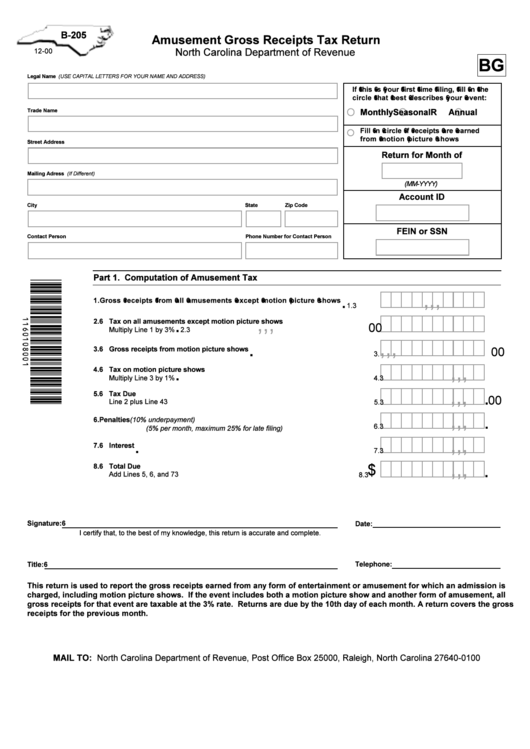

Form B-205 - Amusement Gross Receipts Tax Return

ADVERTISEMENT

B-205

Amusement Gross Receipts Tax Return

North Carolina Department of Revenue

12-00

BG

Legal Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

If this is your first time filing, fill in the

circle that best describes your event:

Monthly

Seasonal

Annual

Trade Name

Fill in circle if receipts are earned

from motion picture shows

Street Address

Return for Month of

Mailing Adress (If Different)

(MM-YYYY)

Account ID

City

State

Zip Code

FEIN or SSN

Contact Person

Phone Number for Contact Person

Part 1.

Computation of Amusement Tax

,

,

,

.

1.

Gross receipts from all amusements except motion picture shows

00

1.

,

,

,

.

2.

Tax on all amusements except motion picture shows

00

Multiply Line 1 by 3%

2.

,

,

,

.

3.

Gross receipts from motion picture shows

00

3.

,

,

,

.

4.

Tax on motion picture shows

00

Multiply Line 3 by 1%

4.

,

,

,

.

5.

Tax Due

00

Line 2 plus Line 4

5.

,

,

,

.

6.

Penalties (10% underpayment)

00

6.

(5% per month, maximum 25% for late filing)

,

,

,

.

7.

Interest

00

7.

,

,

,

.

$

8.

Total Due

00

Add Lines 5, 6, and 7

8.

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Telephone:

Title:

This return is used to report the gross receipts earned from any form of entertainment or amusement for which an admission is

charged, including motion picture shows. If the event includes both a motion picture show and another form of amusement, all

gross receipts for that event are taxable at the 3% rate. Returns are due by the 10th day of each month. A return covers the gross

receipts for the previous month.

MAIL TO: North Carolina Department of Revenue, Post Office Box 25000, Raleigh, North Carolina 27640-0100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2