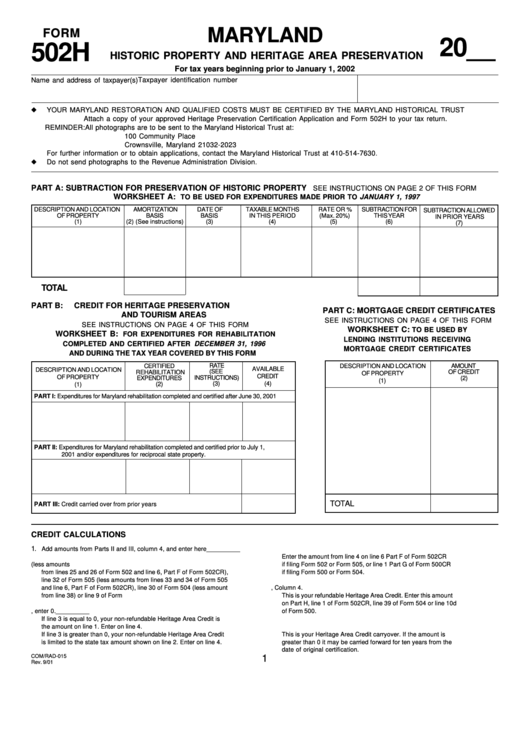

MARYLAND

FORM

20__

502H

HISTORIC PROPERTY AND HERITAGE AREA PRESERVATION

For tax years beginning prior to January 1, 2002

Taxpayer identification number

Name and address of taxpayer(s)

YOUR MARYLAND RESTORATION AND QUALIFIED COSTS MUST BE CERTIFIED BY THE MARYLAND HISTORICAL TRUST

Attach a copy of your approved Heritage Preservation Certification Application and Form 502H to your tax return.

REMINDER: All photographs are to be sent to the Maryland Historical Trust at:

100 Community Place

Crownsville, Maryland 21032-2023

For further information or to obtain applications, contact the Maryland Historical Trust at 410-514-7630.

Do not send photographs to the Revenue Administration Division.

PART A: SUBTRACTION FOR PRESERVATION OF HISTORIC PROPERTY

SEE INSTRUCTIONS ON PAGE 2 OF THIS FORM

WORKSHEET A:

TO BE USED FOR EXPENDITURES MADE PRIOR TO JANUARY 1, 1997

DESCRIPTION AND LOCATION

AMORTIZATION

DATE OF

TAXABLE MONTHS

RATE OR %

SUBTRACTION FOR

SUBTRACTION ALLOWED

OF PROPERTY

BASIS

BASIS

IN THIS PERIOD

(Max. 20%)

THIS YEAR

IN PRIOR YEARS

(1)

(2) (See instructions)

(3)

(4)

(5)

(6)

(7)

TOTAL

PART B:

CREDIT FOR HERITAGE PRESERVATION

PART C: MORTGAGE CREDIT CERTIFICATES

AND TOURISM AREAS

SEE INSTRUCTIONS ON PAGE 4 OF THIS FORM

SEE INSTRUCTIONS ON PAGE 4 OF THIS FORM

WORKSHEET C:

TO BE USED BY

WORKSHEET B:

FOR EXPENDITURES FOR REHABILITATION

LENDING INSTITUTIONS RECEIVING

COMPLETED AND CERTIFIED AFTER DECEMBER 31, 1996

MORTGAGE CREDIT CERTIFICATES

AND DURING THE TAX YEAR COVERED BY THIS FORM

RATE

CERTIFIED

DESCRIPTION AND LOCATION

AMOUNT

AVAILABLE

DESCRIPTION AND LOCATION

(SEE

REHABILITATION

OF CREDIT

OF PROPERTY

CREDIT

OF PROPERTY

EXPENDITURES

INSTRUCTIONS)

(2)

(1)

(3)

(4)

(1)

(2)

PART I: Expenditures for Maryland rehabilitation completed and certified after June 30, 2001

PART II: Expenditures for Maryland rehabilitation completed and certified prior to July 1,

2001 and/or expenditures for reciprocal state property.

TOTAL

PART III: Credit carried over from prior years ..........................................

CREDIT CALCULATIONS

1.

Add amounts from Parts II and III, column 4, and enter here ........... __________

4. Non-refundable Heritage Area Credit. ................................................. _________

Enter the amount from line 4 on line 6 Part F of Form 502CR

2. Enter the State tax from line 24 of Form 502 (less amounts

if filing Form 502 or Form 505, or line 1 Part G of Form 500CR

from lines 25 and 26 of Form 502 and line 6, Part F of Form 502CR),

if filing Form 500 or Form 504.

line 32 of Form 505 (less amounts from lines 33 and 34 of Form 505

and line 6, Part F of Form 502CR), line 30 of Form 504 (less amount

5. Enter the amounts from Part I, Column 4. .......................................... _________

from line 38) or line 9 of Form 500. ..................................................... __________

This is your refundable Heritage Area Credit. Enter this amount

on Part H, line 1 of Form 502CR, line 39 of Form 504 or line 10d

3. Subtract line 2 from line 1. If less than 0, enter 0. ............................ __________

of Form 500.

If line 3 is equal to 0, your non-refundable Heritage Area Credit is

the amount on line 1. Enter on line 4.

6. Enter the amount from line 3. .............................................................. _________

If line 3 is greater than 0, your non-refundable Heritage Area Credit

This is your Heritage Area Credit carryover. If the amount is

is limited to the state tax amount shown on line 2. Enter on line 4.

greater than 0 it may be carried forward for ten years from the

date of original certification.

COM/RAD-015

1

Rev. 9/01

1

1 2

2