Income Tax Return Form - Newark E-Z Tax

ADVERTISEMENT

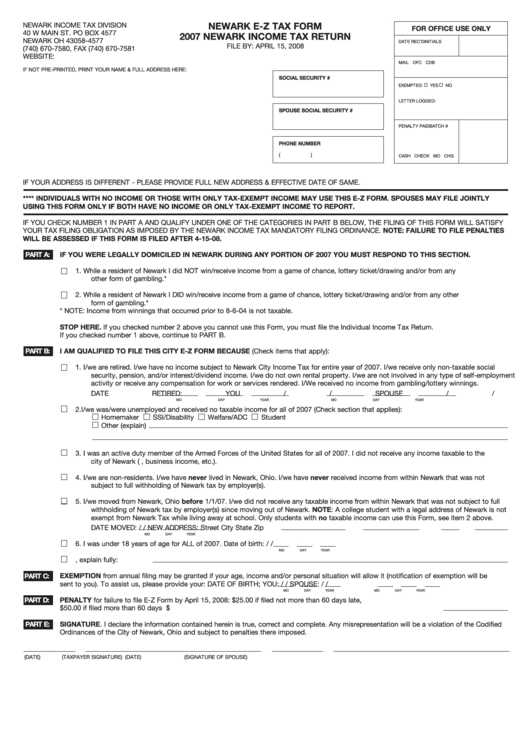

NEWARK INCOME TAX DIVISION

NEWARK E-Z TAX FORM

FOR OFFICE USE ONLY

40 W MAIN ST. PO BOX 4577

2007 NEWARK INCOME TAX RETURN

NEWARK OH 43058-4577

DATE REC’D

INITIALS

FILE BY: APRIL 15, 2008

(740) 670-7580, FAX (740) 670-7581

WEBSITE:

MAIL OFC CDB

IF NOT PRE-PRINTED, PRINT YOUR NAME & FULL ADDRESS HERE:

SOCIAL SECURITY #

EXEMPTED:

YES

NO

LETTER LOGGED:

SPOUSE SOCIAL SECURITY #

PENALTY PAID

BATCH #

PHONE NUMBER

(

)

CASH CHECK MO CHG

IF YOUR ADDRESS IS DIFFERENT - PLEASE PROVIDE FULL NEW ADDRESS & EFFECTIVE DATE OF SAME.

**** INDIVIDUALS WITH NO INCOME OR THOSE WITH ONLY TAX-EXEMPT INCOME MAY USE THIS E-Z FORM. SPOUSES MAY FILE JOINTLY

USING THIS FORM ONLY IF BOTH HAVE NO INCOME OR ONLY TAX-EXEMPT INCOME TO REPORT.

IF YOU CHECK NUMBER 1 IN PART A AND QUALIFY UNDER ONE OF THE CATEGORIES IN PART B BELOW, THE FILING OF THIS FORM WILL SATISFY

YOUR TAX FILING OBLIGATION AS IMPOSED BY THE NEWARK INCOME TAX MANDATORY FILING ORDINANCE. NOTE: FAILURE TO FILE PENALTIES

WILL BE ASSESSED IF THIS FORM IS FILED AFTER 4-15-08.

PART A:

IF YOU WERE LEGALLY DOMICILED IN NEWARK DURING ANY PORTION OF 2007 YOU MUST RESPOND TO THIS SECTION.

1.

While a resident of Newark I did NOT win/receive income from a game of chance, lottery ticket/drawing and/or from any

other form of gambling.*

2.

While a resident of Newark I DID win/receive income from a game of chance, lottery ticket/drawing and/or from any other

form of gambling.*

* NOTE: Income from winnings that occurred prior to 8-6-04 is not taxable.

STOP HERE. If you checked number 2 above you cannot use this Form, you must file the Individual Income Tax Return.

If you checked number 1 above, continue to PART B.

I AM QUALIFIED TO FILE THIS CITY E-Z FORM BECAUSE (Check items that apply):

PART B:

1.

I/we are retired. I/we have no income subject to Newark City Income Tax for entire year of 2007. I/we receive only non-taxable social

security, pension, and/or interest/dividend income. I/we do not own rental property. I/we are not involved in any type of self-employment

activity or receive any compensation for work or services rendered. I/We received no income from gambling/lottery winnings.

DATE RETIRED: YOU

/

/

SPOUSE

/

/

MO

DAY

YEAR

MO

DAY

YEAR

2.

I/we was/were unemployed and received no taxable income for all of 2007 (Check section that applies):

Homemaker

SSI/Disability

Welfare/ADC

Student

Other (explain)

3.

I was an active duty member of the Armed Forces of the United States for all of 2007. I did not receive any income taxable to the

city of Newark (i.e. rental, business income, etc.).

4.

I/we are non-residents. I/we have never lived in Newark, Ohio. I/we have never received income from within Newark that was not

subject to full withholding of Newark tax by employer(s).

5.

I/we moved from Newark, Ohio before 1/1/07. I/we did not receive any taxable income from within Newark that was not subject to full

withholding of Newark tax by employer(s) since moving out of Newark. NOTE: A college student with a legal address of Newark is not

exempt from Newark Tax while living away at school. Only students with no taxable income can use this Form, see item 2 above.

DATE MOVED:

/

/

NEW ADDRESS: Street

City

State

Zip

MO

DAY

YEAR

6.

I was under 18 years of age for ALL of 2007. Date of birth:

/

/

MO

DAY

YEAR

7.

Other, explain fully:

PART C:

EXEMPTION from annual filing may be granted if your age, income and/or personal situation will allow it (notification of exemption will be

sent to you). To assist us, please provide your: DATE OF BIRTH; YOU:

/

/

SPOUSE:

/

/

MO

DAY

YEAR

MO

DAY

YEAR

PART D:

PENALTY for failure to file E-Z Form by April 15, 2008: $25.00 if filed not more than 60 days late,

$50.00 if filed more than 60 days late ............................................................................................................ PENALTY DUE $

PART E:

SIGNATURE. I declare the information contained herein is true, correct and complete. Any misrepresentation will be a violation of the Codified

Ordinances of the City of Newark, Ohio and subject to penalties there imposed.

(DATE)

(TAXPAYER SIGNATURE)

(DATE)

(SIGNATURE OF SPOUSE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1