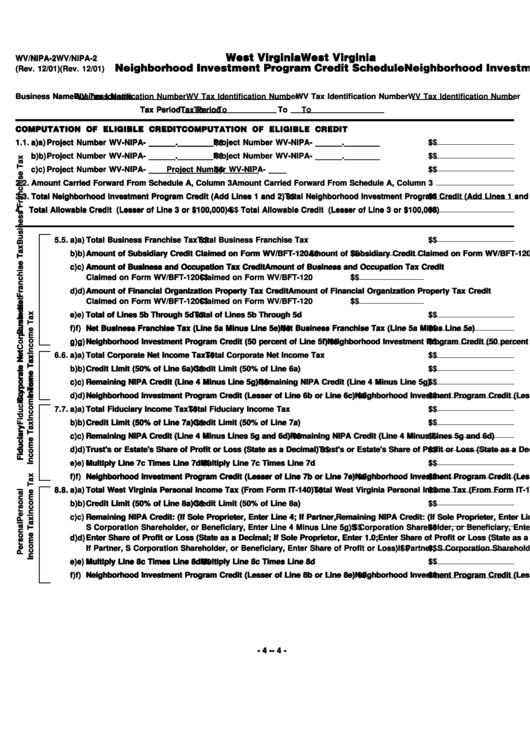

Form Nipa-2 - Neighborhood Investment Program Credit Schedule

ADVERTISEMENT

West Virginia

West Virginia

West Virginia

West Virginia

West Virginia

WV/NIPA-2

WV/NIPA-2

WV/NIPA-2

WV/NIPA-2

WV/NIPA-2

Neighborhood Investment Program Credit Schedule

Neighborhood Investment Program Credit Schedule

Neighborhood Investment Program Credit Schedule

Neighborhood Investment Program Credit Schedule

Neighborhood Investment Program Credit Schedule

(Rev. 12/01)

(Rev. 12/01)

(Rev. 12/01)

(Rev. 12/01)

(Rev. 12/01)

Business Name

Business Name

Business Name

WV Tax Identification Number

WV Tax Identification Number

WV Tax Identification Number

Business Name

Business Name

WV Tax Identification Number

WV Tax Identification Number

Tax Period

Tax Period

To

To

Tax Period

Tax Period

Tax Period

To

To

To

COMPUTATION OF ELIGIBLE CREDIT

COMPUTATION OF ELIGIBLE CREDIT

COMPUTATION OF ELIGIBLE CREDIT

COMPUTATION OF ELIGIBLE CREDIT

COMPUTATION OF ELIGIBLE CREDIT

1. 1. 1. 1. 1.

a) a) a) a) a)

Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________

..................................................................................................

..................................................................................................

.................................................................................................. $ $ $ $ $

Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________ ..................................................................................................

..................................................................................................

b) b) b) b) b) Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________

Project Number WV-NIPA- ______.________ ..................................................................................................

..................................................................................................

..................................................................................................

..................................................................................................

.................................................................................................. $ $ $ $ $

c) c) c) c) c)

Project Number WV-NIPA- ____

Project Number WV-NIPA- ____

Project Number WV-NIPA- ____

Project Number WV-NIPA- ____

Project Number WV-NIPA- ______.________

__.________

__.________

__.________

__.________ ..................................................................................................

..................................................................................................

..................................................................................................

..................................................................................................

.................................................................................................. $ $ $ $ $

2. 2. 2. 2. 2.

Amount Carried Forward From Schedule A, Column 3

Amount Carried Forward From Schedule A, Column 3

Amount Carried Forward From Schedule A, Column 3 .........................................................................................

.........................................................................................

.........................................................................................

.........................................................................................

Amount Carried Forward From Schedule A, Column 3

Amount Carried Forward From Schedule A, Column 3

.........................................................................................

3. 3. 3. 3. 3.

Total Neighborhood Investment Program Credit (Add Lines 1 and 2)

Total Neighborhood Investment Program Credit (Add Lines 1 and 2)

.................................................................

