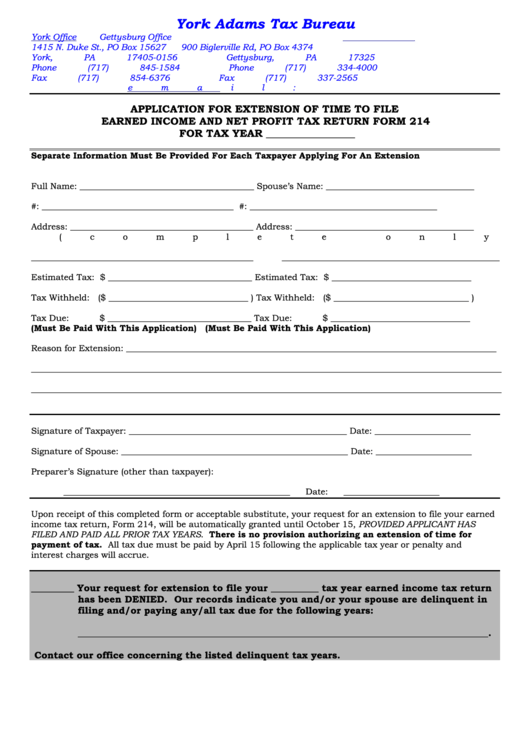

Form 214 - Application For Extension Of Time To File Earned Income And Net Profit Tax Return

ADVERTISEMENT

York Adams Tax Bureau

York Office

Gettysburg Office

1415 N. Duke St., PO Box 15627

900 Biglerville Rd, PO Box 4374

York, PA 17405-0156

Gettysburg, PA 17325

Phone (717) 845-1584

Phone (717) 334-4000

Fax (717) 854-6376

Fax (717) 337-2565

email:

APPLICATION FOR EXTENSION OF TIME TO FILE

EARNED INCOME AND NET PROFIT TAX RETURN FORM 214

FOR TAX YEAR _________________

Separate Information Must Be Provided For Each Taxpayer Applying For An Extension

Full Name: ________________________________________

Spouse’s Name: __________________________________

S.S. #: ____________________________________________

S.S. #: ___________________________________________

Address: __________________________________________

Address: _________________________________________

(complete only if different)

___________________________________________________

__________________________________________________

Estimated Tax: $ _________________________________

Estimated Tax: $ ________________________________

Tax Withheld: ($ ________________________________ )

Tax Withheld: ($ _______________________________ )

Tax Due:

$ _________________________________

Tax Due:

$ ________________________________

(Must Be Paid With This Application)

(Must Be Paid With This Application)

Reason for Extension: _____________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Signature of Taxpayer: __________________________________________________

Date: ______________________

Signature of Spouse: ____________________________________________________

Date: ______________________

Preparer’s Signature (other than taxpayer):

____________________________________________________

Date: ______________________

Upon receipt of this completed form or acceptable substitute, your request for an extension to file your earned

income tax return, Form 214, will be automatically granted until October 15, PROVIDED APPLICANT HAS

FILED AND PAID ALL PRIOR TAX YEARS. There is no provision authorizing an extension of time for

payment of tax. All tax due must be paid by April 15 following the applicable tax year or penalty and

interest charges will accrue.

_________ Your request for extension to file your __________ tax year earned income tax return

has been DENIED. Our records indicate you and/or your spouse are delinquent in

filing and/or paying any/all tax due for the following years:

______________________________________________________________________________________.

Contact our office concerning the listed delinquent tax years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1