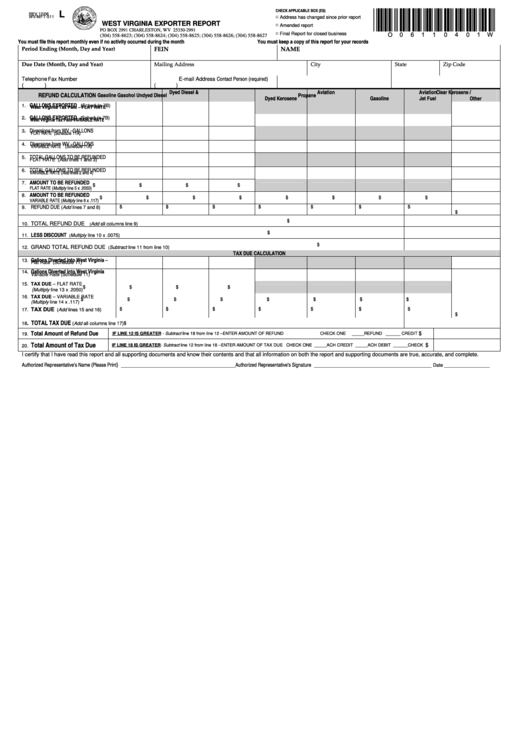

Form Wv/mft-511 - West Virginia Exporter Report

ADVERTISEMENT

CHECK APPLICABLE BOX (ES)

L

□ Address has changed since prior report

*O06110401W

WV/MFT-511

REV 12/06

WEST VIRGINIA EXPORTER REPORT

□ Amended report

PO BOX 2991 CHARLESTON, WV 25330-2991

□ Final Report for closed business

(304) 558-8623; (304) 558-8624; (304) 558-8625; (304) 558-8626; (304) 558-8627

You must file this report monthly even if no activity occurred during the month

You must keep a copy of this report for your records

Period Ending (Month, Day and Year)

FEIN

NAME

Due Date (Month, Day and Year)

Mailing Address

City

State

Zip Code

Contact Person (required)

Telephone

Fax Number

E-mail Address

(

)

(

)

Dyed Diesel &

Aviation

Aviation

Clear Kerosene /

REFUND CALCULATION

Gasoline

Gasohol

Undyed Diesel

Propane

Dyed Kerosene

Gasoline

Jet Fuel

Other

GALLONS EXPORTED

1.

(Schedule 7B)

West Virginia Tax Paid – FLAT RATE

GALLONS EXPORTED

(Schedule 7B)

2.

West Virginia Tax Paid-VARIABLE RATE

Diversions from WV –GALLONS

3.

FLAT RATE (Schedule 11A)

Diversions from WV –GALLONS

4.

VARIABLE RATE (Schedule 11A)

TOTAL GALLONS TO BE REFUNDED

5.

FLAT RATE (Add lines 1 and 3)

TOTAL GALLONS TO BE REFUNDED

6.

VARIABLE RATE (Add lines 2 and 4)

AMOUNT TO BE REFUNDED

7.

$

$

$

$

FLAT RATE (Multiply line 5 x .2050)

AMOUNT TO BE REFUNDED

8.

$

$

$

$

$

$

$

$

VARIABLE RATE (Multiply line 6 x .117)

REFUND DUE

9.

(Add lines 7 and 8)

$

$

$

$

$

$

$

$

$

TOTAL REFUND DUE

10.

Add all columns line 9)

(

$

LESS DISCOUNT

11.

Multiply line 10 x .0075)

(

$

GRAND TOTAL REFUND DUE

12.

Subtract line 11 from line 10)

(

TAX DUE CALCULATION

Gallons Diverted into West Virginia –

13.

Flat Rate (Schedule 11)

Gallons Diverted into West Virginia

14.

Variable Rate (Schedule 11)

15. TAX DUE – FLAT RATE

$

$

$

$

(

Multiply line 13 x .2050)

16. TAX DUE – VARIABLE RATE

$

$

$

$

$

$

$

$

(Multiply line 14 x .117)

TAX DUE

17.

(Add lines 15 and 16)

$

$

$

$

$

$

$

$

. TOTAL TAX DUE

$

18

(Add all columns line 17)

Total Amount of Refund Due

$

19.

IF LINE 12 IS GREATER - Subtract line 18 from line 12 –ENTER AMOUNT OF REFUND

CHECK ONE

_____REFUND ______ CREDIT

Total Amount of Tax Due

$

IF LINE 18 IS GREATER- Subtract line 12 from line 18 –ENTER AMOUNT OF TAX DUE CHECK ONE _____ACH CREDIT _____ACH DEBIT ______CHECK

20.

I certify that I have read this report and all supporting documents and know their contents and that all information on both the report and supporting documents are true, accurate, and complete.

)

Authorized Representative’s Name (Please Print

______________________________________Authorized Representative’s Signature _______________________________________

_______________

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2