Form R-7015 - Power Of Attorney

Download a blank fillable Form R-7015 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form R-7015 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

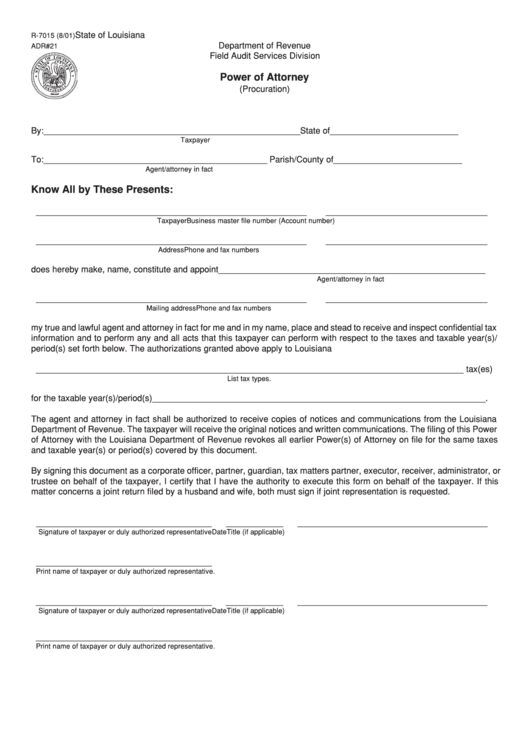

State of Louisiana

R-7015 (8/01)

Department of Revenue

ADR#21

Field Audit Services Division

Power of Attorney

(Procuration)

By:

______________________________________________________ State of ___________________________

Taxpayer

To:

_______________________________________________ Parish/County of ___________________________

Agent/attorney in fact

Know All by These Presents:

_________________________________________________________

__________________________________

Taxpayer

Business master file number (Account number)

_________________________________________________________

__________________________________

Address

Phone and fax numbers

does hereby make, name, constitute and appoint ________________________________________________________

Agent/attorney in fact

_________________________________________________________

__________________________________

Mailing address

Phone and fax numbers

my true and lawful agent and attorney in fact for me and in my name, place and stead to receive and inspect confidential tax

information and to perform any and all acts that this taxpayer can perform with respect to the taxes and taxable year(s)/

period(s) set forth below. The authorizations granted above apply to Louisiana

__________________________________________________________________________________________ tax(es)

List tax types.

for the taxable year(s)/period(s) ______________________________________________________________________ .

The agent and attorney in fact shall be authorized to receive copies of notices and communications from the Louisiana

Department of Revenue. The taxpayer will receive the original notices and written communications. The filing of this Power

of Attorney with the Louisiana Department of Revenue revokes all earlier Power(s) of Attorney on file for the same taxes

and taxable year(s) or period(s) covered by this document.

By signing this document as a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or

trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer. If this

matter concerns a joint return filed by a husband and wife, both must sign if joint representation is requested.

_____________________________________

____________

________________________________________

Signature of taxpayer or duly authorized representative

Date

Title (if applicable)

_____________________________________

Print name of taxpayer or duly authorized representative.

_____________________________________

____________

________________________________________

Signature of taxpayer or duly authorized representative

Date

Title (if applicable)

_____________________________________

Print name of taxpayer or duly authorized representative.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1