Form Sd-Rf - Application For Undyed Diesel Fuel Tax Refund Form - Utah State Tax Comission

ADVERTISEMENT

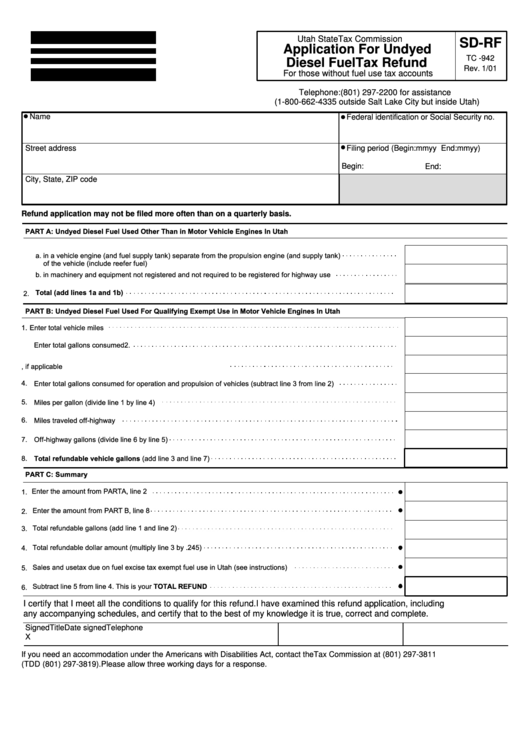

Utah State Tax Commission

SD-RF

Application For Undyed

TC -942

Diesel Fuel Tax Refund

Rev. 1/01

For those without fuel use tax accounts

Telephone: (801) 297-2200 for assistance

(1-800-662-4335 outside Salt Lake City but inside Utah)

Name

Federal identification or Social Security no.

Street address

Filing period (Begin: mmyy End: mmyy)

Begin:

End:

City, State, ZIP code

Refund application may not be filed more often than on a quarterly basis.

PART A: Undyed Diesel Fuel Used Other Than in Motor Vehicle Engines In Utah

1. Qualifying undyed diesel fuel consumed -

a. in a vehicle engine (and fuel supply tank) separate from the propulsion engine (and supply tank)

of the vehicle (include reefer fuel)

b. in machinery and equipment not registered and not required to be registered for highway use

Total (add lines 1a and 1b)

2.

PART B: Undyed Diesel Fuel Used For Qualifying Exempt Use in Motor Vehicle Engines In Utah

1.

Enter total vehicle miles

2.

Enter total gallons consumed

3. Total gallons consumed by PTO units on vehicles, if applicable

4.

Enter total gallons consumed for operation and propulsion of vehicles (subtract line 3 from line 2)

5.

Miles per gallon (divide line 1 by line 4)

6.

Miles traveled off-highway

7.

Off-highway gallons (divide line 6 by line 5)

8.

Total refundable vehicle gallons (add line 3 and line 7)

PART C: Summary

1. Enter the amount from PART A, line 2

Enter the amount from PART B, line 8

2.

Total refundable gallons (add line 1 and line 2)

3.

Total refundable dollar amount (multiply line 3 by .245)

4.

Sales and use tax due on fuel excise tax exempt fuel use in Utah (see instructions)

5.

Subtract line 5 from line 4. This is your TOTAL REFUND

6.

I certify that I meet all the conditions to qualify for this refund. I have examined this refund application, including

any accompanying schedules, and certify that to the best of my knowledge it is true, correct and complete.

Signed

Date signed

Title

Telephone

X

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at (801) 297-3811

(TDD (801) 297-3819). Please allow three working days for a response.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1