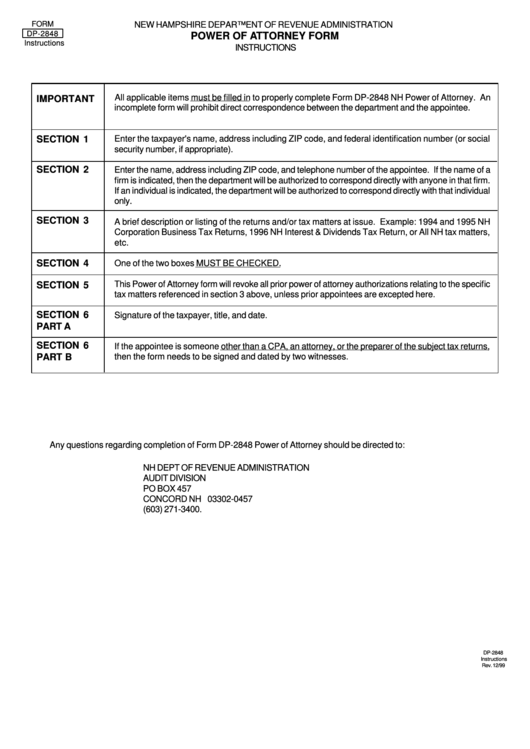

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

DP-2848

POWER OF ATTORNEY FORM

Instructions

INSTRUCTIONS

All applicable items must be filled in to properly complete Form DP-2848 NH Power of Attorney. An

IMPORTANT

incomplete form will prohibit direct correspondence between the department and the appointee.

SECTION 1

Enter the taxpayer's name, address including ZIP code, and federal identification number (or social

security number, if appropriate).

SECTION 2

Enter the name, address including ZIP code, and telephone number of the appointee. If the name of a

firm is indicated, then the department will be authorized to correspond directly with anyone in that firm.

If an individual is indicated, the department will be authorized to correspond directly with that individual

only.

SECTION 3

A brief description or listing of the returns and/or tax matters at issue. Example: 1994 and 1995 NH

Corporation Business Tax Returns, 1996 NH Interest & Dividends Tax Return, or All NH tax matters,

etc.

SECTION 4

One of the two boxes MUST BE CHECKED.

This Power of Attorney form will revoke all prior power of attorney authorizations relating to the specific

SECTION 5

tax matters referenced in section 3 above, unless prior appointees are excepted here.

SECTION 6

Signature of the taxpayer, title, and date.

PART A

SECTION 6

If the appointee is someone other than a CPA, an attorney, or the preparer of the subject tax returns,

PART B

then the form needs to be signed and dated by two witnesses.

Any questions regarding completion of Form DP-2848 Power of Attorney should be directed to:

NH DEPT OF REVENUE ADMINISTRATION

AUDIT DIVISION

PO BOX 457

CONCORD NH 03302-0457

(603) 271-3400.

DP-2848

Instructions

Rev. 12/99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1