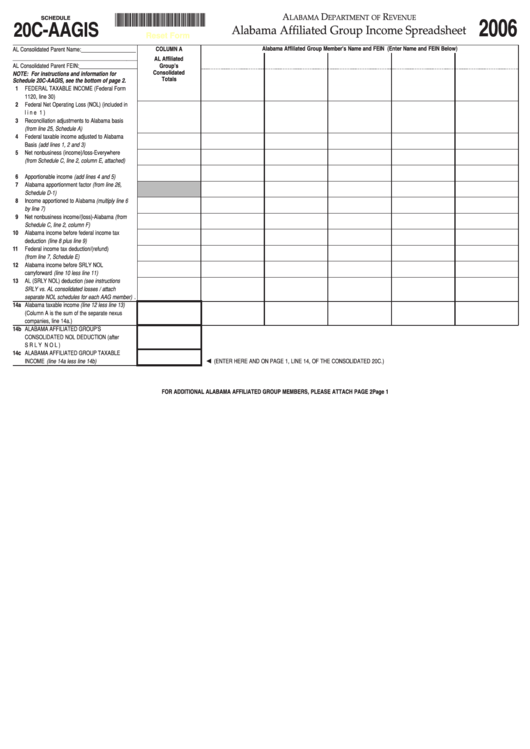

*0612830920C*

A

D

R

LABAMA

EPARTMENT OF

EVENUE

SCHEDULE

2006

20C-AAGIS

Alabama Affiliated Group Income Spreadsheet

Reset Form

Alabama Affiliated Group Member’s Name and FEIN (Enter Name and FEIN Below)

COLUMN A

AL Consolidated Parent Name: ____________________

_____________________________________________

AL Affiliated

AL Consolidated Parent FEIN: _____________________

Group’s

Consolidated

NOTE: For instructions and information for

Totals

Schedule 20C-AAGIS, see the bottom of page 2.

1

FEDERAL TAXABLE INCOME (Federal Form

1120, line 30). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Federal Net Operating Loss (NOL) (included in

line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Reconciliation adjustments to Alabama basis

(from line 25, Schedule A) . . . . . . . . . . . . . . . . . . . .

4

Federal taxable income adjusted to Alabama

Basis (add lines 1, 2 and 3) . . . . . . . . . . . . . . . . . .

5

Net nonbusiness (income)/loss-Everywhere

(from Schedule C, line 2, column E, attached) . . . .

6

Apportionable income (add lines 4 and 5) . . . . . . .

7

Alabama apportionment factor (from line 26,

Schedule D-1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Income apportioned to Alabama (multiply line 6

by line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net nonbusiness income/(loss)-Alabama (from

9

Schedule C, line 2, column F) . . . . . . . . . . . . . . . . .

10

Alabama income before federal income tax

deduction (line 8 plus line 9) . . . . . . . . . . . . . . . . . .

11

Federal income tax deduction/(refund)

(from line 7, Schedule E) . . . . . . . . . . . . . . . . . . . .

12

Alabama income before SRLY NOL

carryforward (line 10 less line 11) . . . . . . . . . . . . . .

13

AL (SRLY NOL) deduction (see instructions

SRLY vs. AL consolidated losses / attach

separate NOL schedules for each AAG member) .

14a Alabama taxable income (line 12 less line 13)

(Column A is the sum of the separate nexus

companies, line 14a.) . . . . . . . . . . . . . . . . . . . . . . .

14b ALABAMA AFFILIATED GROUP’S

CONSOLIDATED NOL DEDUCTION (after

SRLY NOL) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14c ALABAMA AFFILIATED GROUP TAXABLE

INCOME (line 14a less line 14b) . . . . . . . . . . . . . . .

(ENTER HERE AND ON PAGE 1, LINE 14, OF THE CONSOLIDATED 20C.)

FOR ADDITIONAL ALABAMA AFFILIATED GROUP MEMBERS, PLEASE ATTACH PAGE 2

Page 1

1

1 2

2