Harvest Value Schedule - California State Board Of Equalization

ADVERTISEMENT

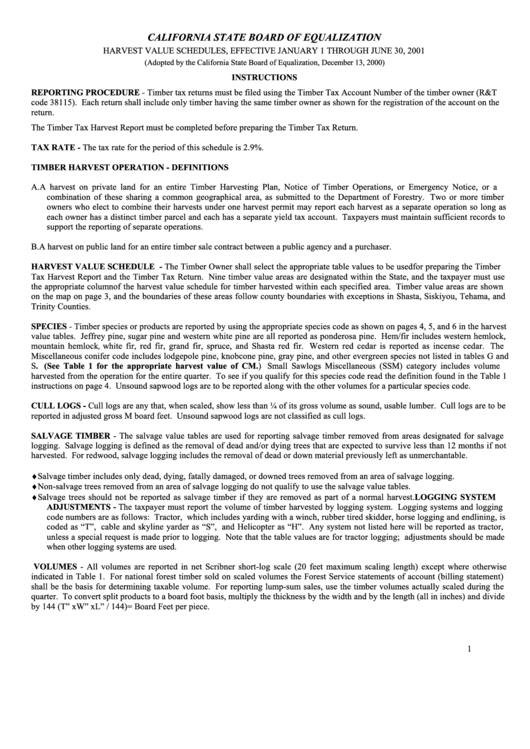

CALIFORNIA STATE BOARD OF EQUALIZATION

HARVEST VALUE SCHEDULES, EFFECTIVE JANUARY 1 THROUGH JUNE 30, 2001

(Adopted by the California State Board of Equalization, December 13, 2000)

INSTRUCTIONS

REPORTING PROCEDURE - Timber tax returns must be filed using the Timber Tax Account Number of the timber owner (R&T

code 38115). Each return shall include only timber having the same timber owner as shown for the registration of the account on the

return.

The Timber Tax Harvest Report must be completed before preparing the Timber Tax Return.

TAX RATE - The tax rate for the period of this schedule is 2.9%.

TIMBER HARVEST OPERATION - DEFINITIONS

A. A harvest on private land for an entire Timber Harvesting Plan, Notice of Timber Operations, or Emergency Notice, or a

combination of these sharing a common geographical area, as submitted to the Department of Forestry. Two or more timber

owners who elect to combine their harvests under one harvest permit may report each harvest as a separate operation so long as

each owner has a distinct timber parcel and each has a separate yield tax account. Taxpayers must maintain sufficient records to

support the reporting of separate operations.

B. A harvest on public land for an entire timber sale contract between a public agency and a purchaser.

HARVEST VALUE SCHEDULE - The Timber Owner shall select the appropriate table values to be used for preparing the Timber

Tax Harvest Report and the Timber Tax Return. Nine timber value areas are designated within the State, and the taxpayer must use

the appropriate column of the harvest value schedule for timber harvested within each specified area. Timber value areas are shown

on the map on page 3, and the boundaries of these areas follow county boundaries with exceptions in Shasta, Siskiyou, Tehama, and

Trinity Counties.

SPECIES - Timber species or products are reported by using the appropriate species code as shown on pages 4, 5, and 6 in the harvest

value tables. Jeffrey pine, sugar pine and western white pine are all reported as ponderosa pine. Hem/fir includes western hemlock,

mountain hemlock, white fir, red fir, grand fir, spruce, and Shasta red fir. Western red cedar is reported as incense cedar. The

Miscellaneous conifer code includes lodgepole pine, knobcone pine, gray pine, and other evergreen species not listed in tables G and

S. (See Table 1 for the appropriate harvest value of CM.) Small Sawlogs Miscellaneous (SSM) category includes volume

harvested from the operation for the entire quarter. To see if you qualify for this species code read the definition found in the Table 1

instructions on page 4. Unsound sapwood logs are to be reported along with the other volumes for a particular species code.

CULL LOGS - Cull logs are any that, when scaled, show less than ¼ of its gross volume as sound, usable lumber. Cull logs are to be

reported in adjusted gross M board feet. Unsound sapwood logs are not classified as cull logs.

SALVAGE TIMBER - The salvage value tables are used for reporting salvage timber removed from areas designated for salvage

logging. Salvage logging is defined as the removal of dead and/or dying trees that are expected to survive less than 12 months if not

harvested. For redwood, salvage logging includes the removal of dead or down material previously left as unmerchantable.

♦

Salvage timber includes only dead, dying, fatally damaged, or downed trees removed from an area of salvage logging.

♦

Non-salvage trees removed from an area of salvage logging do not qualify to use the salvage value tables.

♦

Salvage trees should not be reported as salvage timber if they are removed as part of a normal harvest.LOGGING SYSTEM

ADJUSTMENTS - The taxpayer must report the volume of timber harvested by logging system. Logging systems and logging

code numbers are as follows: Tractor, which includes yarding with a winch, rubber tired skidder, horse logging and endlining, is

coded as “T”, cable and skyline yarder as “S”, and Helicopter as “H”. Any system not listed here will be reported as tractor,

unless a special request is made prior to logging. Note that the table values are for tractor logging; adjustments should be made

when other logging systems are used.

VOLUMES - All volumes are reported in net Scribner short-log scale (20 feet maximum scaling length) except where otherwise

indicated in Table 1. For national forest timber sold on scaled volumes the Forest Service statements of account (billing statement)

shall be the basis for determining taxable volume. For reporting lump-sum sales, use the timber volumes actually scaled during the

quarter. To convert split products to a board foot basis, multiply the thickness by the width and by the length (all in inches) and divide

by 144 (T” xW” xL” / 144)= Board Feet per piece.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6