Form 140es 2001 Individual Estimated Tax Payment Instructions

ADVERTISEMENT

Arizona Form

2001 Individual Estimated Tax Payment Instructions

140ES

Phone Numbers

For estimated payment purposes, the Arizona gross income of married

individuals who file a joint federal return is not the federal adjusted gross

income on that joint return. In order for each spouse to determine whether he

If you have questions, please call one of the following help numbers:

or she must make Arizona estimated payments, the spouses must determine

Phoenix

(602) 255-3381

what portion of the total income is attributable to each spouse. Each spouse

Nationwide, toll-free

(800) 352-4090

must compute his or her income as if filing a separate Arizona income tax

Form orders

(602) 542-4260

return. This calculation determines whether either spouse must make Arizona

Forms by Fax

(602) 542-3756

estimated income tax payments.

Recorded Tax Information

Each spouse must consider Arizona's community property laws when

Phoenix

(602) 542-1991

separately calculating his or her income. Any income that is designated as

Other Arizona areas, toll-free

(800) 845-8192

community income is taxable one-half to each spouse. Each spouse may

Hearing impaired TDD user

claim one-half of the deductions and credits related to items of community

Phoenix

(602) 542-4021

property. In addition, each spouse may claim one-half of the total income tax

Other Arizona areas, toll-free

(800) 397-0256

withheld on community income. For estimated payment purposes, each

You may also visit our web site at:

spouse's Arizona gross income must reflect one-half of the community income

from all sources taxable to Arizona plus any separate income taxable to

General Information

Arizona.

For more information, see Arizona Department of Revenue Income Tax

•

Complete Form 140ES using black ink or blue ink.

Ruling ITR 92-1. To get a copy of this ruling, call one of the help numbers

•

Once you make an estimated payment, you must file a tax return for that

listed on this page of the instructions.

year in order to claim the estimated payment.

How Much Should My Estimated Payments

•

Total?

You must round each estimated payment to whole dollars (no cents).

•

Use Tax Table X or Y (in the 2000 tax instruction booklet) to help

If you have to make Arizona estimated payments, your payments must

estimate this year's tax liability. Figure this tax on your total annual

reasonably reflect your 2001 Arizona income tax liability. Your combined

income.

Arizona estimated income tax payments and Arizona withholding must total

The department will charge you a penalty if you fail to make any required

one of the following.

Underpayment of Estimated Tax by

estimated payment. Use Form 221,

1.

90 percent of the tax due for 2001.

Individuals

, to determine the amount of underpayment penalty. For the

2001 taxable year, the penalty is equal to the interest that would accrue on the

2.

100 percent of the tax due for 2000.

underpayment. The penalty cannot be more than 10 percent of the

You can use your 2000 tax to figure the amount of payments that you must

underpayment.

make during 2001 only if you were required to file and did file a 2000 Arizona

Required Payments

income tax return.

When Should I Make My Estimated Payments?

Arizona requires certain individuals to make estimated income tax payments.

For the most part, you must make your payments in four equal installments.

You must make Arizona estimated income tax payments during 2001 if either

The due dates for these installments for a calendar year taxpayer are as

of the following apply.

follows.

1.

You reasonably expect your Arizona gross income to exceed $75,000 in

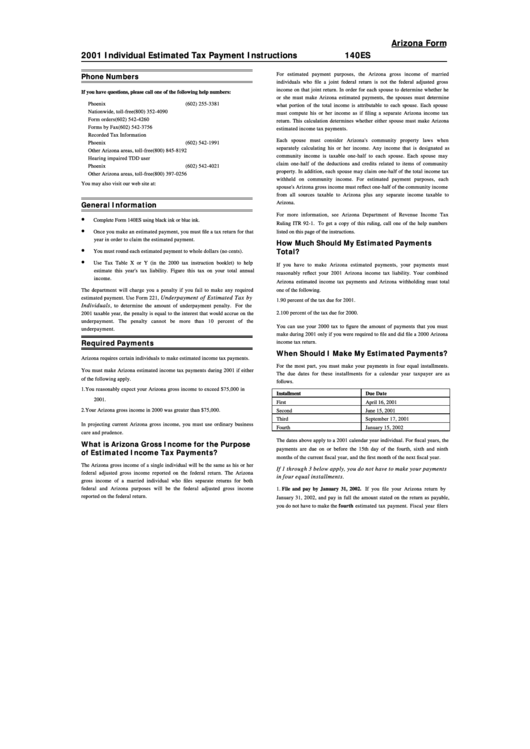

Installment

Due Date

2001.

First

April 16, 2001

Second

June 15, 2001

2.

Your Arizona gross income in 2000 was greater than $75,000.

Third

September 17, 2001

In projecting current Arizona gross income, you must use ordinary business

Fourth

January 15, 2002

care and prudence.

The dates above apply to a 2001 calendar year individual. For fiscal years, the

What is Arizona Gross Income for the Purpose

payments are due on or before the 15th day of the fourth, sixth and ninth

of Estimated Income Tax Payments?

months of the current fiscal year, and the first month of the next fiscal year.

The Arizona gross income of a single individual will be the same as his or her

If 1 through 3 below apply, you do not have to make your payments

federal adjusted gross income reported on the federal return. The Arizona

in four equal installments.

gross income of a married individual who files separate returns for both

federal and Arizona purposes will be the federal adjusted gross income

1. File and pay by January 31, 2002. If you file your Arizona return by

reported on the federal return.

January 31, 2002, and pay in full the amount stated on the return as payable,

you do not have to make the fourth estimated tax payment. Fiscal year filers

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2