Form Wv/mft-50 - West Virginia Supplier/permissive Supplier Report

ADVERTISEMENT

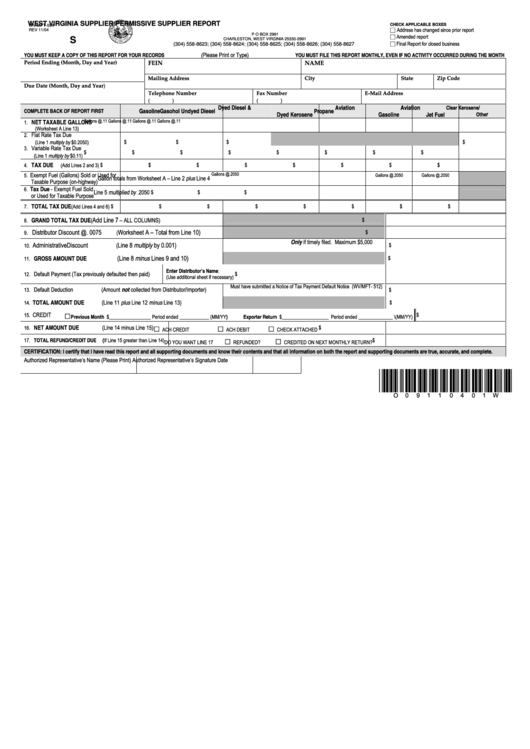

WEST VIRGINIA SUPPLIER/PERMISSIVE SUPPLIER REPORT

CHECK APPLICABLE BOXES

WV/MFT-504

□ Address has changed since prior report

REV 11/04

P O BOX 2991

□ Amended report

S

CHARLESTON, WEST VIRGINIA 25330-2991

□ Final Report for closed business

(304) 558-8623; (304) 558-8624; (304) 558-8625; (304) 558-8626; (304) 558-8627

Please Print or Type)

YOU MUST KEEP A COPY OF THIS REPORT FOR YOUR RECORDS

(

YOU MUST FILE THIS REPORT MONTHLY, EVEN IF NO ACTIVITY OCCURRED DURING THE MONTH

Period Ending (Month, Day and Year)

FEIN

NAME

Mailing Address

City

State

Zip Code

Due Date (Month, Day and Year)

Telephone Number

Fax Number

E-Mail Address

(

)

(

)

Dyed Diesel &

Aviation

Aviation

Clear Kerosene/

Gasoline

Gasohol

Undyed Diesel

Propane

COMPLETE BACK OF REPORT FIRST

Dyed Kerosene

Gasoline

Jet Fuel

r

Othe

Gallons @.11

Gallons @.11

Gallons @.11

Gallons @.11

NET TAXABLE GALLONS

1.

(Worksheet A Line 13)

Flat Rate Tax Due

2.

$

$

$

$

(Line 1 multiply by $0.2050)

Variable Rate Tax Due

3.

$

$

$

$

$

$

$

$

(Line 1 multiply by $0.11)

TAX DUE

4.

(Add Lines 2 and 3)

$

$

$

$

$

$

$

$

Exempt Fuel (Gallons) Sold or Used for

Gallons @.2050

5.

Gallons @.2050

Gallons @.2050

Gallon totals from Worksheet A – Line 2 plus Line 4

Taxable Purpose (on-highway)

Tax Due - Exempt Fuel Sold

6.

Line 5 multiplied by .2050

$

$

$

or Used for Taxable Purpose

TOTAL TAX DUE

$

$

$

$

$

$

$

$

7.

(Add Lines 4 and 6)

Add Line 7

GRAND TOTAL TAX DUE

(

– ALL COLUMNS)

$

8.

Distributor Discount @. 0075

Worksheet A – Total from Line 10)

.

$

9

(

Only if timely filed. Maximum $5,000

Administrative Discount

Line 8 multiply by 0.001)

(

$

10.

(Line 8 minus Lines 9 and 10)

GROSS AMOUNT DUE

$

11.

Enter Distributor’s Name:

Default Payment (Tax previously defaulted then paid)

$

12.

(Use additional sheet if necessary)

Must have submitted a Notice of Tax Payment Default Notice (WV/MFT- 512)

Default Deduction

(Amount not collected from Distributor/Importer)

$

13.

TOTAL AMOUNT DUE

(Line 11 plus Line 12 minus Line 13)

14.

$

□

CREDIT

$

15.

Previous Month $_________________ Period ended ____________ (MM/YY)

Exporter Return $___________________ Period ended ______________ \(MM/YY)

□

□

□

NET AMOUNT DUE

(Line 14 minus Line 15)

16.

$

ACH CREDIT

ACH DEBIT

CHECK ATTACHED

□

□

17. TOTAL REFUND/CREDIT DUE

(If Line 15 greater than Line 14)

$

DO YOU WANT LINE 17

REFUNDED?

CREDITED ON NEXT MONTHLY RETURN?

CERTIFICATION: I certify that I have read this report and all supporting documents and know their contents and that all information on both the report and supporting documents are true, accurate, and complete.

Authorized Representative’s Name (Please Print)

Authorized Representative’s Signature

Date

*O09110401W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2