Reset Form

Print Form

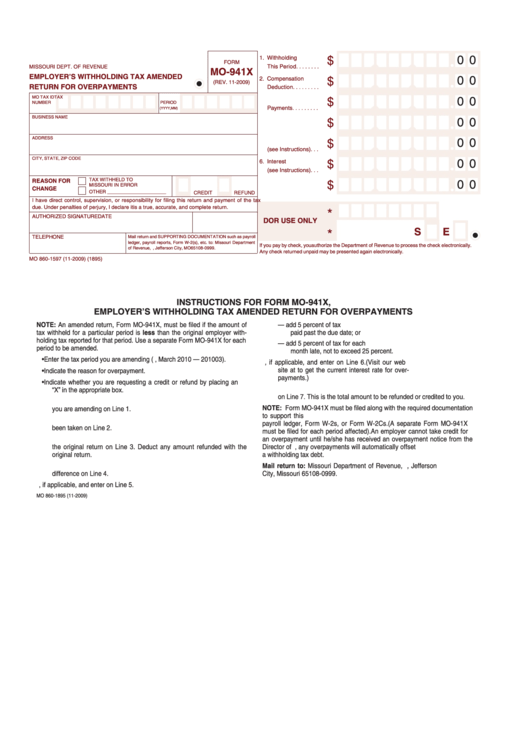

1. Withholding

0 0

$

FORM

•

This Period . . . . . . . .

MISSOURI DEPT. OF REVENUE

MO-941X

EMPLOYER’S WITHHOLDING TAX AMENDED

2. Compensation

0 0

$

(REV. 11-2009)

RETURN FOR OVERPAYMENTS

•

Deduction . . . . . . . . .

MO TAX ID

TAX

3. Previous Overpay/

0 0

$

NUMBER

PERIOD

•

Payments . . . . . . . . .

(YYYY,MM)

BUSINESS NAME

0 0

$

•

4. Balance . . . . . . . . . .

ADDRESS

5. Additions to Tax

0 0

$

•

(see Instructions) . . .

CITY, STATE, ZIP CODE

6. Interest

0 0

$

•

(see Instructions) . . .

TAX WITHHELD TO

REASON FOR

0 0

$

MISSOURI IN ERROR

CHANGE

•

7. Overpayment . . . . . .

OTHER ______________________

CREDIT

REFUND

I have direct control, supervision, or responsibility for filing this return and payment of the tax

due. Under penalties of perjury, I declare it is a true, accurate, and complete return.

*

AUTHORIZED SIGNATURE

DATE

DOR USE ONLY

S

E

*

Mail return and SUPPORTING DOCUMENTATION such as payroll

TELEPHONE

ledger, payroll reports, Form W-2(s), etc. to: Missouri Department

If you pay by check, you authorize the Department of Revenue to process the check electronically.

of Revenue, P.O. Box 999, Jefferson City, MO 65108-0999.

Any check returned unpaid may be presented again electronically.

MO 860-1597 (11-2009) 1895)

INSTRUCTIONS FOR FORM MO-941X,

EMPLOYER’S WITHHOLDING TAX AMENDED RETURN FOR OVERPAYMENTS

NOTE: An amended return, Form MO-941X, must be filed if the amount of

A. If the original withholding tax was paid late — add 5 percent of tax

tax withheld for a particular period is less than the original employer with-

paid past the due date; or

holding tax reported for that period. Use a separate Form MO-941X for each

B. If the original return was filed late — add 5 percent of tax for each

period to be amended.

month late, not to exceed 25 percent.

•

Enter the tax period you are amending (e.g., March 2010 — 201003).

6.

Compute interest, if applicable, and enter on Line 6. (Visit our web

site at to get the current interest rate for over-

•

Indicate the reason for overpayment.

payments.)

•

Indicate whether you are requesting a credit or refund by placing an

7.

Compute overpayment. Subtract Lines 5 and 6 from Line 4 and enter

“X” in the appropriate box.

on Line 7. This is the total amount to be refunded or credited to you.

1.

Enter the correct amount of employer withholding tax for the period

NOTE: Form MO-941X must be filed along with the required documentation

you are amending on Line 1.

to support this overpayment. Documentation may include a copy of your

2.

Enter the correct amount of compensation deduction that should have

payroll ledger, Form W-2s, or Form W-2Cs. (A separate Form MO-941X

been taken on Line 2.

must be filed for each period affected). An employer cannot take credit for

3.

Enter previous overpayments/credits taken and/or payments made on

an overpayment until he/she has received an overpayment notice from the

the original return on Line 3. Deduct any amount refunded with the

Director of Revenue. In addition, any overpayments will automatically offset

original return.

a withholding tax debt.

4.

Compute balance. Subtract Lines 2 and 3 from Line 1 and enter the

Mail return to: Missouri Department of Revenue, P.O. Box 999, Jefferson

difference on Line 4.

City, Missouri 65108-0999.

5.

Compute additions to tax, if applicable, and enter on Line 5.

MO 860-1895 (11-2009)

1

1