Schedule Ct-945-A Back - Annual Record Of Withheld Connecticut Income Tax Form - State Of Connecticut Department Of Revenue Services - 2004

ADVERTISEMENT

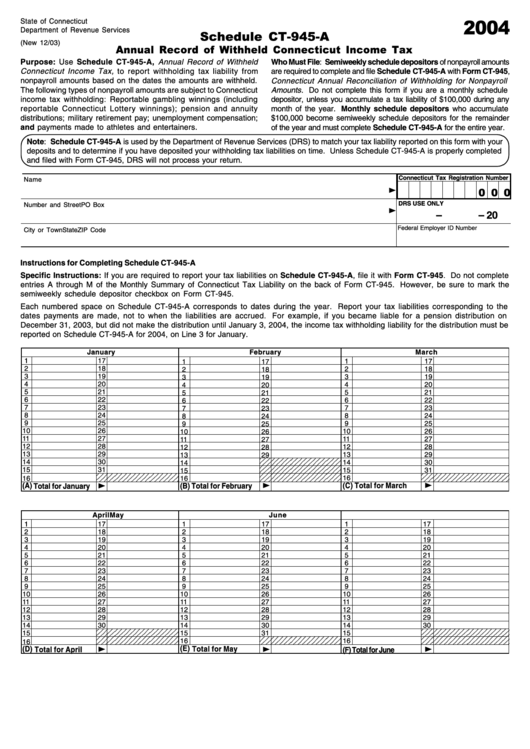

2004

State of Connecticut

Department of Revenue Services

Schedule CT-945-A

(New 12/03)

Annual Record of Withheld Connecticut Income Tax

Purpose: Use Schedule CT-945-A, Annual Record of Withheld

Who Must File: Semiweekly schedule depositors of nonpayroll amounts

Connecticut Income Tax, to report withholding tax liability from

are required to complete and file Schedule CT-945-A with Form CT-945,

nonpayroll amounts based on the dates the amounts are withheld.

Connecticut Annual Reconciliation of Withholding for Nonpayroll

The following types of nonpayroll amounts are subject to Connecticut

Amounts . Do not complete this form if you are a monthly schedule

income tax withholding: Reportable gambling winnings (including

depositor, unless you accumulate a tax liability of $100,000 during any

reportable Connecticut Lottery winnings); pension and annuity

month of the year. Monthly schedule depositors who accumulate

distributions; military retirement pay; unemployment compensation;

$100,000 become semiweekly schedule depositors for the remainder

and payments made to athletes and entertainers.

of the year and must complete Schedule CT-945-A for the entire year.

Note: Schedule CT-945-A is used by the Department of Revenue Services (DRS) to match your tax liability reported on this form with your

deposits and to determine if you have deposited your withholding tax liabilities on time. Unless Schedule CT-945-A is properly completed

and filed with Form CT-945, DRS will not process your return.

Connecticut Tax Registration Number

Name

0 0 0

DRS USE ONLY

Number and Street

PO Box

–

– 20

Federal Employer ID Number

City or Town

State

ZIP Code

Instructions for Completing Schedule CT-945-A

Specific Instructions: If you are required to report your tax liabilities on Schedule CT-945-A, file it with Form CT-945. Do not complete

entries A through M of the Monthly Summary of Connecticut Tax Liability on the back of Form CT-945. However, be sure to mark the

semiweekly schedule depositor checkbox on Form CT-945.

Each numbered space on Schedule CT-945-A corresponds to dates during the year. Report your tax liabilities corresponding to the

dates payments are made, not to when the liabilities are accrued. For example, if you became liable for a pension distribution on

December 31, 2003, but did not make the distribution until January 3, 2004, the income tax withholding liability for the distribution must be

reported on Schedule CT-945-A for 2004, on Line 3 for January.

January

February

March

1

17

1

17

1

17

2

18

2

18

2

18

3

19

3

19

3

19

4

20

4

20

4

20

5

21

21

5

21

5

6

22

6

22

6

22

7

23

7

23

7

23

8

24

8

24

8

24

9

25

9

25

9

25

10

26

10

26

10

26

11

27

11

27

11

27

12

28

28

12

28

12

13

29

29

13

29

13

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

14

30

14

30

14

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

15

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

31

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

15

15

31

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

16

16

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

(A) Total for January

(B) Total for February

(C) Total for March

April

May

June

1

17

1

17

1

17

2

18

2

18

2

18

3

19

3

19

3

19

4

20

4

20

4

20

5

21

5

21

5

21

6

22

6

22

6

22

7

23

7

23

7

23

8

24

8

24

8

24

9

25

9

25

9

25

10

26

10

26

10

26

11

27

11

27

11

27

12

28

12

28

12

28

13

29

13

29

13

29

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

14

30

14

30

14

30

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

15

15

31

15

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

16

16

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

(D) Total for April

(E) Total for May

(F) Total for June

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2