.................................................................

................................................................. $ $ $ $ $

Total Neighborhood Investment Program Credit (Add Lines 1 and 2)

Total Neighborhood Investment Program Credit (Add Lines 1 and 2)

Total Neighborhood Investment Program Credit (Add Lines 1 and 2) .................................................................

.................................................................

4. Total Allowable Credit (Lesser of Line 3 or $100,000)

4. Total Allowable Credit (Lesser of Line 3 or $100,000)

4. Total Allowable Credit (Lesser of Line 3 or $100,000)

4. Total Allowable Credit (Lesser of Line 3 or $100,000)

4. Total Allowable Credit (Lesser of Line 3 or $100,000) ...........................................................................................

...........................................................................................

...........................................................................................

...........................................................................................

........................................................................................... $ $ $ $ $

5. 5. 5. 5. 5.

a) a) a) a) a)

Total Business Franchise Tax

Total Business Franchise Tax

Total Business Franchise Tax

Total Business Franchise Tax

Total Business Franchise Tax .........................................................................................................

.........................................................................................................

.........................................................................................................

.........................................................................................................

......................................................................................................... $ $ $ $ $

b) b) b) b) b) Amount of Subsidiary Credit Claimed on Form WV/BFT-120

Amount of Subsidiary Credit Claimed on Form WV/BFT-120

Amount of Subsidiary Credit Claimed on Form WV/BFT-120

Amount of Subsidiary Credit Claimed on Form WV/BFT-120 ..................

..................

.................. $ $ $ $ $

..................

Amount of Subsidiary Credit Claimed on Form WV/BFT-120

..................

c) c) c) c) c)

Amount of Business and Occupation Tax Credit

Amount of Business and Occupation Tax Credit

Amount of Business and Occupation Tax Credit

Amount of Business and Occupation Tax Credit

Amount of Business and Occupation Tax Credit

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120 .....................................................................

.....................................................................

.....................................................................

.....................................................................

..................................................................... $ $ $ $ $

d) d) d) d) d) Amount of Financial Organization Property Tax Credit

Amount of Financial Organization Property Tax Credit

Amount of Financial Organization Property Tax Credit

Amount of Financial Organization Property Tax Credit

Amount of Financial Organization Property Tax Credit

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120

.....................................................................

.....................................................................

..................................................................... $ $ $ $ $

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120

Claimed on Form WV/BFT-120 .....................................................................

.....................................................................

e) e) e) e) e)

Total of Lines 5b Through 5d

Total of Lines 5b Through 5d

Total of Lines 5b Through 5d

Total of Lines 5b Through 5d

Total of Lines 5b Through 5d ...........................................................................................................

...........................................................................................................

...........................................................................................................

...........................................................................................................

........................................................................................................... $ $ $ $ $

f) f) f) f) f)

Net Business Franchise Tax (Line 5a Minus Line 5e)

Net Business Franchise Tax (Line 5a Minus Line 5e)

Net Business Franchise Tax (Line 5a Minus Line 5e)

Net Business Franchise Tax (Line 5a Minus Line 5e)

Net Business Franchise Tax (Line 5a Minus Line 5e) ...................................................................

...................................................................

...................................................................

...................................................................

................................................................... $ $ $ $ $

g) g) g) g) g) Neighborhood Investment Program Credit (50 percent of Line 5f)

Neighborhood Investment Program Credit (50 percent of Line 5f)

Neighborhood Investment Program Credit (50 percent of Line 5f)

Neighborhood Investment Program Credit (50 percent of Line 5f)

Neighborhood Investment Program Credit (50 percent of Line 5f) .............................................

.............................................

.............................................

.............................................

............................................. $ $ $ $ $

6. 6. 6. 6. 6.

a) a) a) a) a)

Total Corporate Net Income Tax

Total Corporate Net Income Tax

Total Corporate Net Income Tax ......................................................................................................

......................................................................................................

......................................................................................................

