Form 301 - Instructions For Making Application For A Certificate Of Authority By A Business Corporation

ADVERTISEMENT

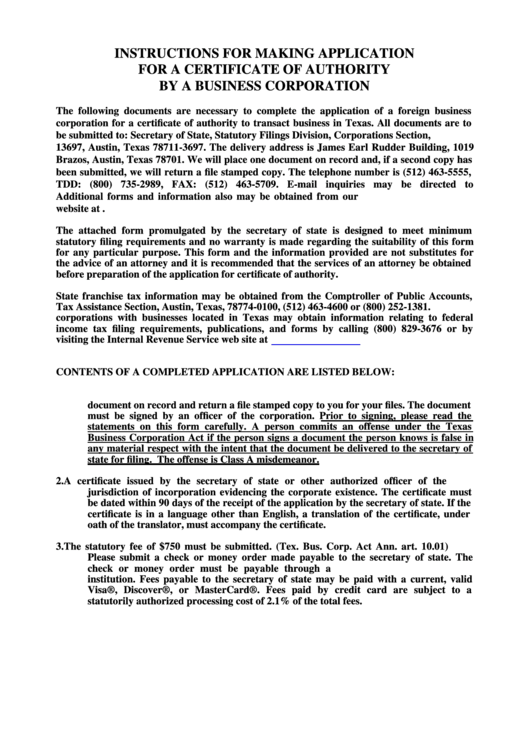

INSTRUCTIONS FOR MAKING APPLICATION

FOR A CERTIFICATE OF AUTHORITY

BY A BUSINESS CORPORATION

The following documents are necessary to complete the application of a foreign business

corporation for a certificate of authority to transact business in Texas. All documents are to

be submitted to: Secretary of State, Statutory Filings Division, Corporations Section, P.O. Box

13697, Austin, Texas 78711-3697. The delivery address is James Earl Rudder Building, 1019

Brazos, Austin, Texas 78701. We will place one document on record and, if a second copy has

been submitted, we will return a file stamped copy. The telephone number is (512) 463-5555,

TDD: (800) 735-2989, FAX: (512) 463-5709. E-mail inquiries may be directed to

corphelp@sos.state.tx.us. Additional forms and information also may be obtained from our

website at

The attached form promulgated by the secretary of state is designed to meet minimum

statutory filing requirements and no warranty is made regarding the suitability of this form

for any particular purpose. This form and the information provided are not substitutes for

the advice of an attorney and it is recommended that the services of an attorney be obtained

before preparation of the application for certificate of authority.

State franchise tax information may be obtained from the Comptroller of Public Accounts,

Tax Assistance Section, Austin, Texas, 78774-0100, (512) 463-4600 or (800) 252-1381. Non-U.S.

corporations with businesses located in Texas may obtain information relating to federal

income tax filing requirements, publications, and forms by calling (800) 829-3676 or by

visiting the Internal Revenue Service web site at

CONTENTS OF A COMPLETED APPLICATION ARE LISTED BELOW:

1.

Submit two copies of the application for a certificate of authority. We will place one

document on record and return a file stamped copy to you for your files. The document

must be signed by an officer of the corporation. Prior to signing, please read the

statements on this form carefully. A person commits an offense under the Texas

Business Corporation Act if the person signs a document the person knows is false in

any material respect with the intent that the document be delivered to the secretary of

state for filing. The offense is Class A misdemeanor.

2.

A certificate issued by the secretary of state or other authorized officer of the

jurisdiction of incorporation evidencing the corporate existence. The certificate must

be dated within 90 days of the receipt of the application by the secretary of state. If the

certificate is in a language other than English, a translation of the certificate, under

oath of the translator, must accompany the certificate.

3.

The statutory fee of $750 must be submitted. (Tex. Bus. Corp. Act Ann. art. 10.01)

Please submit a check or money order made payable to the secretary of state. The

check or money order must be payable through a U.S. bank or other financial

institution. Fees payable to the secretary of state may be paid with a current, valid

Visa®, Discover®, or MasterCard®. Fees paid by credit card are subject to a

statutorily authorized processing cost of 2.1% of the total fees.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2