Form Dtf-82 - 2006 - Application For Qualified Empire Zone Enterprise (Qeze) Sales Tax Certification

ADVERTISEMENT

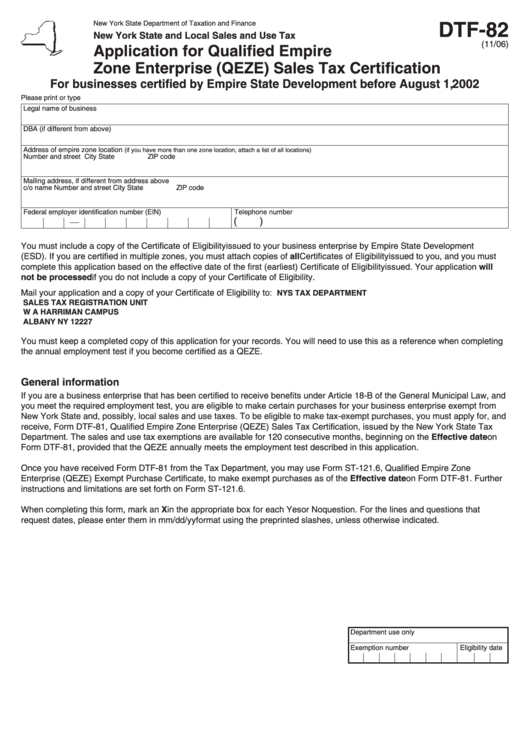

DTF-82

New York State Department of Taxation and Finance

New York State and Local Sales and Use Tax

(11/06)

Application for Qualified Empire

Zone Enterprise (QEZE) Sales Tax Certification

For businesses certified by Empire State Development before August 1, 2002

Please print or type

Legal name of business

DBA (if different from above)

Address of empire zone location

(if you have more than one zone location, attach a list of all locations)

Number and street

City

State

ZIP code

Mailing address, if different from address above

c/o name

Number and street

City

State

ZIP code

Federal employer identification number (EIN)

Telephone number

(

)

You must include a copy of the Certificate of Eligibility issued to your business enterprise by Empire State Development

(ESD). If you are certified in multiple zones, you must attach copies of all Certificates of Eligibility issued to you, and you must

complete this application based on the effective date of the first (earliest) Certificate of Eligibility issued. Your application will

not be processed if you do not include a copy of your Certificate of Eligibility.

Mail your application and a copy of your Certificate of Eligibility to:

NYS TAX DEPARTMENT

SALES TAX REGISTRATION UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

You must keep a completed copy of this application for your records. You will need to use this as a reference when completing

the annual employment test if you become certified as a QEZE.

General information

If you are a business enterprise that has been certified to receive benefits under Article 18‑B of the General Municipal Law, and

you meet the required employment test, you are eligible to make certain purchases for your business enterprise exempt from

New York State and, possibly, local sales and use taxes. To be eligible to make tax‑exempt purchases, you must apply for, and

receive, Form DTF‑81, Qualified Empire Zone Enterprise (QEZE) Sales Tax Certification, issued by the New York State Tax

Department. The sales and use tax exemptions are available for 120 consecutive months, beginning on the Effective date on

Form DTF‑81, provided that the QEZE annually meets the employment test described in this application.

Once you have received Form DTF‑81 from the Tax Department, you may use Form ST‑121.6, Qualified Empire Zone

Enterprise (QEZE) Exempt Purchase Certificate, to make exempt purchases as of the Effective date on Form DTF‑81. Further

instructions and limitations are set forth on Form ST‑121.6.

When completing this form, mark an X in the appropriate box for each Yes or No question. For the lines and questions that

request dates, please enter them in mm/dd/yy format using the preprinted slashes, unless otherwise indicated.

Department use only

Exemption number

Eligibility date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4