Form E-500 - Sales And Use Tax Return

ADVERTISEMENT

4

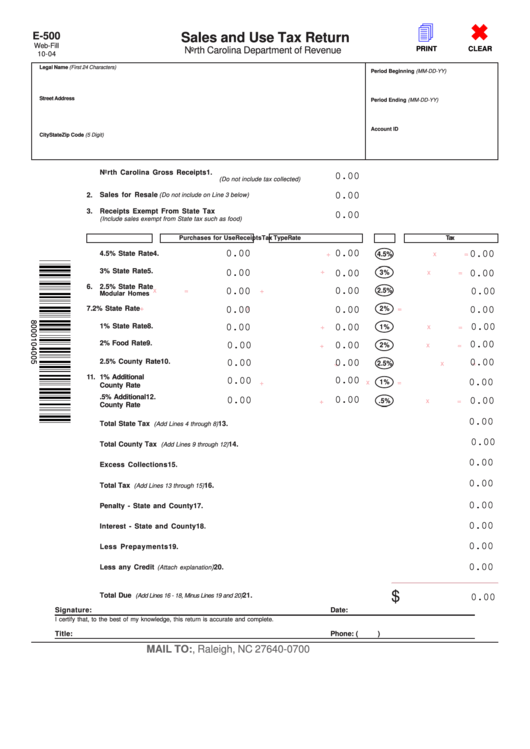

E-500

Sales and Use Tax Return

Web-Fill

North Carolina Department of Revenue

PRINT

CLEAR

10-04

Legal Name (First 24 Characters)

Period Beginning (MM-DD-YY)

Street Address

Period Ending (MM-DD-YY)

Account ID

City

State

Zip Code (5 Digit)

1.

North Carolina Gross Receipts

0.00

(Do not include tax collected)

0.00

2.

Sales for Resale

(Do not include on Line 3 below)

3.

Receipts Exempt From State Tax

0.00

(Include sales exempt from State tax such as food)

Tax Type

Purchases for Use

Receipts

Rate

Tax

0.00

0.00

0.00

4.

4.5% State Rate

+

x

4.5%

=

5.

3% State Rate

+

0.00

0.00

x

3%

=

0.00

6.

2.5% State Rate

0.00

0.00

x

2.5%

0.00

+

=

Modular Homes

7. 2% State Rate

0.00

+

0.00

x

2%

=

0.00

0.00

8.

1% State Rate

0.00

0.00

x

1%

+

=

9.

2% Food Rate

0.00

0.00

0.00

x

2%

=

+

0.00

10.

2.5% County Rate

0.00

0.00

x

2.5%

=

+

11.

1% Additional

0.00

0.00

0.00

x

1%

=

+

County Rate

12.

.5% Additional

0.00

0.00

0.00

x

.5%

=

+

County Rate

0.00

13.

Total State Tax

(Add Lines 4 through 8)

0.00

14.

Total County Tax

(Add Lines 9 through 12)

0.00

15.

Excess Collections

0.00

16.

Total Tax

(Add Lines 13 through 15)

0.00

17.

Penalty - State and County

0.00

18.

Interest - State and County

0.00

19.

Less Prepayments

0.00

20.

Less any Credit

)

(Attach explanation

$

21.

Total Due

(Add Lines 16 - 18, Minus Lines 19 and 20)

0.00

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Title:

Phone: (

)

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0700

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1