...................................................................................................... $ $ $ $ $

Total Corporate Net Income Tax

Total Corporate Net Income Tax

......................................................................................................

b) b) b) b) b) Credit Limit (50% of Line 6a)

Credit Limit (50% of Line 6a)

Credit Limit (50% of Line 6a)

...........................................................................................................

...........................................................................................................

........................................................................................................... $ $ $ $ $

Credit Limit (50% of Line 6a)

Credit Limit (50% of Line 6a) ...........................................................................................................

...........................................................................................................

c) c) c) c) c)

Remaining NIPA Credit (Line 4 Minus Line 5g)

Remaining NIPA Credit (Line 4 Minus Line 5g)

Remaining NIPA Credit (Line 4 Minus Line 5g)

Remaining NIPA Credit (Line 4 Minus Line 5g)

Remaining NIPA Credit (Line 4 Minus Line 5g) .............................................................................

.............................................................................

.............................................................................

............................................................................. $ $ $ $ $

.............................................................................

d) d) d) d) d) Neighborhood Investment Program Credit (Lesser of Line 6b or Line 6c)

Neighborhood Investment Program Credit (Lesser of Line 6b or Line 6c)

Neighborhood Investment Program Credit (Lesser of Line 6b or Line 6c)

Neighborhood Investment Program Credit (Lesser of Line 6b or Line 6c)

Neighborhood Investment Program Credit (Lesser of Line 6b or Line 6c) ................................

................................

................................

................................ $ $ $ $ $

................................

7. 7. 7. 7. 7.

a) a) a) a) a)

Total Fiduciary Income Tax

Total Fiduciary Income Tax

Total Fiduciary Income Tax ..............................................................................................................

..............................................................................................................

..............................................................................................................

.............................................................................................................. $ $ $ $ $

Total Fiduciary Income Tax

Total Fiduciary Income Tax

..............................................................................................................

b) b) b) b) b) Credit Limit (50% of Line 7a)

Credit Limit (50% of Line 7a)

Credit Limit (50% of Line 7a)

...........................................................................................................

...........................................................................................................

........................................................................................................... $ $ $ $ $

Credit Limit (50% of Line 7a)

Credit Limit (50% of Line 7a) ...........................................................................................................

...........................................................................................................

c) c) c) c) c)

Remaining NIPA Credit (Line 4 Minus Lines 5g and 6d)

Remaining NIPA Credit (Line 4 Minus Lines 5g and 6d)

Remaining NIPA Credit (Line 4 Minus Lines 5g and 6d)

Remaining NIPA Credit (Line 4 Minus Lines 5g and 6d)

Remaining NIPA Credit (Line 4 Minus Lines 5g and 6d) ..............................................................

..............................................................

..............................................................

..............................................................

.............................................................. $ $ $ $ $

d) d) d) d) d) Trust's or Estate's Share of Profit or Loss (State as a Decimal)

Trust's or Estate's Share of Profit or Loss (State as a Decimal)

Trust's or Estate's Share of Profit or Loss (State as a Decimal)

Trust's or Estate's Share of Profit or Loss (State as a Decimal)

Trust's or Estate's Share of Profit or Loss (State as a Decimal) .................................................

.................................................

.................................................

.................................................

................................................. $ $ $ $ $

e) e) e) e) e)

Multiply Line 7c Times Line 7d

Multiply Line 7c Times Line 7d

Multiply Line 7c Times Line 7d

Multiply Line 7c Times Line 7d

Multiply Line 7c Times Line 7d ........................................................................................................

........................................................................................................

........................................................................................................

........................................................................................................ $ $ $ $ $

........................................................................................................

f) f) f) f) f)

Neighborhood Investment Program Credit (Lesser of Line 7b or Line 7e)

Neighborhood Investment Program Credit (Lesser of Line 7b or Line 7e)

Neighborhood Investment Program Credit (Lesser of Line 7b or Line 7e) ................................

................................

................................ $ $ $ $ $

................................

Neighborhood Investment Program Credit (Lesser of Line 7b or Line 7e)

Neighborhood Investment Program Credit (Lesser of Line 7b or Line 7e)

................................

