Form It-40 - County Tax Schedule For Indiana Residents Form

ADVERTISEMENT

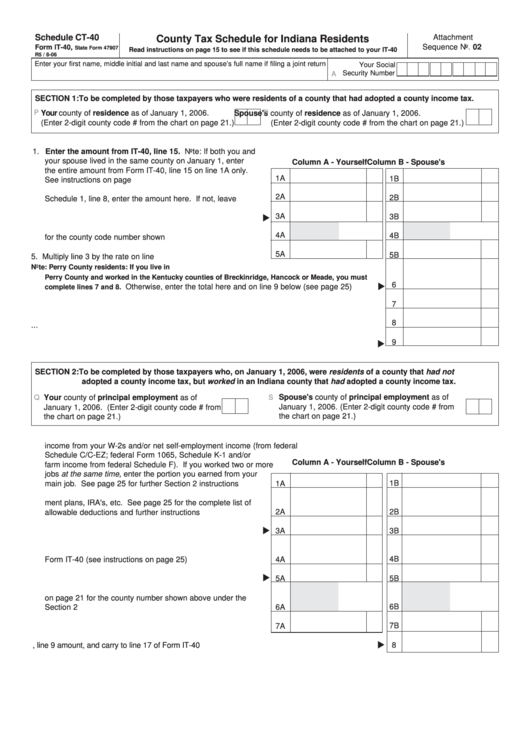

Schedule CT-40

Attachment

County Tax Schedule for Indiana Residents

Sequence No. 02

Form IT-40,

State Form 47907

Read instructions on page 15 to see if this schedule needs to be attached to your IT-40

R5 / 8-06

Enter your first name, middle initial and last name and spouse’s full name if filing a joint return

Your Social

Security Number

A

SECTION 1: To be completed by those taxpayers who were residents of a county that had adopted a county income tax.

P

Your county of residence as of January 1, 2006.

R

Spouse's county of residence as of January 1, 2006.

(Enter 2-digit county code # from the chart on page 21.)

(Enter 2-digit county code # from the chart on page 21.)

1. Enter the amount from IT-40, line 15. Note: If both you and

your spouse lived in the same county on January 1, enter

Column A - Yourself

Column B - Spouse's

the entire amount from Form IT-40, line 15 on line 1A only.

1A

1B

See instructions on page 24 .........................................................

2. If you claimed a non-Indiana locality earnings deduction on

2A

2B

Schedule 1, line 8, enter the amount here. If not, leave blank ....

3A

3B

3. Add lines 1 and 2 .....................................................................

4. Enter the resident rate from the county tax chart on page 21

4A

4B

for the county code number shown above ...................................

5A

5B

5. Multiply line 3 by the rate on line 4 ...............................................

6. Add lines 5A and 5B. Enter the total here.

Note: Perry County residents: If you live in

Perry County and worked in the Kentucky counties of Breckinridge, Hancock or Meade, you must

6

Otherwise, enter the total here and on line 9 below (see page 25) .........

complete lines 7 and 8.

7

7. Enter the amount of income that was taxed by any of the Kentucky counties listed on line 6 above

8

8. Multiply line 7 by .0053 and enter total here ..................................................................................

9

9. Line 6 minus line 8. Enter the total here and on line 17 of Form IT-40 ........................................

SECTION 2: To be completed by those taxpayers who, on January 1, 2006, were residents of a county that had not

adopted a county income tax, but worked in an Indiana county that had adopted a county income tax.

Spouse's county of principal employment as of

Q

Your county of principal employment as of

S

January 1, 2006. (Enter 2-digit county code # from

January 1, 2006. (Enter 2-digit county code # from

the chart on page 21.)

the chart on page 21.)

1. Enter your principal employment income by entering the total

income from your W-2s and/or net self-employment income (from federal

Schedule C/C-EZ; federal Form 1065, Schedule K-1 and/or

Column A - Yourself

Column B - Spouse's

farm income from federal Schedule F). If you worked two or more

jobs at the same time, enter the portion you earned from your

1B

1A

main job. See page 25 for further Section 2 instructions ............

2. Enter any amounts for payments made to self-employed retire-

ment plans, IRA's, etc. See page 25 for the complete list of

allowable deductions and further instructions ..............................

2A

2B

3. Subtract line 2 from line 1 ........................................................

3A

3B

4. Enter some or all of the exemptions from line 14 of

4B

Form IT-40 (see instructions on page 25) ....................................

4A

5B

5. Subtract line 4 from line 3 ........................................................

5A

6. Enter the nonresident rate from the county tax rate chart

on page 21 for the county number shown above under the

6B

Section 2 heading .........................................................................

6A

7B

7. Multiply the income on line 5 by the rate on line 6 .......................

7A

8

8. Enter total of 7A plus 7B. Add to any Section 1, line 9 amount, and carry to line 17 of Form IT-40

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1