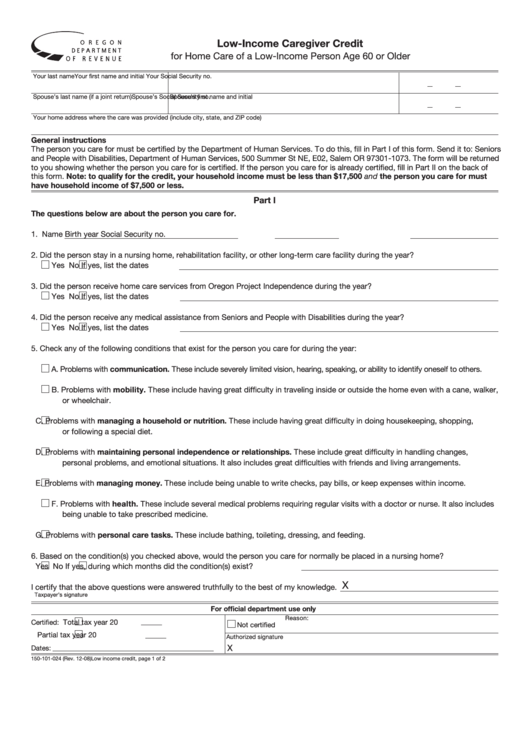

Low-Income Caregiver Credit

Clear Form

for Home Care of a Low-Income Person Age 60 or Older

Your last name

Your first name and initial

Your Social Security no.

Spouse’s last name (if a joint return)

Spouse’s first name and initial

Spouse’s Social Security no.

Your home address where the care was provided (include city, state, and ZIP code)

General instructions

The person you care for must be certified by the Department of Human Services. To do this, fill in Part I of this form. Send it to: Seniors

and People with Disabilities, Department of Human Services, 500 Summer St NE, E02, Salem OR 97301-1073. The form will be returned

to you showing whether the person you care for is certified. If the person you care for is already certified, fill in Part II on the back of

this form. Note: to qualify for the credit, your household income must be less than $17,500 and the person you care for must

have household income of $7,500 or less.

Part I

The questions below are about the person you care for.

1. Name

Birth year

Social Security no.

2. Did the person stay in a nursing home, rehabilitation facility, or other long-term care facility during the year?

Yes

No

If yes, list the dates

3. Did the person receive home care services from Oregon Project Independence during the year?

Yes

No

If yes, list the dates

4. Did the person receive any medical assistance from Seniors and People with Disabilities during the year?

Yes

No

If yes, list the dates

5. Check any of the following conditions that exist for the person you care for during the year:

A. Problems with communication. These include severely limited vision, hearing, speaking, or ability to identify oneself to others.

B. Problems with mobility. These include having great difficulty in traveling inside or outside the home even with a cane, walker,

or wheelchair.

C. Problems with managing a household or nutrition. These include having great difficulty in doing housekeeping, shopping,

or following a special diet.

D. Problems with maintaining personal independence or relationships. These include great difficulty in handling changes,

personal problems, and emotional situations. It also includes great difficulties with friends and living arrangements.

E. Problems with managing money. These include being unable to write checks, pay bills, or keep expenses within income.

F. Problems with health. These include several medical problems requiring regular visits with a doctor or nurse. It also includes

being unable to take prescribed medicine.

G. Problems with personal care tasks. These include bathing, toileting, dressing, and feeding.

6. Based on the condition(s) you checked above, would the person you care for normally be placed in a nursing home?

Yes

No

If yes, during which months did the condition(s) exist?

X

I certify that the above questions were answered truthfully to the best of my knowledge.

Taxpayer’s signature

For official department use only

Reason:

Total tax year 20

Certified:

Not certified

Partial tax year 20

Authorized signature

X

Dates:

150-101-024 (Rev. 12-08)

Low income credit, page 1 of 2

1

1 2

2