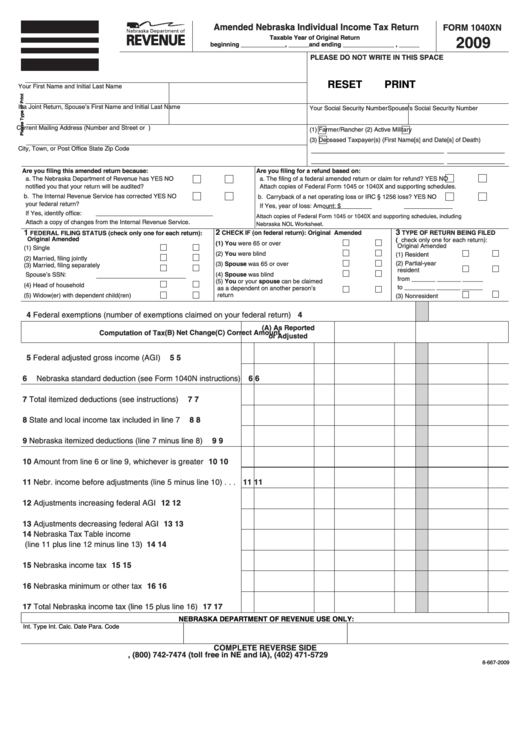

Amended Nebraska Individual Income Tax Return

FORM 1040XN

2009

Taxable Year of Original Return

beginning _____________, ______and ending _______________ , ______

PLEASE DO NOT WRITE IN THIS SPACE

RESET

PRINT

Your First Name and Initial

Last Name

If a Joint Return, Spouse’s First Name and Initial

Last Name

Your Social Security Number

Spouse’s Social Security Number

Current Mailing Address (Number and Street or P .O . Box)

(1)

Farmer/Rancher

(2)

Active Military

(3)

Deceased Taxpayer(s) (First Name[s] and Date[s] of Death)

City, Town, or Post Office

State

Zip Code

Are you filing this amended return because:

Are you filing for a refund based on:

a . The Nebraska Department of Revenue has

YES

NO

a . The filing of a federal amended return or claim for refund?

YES

NO

notified you that your return will be audited?

Attach copies of Federal Form 1045 or 1040X and supporting schedules .

b . The Internal Revenue Service has corrected

YES

NO

b . Carryback of a net operating loss or IRC § 1256 loss?

YES

NO

your federal return?

If Yes, year of loss:

Amount: $

If Yes, identify office:

Attach copies of Federal Form 1045 or 1040X and supporting schedules, including

Attach a copy of changes from the Internal Revenue Service .

Nebraska NOL Worksheet .

2

3

1

CHECK IF (on federal return):

Original Amended

TYPE OF RETURN BEING FILED

FEDERAL FILING STATUS (check only one for each return):

Original

Amended

(check only one for each return):

(1) You were 65 or over

Original

Amended

(1) Single

(2) You were blind

(1) Resident

(2) Married, filing jointly

(2) Partial-year

(3) Spouse was 65 or over

(3) Married, filing separately

resident

(4) Spouse was blind

Spouse’s SSN:

from _______

_______ ______

(5) You or your spouse can be claimed

(4) Head of household

to _________

_______ ______

as a dependent on another person’s

(5) Widow(er) with dependent child(ren)

return

(3) Nonresident

4 Federal exemptions (number of exemptions claimed on your federal return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

(A) As Reported

(B) Net Change

(C) Correct Amount

Computation of Tax

or Adjusted

5 Federal adjusted gross income (AGI) . . . . . . . . . . . . . . . . .

5

5

6 Nebraska standard deduction (see Form 1040N instructions) 6

6

7 Total itemized deductions (see instructions) . . . . . . . . . . . .

7

7

8 State and local income tax included in line 7 . . . . . . . . . . .

8

8

9 Nebraska itemized deductions (line 7 minus line 8) . . . . . .

9

9

10 Amount from line 6 or line 9, whichever is greater . . . . . . . 10

10

11 Nebr . income before adjustments (line 5 minus line 10) . . . 11

11

12 Adjustments increasing federal AGI . . . . . . . . . . . . . . . . . . 12

12

13 Adjustments decreasing federal AGI . . . . . . . . . . . . . . . . . . 13

13

14 Nebraska Tax Table income

14

14

(line 11 plus line 12 minus line 13) . . . . . . . . . . . . . . . . . .

15 Nebraska income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

15

16 Nebraska minimum or other tax . . . . . . . . . . . . . . . . . . . . . 16

16

17 Total Nebraska income tax (line 15 plus line 16) . . . . . . . . . 17

17

NEBRASKA DEPARTMENT OF REVENUE USE ONLY:

Int . Type

Int . Calc . Date

Para . Code

COMPLETE REVERSE SIDE

, (800) 742-7474 (toll free in NE and IA), (402) 471-5729

8-667-2009

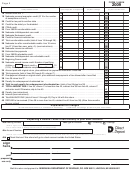

1

1 2

2 3

3