Form 101 - City Of Shively Legal Form

ADVERTISEMENT

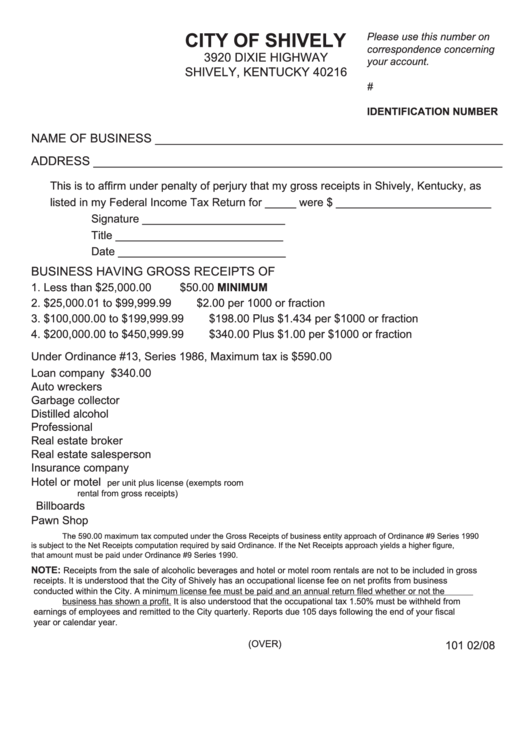

CITY OF SHIVELY

Please use this number on

correspondence concerning

3920 DIXIE HIGHWAY

your account.

SHIVELY, KENTUCKY 40216

#

IDENTIFICATION NUMBER

NAME OF BUSINESS ___________________________________________________

ADDRESS ____________________________________________________________

This is to affirm under penalty of perjury that my gross receipts in Shively, Kentucky, as

listed in my Federal Income Tax Return for _____ were $ _________________________

Signature _______________________

Title ___________________________

Date ___________________________

BUSINESS HAVING GROSS RECEIPTS OF

1. Less than $25,000.00

$50.00 MINIMUM

2. $25,000.01 to $99,999.99

$2.00 per 1000 or fraction

3. $100,000.00 to $199,999.99

$198.00 Plus $1.434 per $1000 or fraction

4. $200,000.00 to $450,999.99

$340.00 Plus $1.00 per $1000 or fraction

Under Ordinance #13, Series 1986, Maximum tax is $590.00

Loan company ......................................$340.00

Auto wreckers ....................................... 255.00

Garbage collector ................................. 170.00 plus license fee

Distilled alcohol ..................................... 170.00

Professional ..........................................

85.00

Real estate broker .................................

85.00

Real estate salesperson ........................

50.00

Insurance company ...............................

50.00

Hotel or motel ........................................

5.10

per unit plus license (exempts room

rental from gross receipts)

Billboards ...............................................

50.00 ea.

Pawn Shop ............................................ 460.00

The 590.00 maximum tax computed under the Gross Receipts of business entity approach of Ordinance #9 Series 1990

is subject to the Net Receipts computation required by said Ordinance. If the Net Receipts approach yields a higher figure,

that amount must be paid under Ordinance #9 Series 1990.

NOTE:

Receipts from the sale of alcoholic beverages and hotel or motel room rentals are not to be included in gross

receipts. It is understood that the City of Shively has an occupational license fee on net profits from business

conducted within the City. A minimum license fee must be paid and an annual return filed whether or not the

business has shown a profit. It is also understood that the occupational tax 1.50% must be withheld from

earnings of employees and remitted to the City quarterly. Reports due 105 days following the end of your fiscal

year or calendar year.

(OVER)

101 02/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1