Prepaid Local Taxon Motor Fuel Floor Stock As Of December 31, 2007 Form - State Of Georgia Department Of Revenue

ADVERTISEMENT

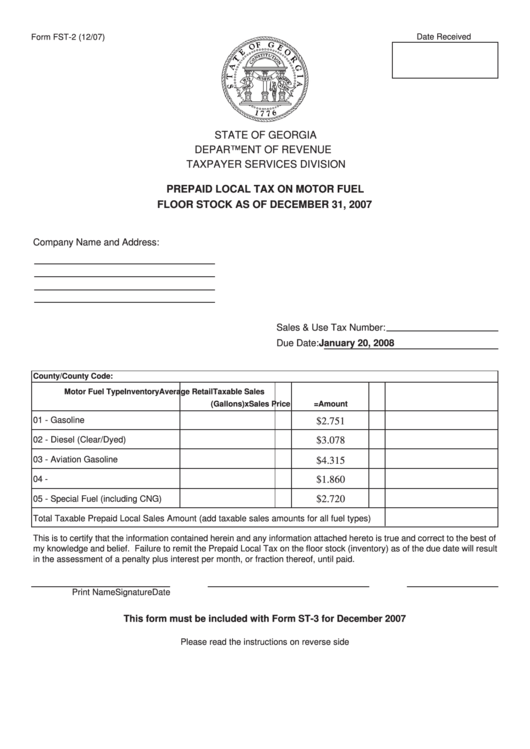

Form FST-2 (12/07)

Date Received

STATE OF GEORGIA

DEPARTMENT OF REVENUE

TAXPAYER SERVICES DIVISION

PREPAID LOCAL TAX ON MOTOR FUEL

FLOOR STOCK AS OF DECEMBER 31, 2007

Company Name and Address:

Sales & Use Tax Number:

Due Date:

January 20, 2008

County/County Code:

Motor Fuel Type

Inventory

Average Retail

Taxable Sales

(Gallons)

x

Sales Price

=

Amount

01 - Gasoline

$2.751

02 - Diesel (Clear/Dyed)

$3.078

03 - Aviation Gasoline

$4.315

04 - L.P.G.

$1.860

$2.720

05 - Special Fuel (including CNG)

Total Taxable Prepaid Local Sales Amount (add taxable sales amounts for all fuel types)

This is to certify that the information contained herein and any information attached hereto is true and correct to the best of

my knowledge and belief. Failure to remit the Prepaid Local Tax on the floor stock (inventory) as of the due date will result

in the assessment of a penalty plus interest per month, or fraction thereof, until paid.

Print Name

Signature

Date

This form must be included with Form ST-3 for December 2007

Please read the instructions on reverse side

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1