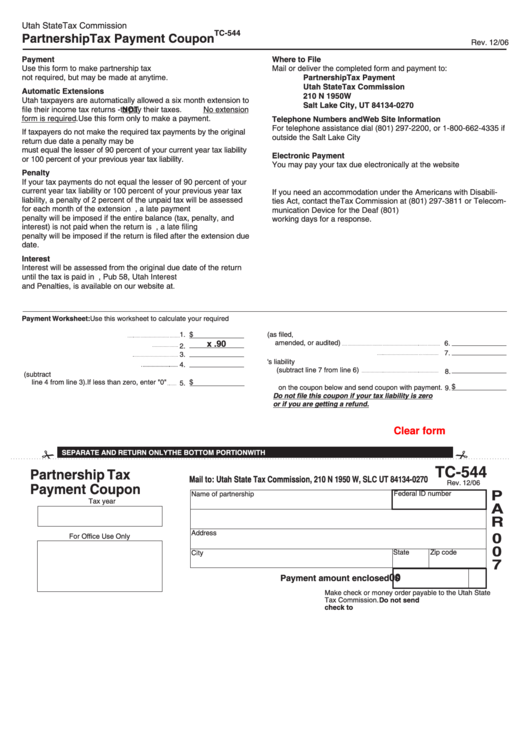

Utah State Tax Commission

TC-544

Partnership Tax Payment Coupon

Rev. 12/06

Payment

Where to File

Use this form to make partnership tax payments. Prepayments are

Mail or deliver the completed form and payment to:

not required, but may be made at anytime.

Partnership Tax Payment

Utah State Tax Commission

Automatic Extensions

210 N 1950 W

Utah taxpayers are automatically allowed a six month extension to

Salt Lake City, UT 84134-0270

file their income tax returns -

NOT

to pay their taxes.

No extension

form is required

. Use this form only to make a payment.

Telephone Numbers and Web Site Information

For telephone assistance dial (801) 297-2200, or 1-800-662-4335 if

If taxpayers do not make the required tax payments by the original

outside the Salt Lake City area. Our web site is

tax.utah.gov

.

return due date a penalty may be assessed. The required payment

must equal the lesser of 90 percent of your current year tax liability

Electronic Payment

or 100 percent of your previous year tax liability.

You may pay your tax due electronically at the website

Penalty

If your tax payments do not equal the lesser of 90 percent of your

current year tax liability or 100 percent of your previous year tax

If you need an accommodation under the Americans with Disabili-

liability, a penalty of 2 percent of the unpaid tax will be assessed

ties Act, contact the Tax Commission at (801) 297-3811 or Telecom-

for each month of the extension period. Also, a late payment

munication Device for the Deaf (801) 297-2020. Please allow three

penalty will be imposed if the entire balance (tax, penalty, and

working days for a response.

interest) is not paid when the return is filed. In addition, a late filing

penalty will be imposed if the return is filed after the extension due

date.

Interest

Interest will be assessed from the original due date of the return

until the tax is paid in full. For information, Pub 58, Utah Interest

and Penalties, is available on our website at

tax.utah.gov/forms

.

Payment Worksheet: Use this worksheet to calculate your required payment. Pay the amount on line 9 on or before the filing deadline.

1.

$

1. Tax you expect to owe this year

6. Utah tax liability for preceding year (as filed,

amended, or audited)

x .90

6.

2. Rate to determine minimum payment

2.

7. Prepayments from line 4 above

7.

3. Multiply line 1 by rate on line 2

3.

8. Amount required to equal previous year's liability

4. Tax prepayments made for this year

4.

(subtract line 7 from line 6)

8.

5. Amount required to equal 90 percent (subtract

9. Lesser of line 5 or line 8. Enter this amount

$

line 4 from line 3). If less than zero, enter "0"

5.

$

on the coupon below and send coupon with payment.

9.

Do not file this coupon if your tax liability is zero

or if you are getting a refund.

Clear form

SEPARATE AND RETURN ONLY THE BOTTOM PORTION WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS.

TC-544

Partnership Tax

Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0270

Rev. 12/06

Payment Coupon

P

Name of partnership

Federal ID number

Tax year

A

R

Address

0

For Office Use Only

0

State

Zip code

City

7

00

$

Payment amount enclosed

Make check or money order payable to the Utah State

Tax Commission.

Do not send cash. Do not staple

check to coupon. Detach check stub.

1

1