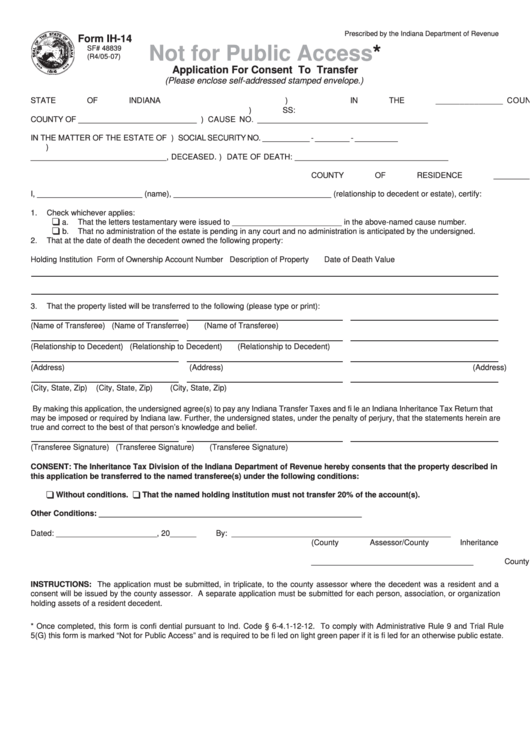

Prescribed by the Indiana Department of Revenue

Form IH-14

SF# 48839

Not for Public

Access*

(R4/05-07)

Application For Consent To Transfer

(Please enclose self-addressed stamped envelope.)

STATE OF INDIANA

)

IN THE ______________ COUNTY _________ COURT

) SS:

COUNTY OF ___________________________

)

CAUSE NO. _____________________________________

IN THE MATTER OF THE ESTATE OF

)

SOCIAL SECURITY NO. ___________ - ________ - __________

)

_______________________________, DECEASED. )

DATE OF DEATH: ___________________________________

COUNTY OF RESIDENCE ____________________________

I, ________________________ (name), ____________________________________ (relationship to decedent or estate), certify:

1.

Check whichever applies:

a.

That the letters testamentary were issued to _________________________ in the above-named cause number.

b.

That no administration of the estate is pending in any court and no administration is anticipated by the undersigned.

2.

That at the date of death the decedent owned the following property:

Holding Institution

Form of Ownership

Account Number

Description of Property

Date of Death Value

3.

That the property listed will be transferred to the following (please type or print):

(Name of Transferee)

(Name of Transferree)

(Name of Transferee)

(Relationship to Decedent)

(Relationship to Decedent)

(Relationship to Decedent)

(Address)

(Address)

(Address)

(City, State, Zip)

(City, State, Zip)

(City, State, Zip)

By making this application, the undersigned agree(s) to pay any Indiana Transfer Taxes and fi le an Indiana Inheritance Tax Return that

may be imposed or required by Indiana law. Further, the undersigned states, under the penalty of perjury, that the statements herein are

true and correct to the best of that person’s knowledge and belief.

(Transferee Signature)

(Transferee Signature)

(Transferee Signature)

CONSENT: The Inheritance Tax Division of the Indiana Department of Revenue hereby consents that the property described in

this application be transferred to the named transferee(s) under the following conditions:

Without conditions.

That the named holding institution must not transfer 20% of the account(s).

Other Conditions: ____________________________________________________________

Dated: _______________________, 20______

By: __________________________________________________

(County Assessor/County Inheritance Tax Appraiser)

_____________________________________ County, Indiana

INSTRUCTIONS: The application must be submitted, in triplicate, to the county assessor where the decedent was a resident and a

consent will be issued by the county assessor. A separate application must be submitted for each person, association, or organization

holding assets of a resident decedent.

* Once completed, this form is confi dential pursuant to Ind. Code § 6-4.1-12-12. To comply with Administrative Rule 9 and Trial Rule

5(G) this form is marked “Not for Public Access” and is required to be fi led on light green paper if it is fi led for an otherwise public estate.

1

1