8. 8. 8. 8. 8.

a) a) a) a) a)

Total West Virginia Personal Income Tax (From Form IT-140)

Total West Virginia Personal Income Tax (From Form IT-140)

....................................................

.................................................... $ $ $ $ $

....................................................

Total West Virginia Personal Income Tax (From Form IT-140)

Total West Virginia Personal Income Tax (From Form IT-140)

Total West Virginia Personal Income Tax (From Form IT-140) ....................................................

....................................................

b) b) b) b) b) Credit Limit (50% of Line 8a)

Credit Limit (50% of Line 8a)

Credit Limit (50% of Line 8a)

Credit Limit (50% of Line 8a)

Credit Limit (50% of Line 8a) ...........................................................................................................

...........................................................................................................

...........................................................................................................

...........................................................................................................

........................................................................................................... $ $ $ $ $

c) c) c) c) c)

Remaining NIPA Credit: (If Sole Proprieter, Enter Line 4; If Partner,

Remaining NIPA Credit: (If Sole Proprieter, Enter Line 4; If Partner,

Remaining NIPA Credit: (If Sole Proprieter, Enter Line 4; If Partner,

Remaining NIPA Credit: (If Sole Proprieter, Enter Line 4; If Partner,

Remaining NIPA Credit: (If Sole Proprieter, Enter Line 4; If Partner,

S Corporation Shareholder, or Beneficiary, Enter Line 4 Minus Line 5g)

S Corporation Shareholder, or Beneficiary, Enter Line 4 Minus Line 5g)

..................................

..................................

.................................. $ $ $ $ $

S Corporation Shareholder, or Beneficiary, Enter Line 4 Minus Line 5g)

S Corporation Shareholder, or Beneficiary, Enter Line 4 Minus Line 5g)

S Corporation Shareholder, or Beneficiary, Enter Line 4 Minus Line 5g) ..................................

..................................

d) d) d) d) d) Enter Share of Profit or Loss (State as a Decimal; If Sole Proprietor, Enter 1.0;

Enter Share of Profit or Loss (State as a Decimal; If Sole Proprietor, Enter 1.0;

Enter Share of Profit or Loss (State as a Decimal; If Sole Proprietor, Enter 1.0;

Enter Share of Profit or Loss (State as a Decimal; If Sole Proprietor, Enter 1.0;

Enter Share of Profit or Loss (State as a Decimal; If Sole Proprietor, Enter 1.0;

If Partner, S Corporation Shareholder, or Beneficiary, Enter Share of Profit or Loss)

If Partner, S Corporation Shareholder, or Beneficiary, Enter Share of Profit or Loss)

If Partner, S Corporation Shareholder, or Beneficiary, Enter Share of Profit or Loss) ............

............

............

............ $ $ $ $ $

If Partner, S Corporation Shareholder, or Beneficiary, Enter Share of Profit or Loss)

If Partner, S Corporation Shareholder, or Beneficiary, Enter Share of Profit or Loss)

............

e) e) e) e) e)

Multiply Line 8c Times Line 8d

Multiply Line 8c Times Line 8d

........................................................................................................

........................................................................................................ $ $ $ $ $

........................................................................................................

Multiply Line 8c Times Line 8d

Multiply Line 8c Times Line 8d

Multiply Line 8c Times Line 8d ........................................................................................................

........................................................................................................

f) f) f) f) f)

Neighborhood Investment Program Credit (Lesser of Line 8b or Line 8e)

Neighborhood Investment Program Credit (Lesser of Line 8b or Line 8e)

Neighborhood Investment Program Credit (Lesser of Line 8b or Line 8e)

Neighborhood Investment Program Credit (Lesser of Line 8b or Line 8e)

Neighborhood Investment Program Credit (Lesser of Line 8b or Line 8e) ................................

................................

................................

................................ $ $ $ $ $

................................

- 4 -

- 4 -

- 4 -

- 4 -

- 4 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2