Form Csr-1 - Coal Mining Assessment And Special 2 Cent Per Ton Tax

ADVERTISEMENT

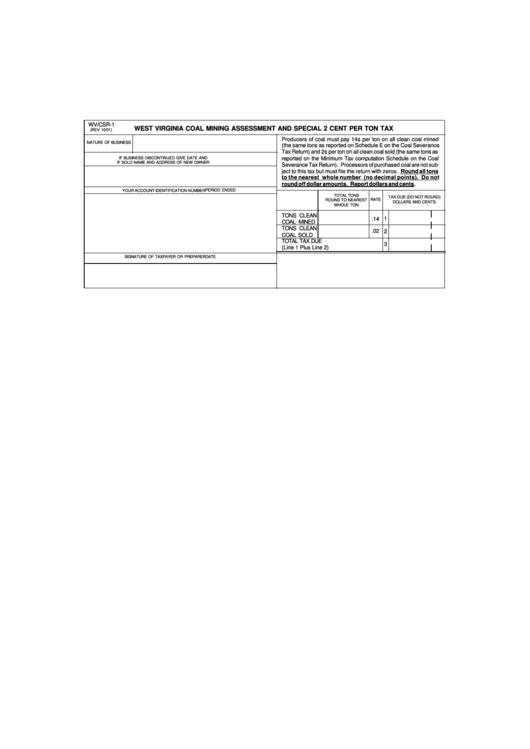

WV/CSR-1

WEST VIRGINIA COAL MINING ASSESSMENT AND SPECIAL 2 CENT PER TON TAX

(REV 10/01)

Producers of coal must pay 14¢ per ton on all clean coal mined

NATURE OF BUSINESS

(the same tons as reported on Schedule E on the Coal Severance

Tax Return) and 2¢ per ton on all clean coal sold (the same tons as

IF BUSINESS DISCONTINUED GIVE DATE AND

reported on the Minimum Tax computation Schedule on the Coal

IF SOLD NAME AND ADDRESS OF NEW OWNER

Severance Tax Return). Processors of purchased coal are not sub-

ject to this tax but must file the return with zeros. Round all tons

to the nearest whole number (no decimal points). Do not

round off dollar amounts. Report dollars and cents.

PERIOD ENDED

YOUR ACCOUNT IDENTIFICATION NUMBER

TOTAL TONS

TAX DUE (DO NOT ROUND)

RATE

ROUND TO NEAREST

DOLLARS AND CENTS

WHOLE TON

TONS CLEAN

1

.14

COAL MINED

TONS CLEAN

.02

2

COAL SOLD

TOTAL TAX DUE

3

(Line 1 Plus Line 2)

SIGNATURE OF TAXPAYER OR PREPARER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1