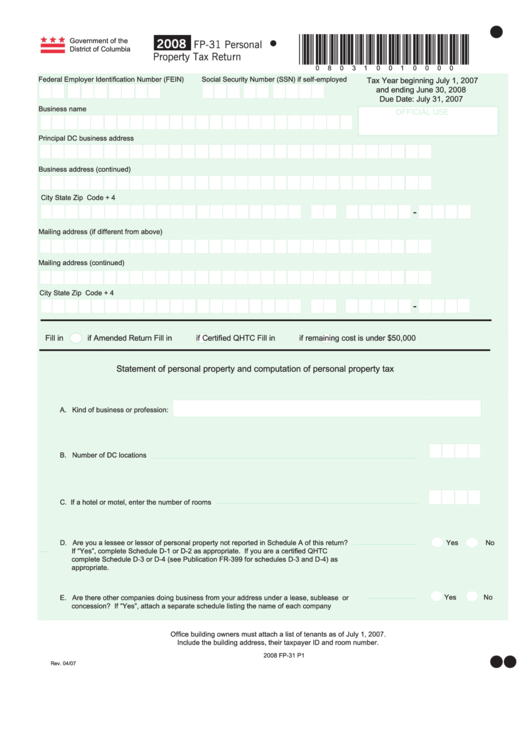

Form Fp-31 - Personal Property Tax Return 2008

ADVERTISEMENT

l

*080310010000*

2008

Government of the

FP-31 Personal

l

District of Columbia

Property Tax Return

Federal Employer Identification Number (FEIN)

Social Security Number (SSN) if self-employed

Tax Year beginning July 1, 2007

and ending June 30, 2008

Due Date: July 31, 2007

Business name

OFFICIAL USE

Principal DC business address

Business address (continued)

City

State

Zip Code + 4

-

Mailing address (if different from above)

Mailing address (continued)

City

State

Zip Code + 4

-

Fill in

if Amended Return

Fill in

if Certified QHTC

Fill in

if remaining cost is under $50,000

Statement of personal property and computation of personal property tax

A. Kind of business or profession:

B. Number of DC locations

C. If a hotel or motel, enter the number of rooms

D. Are you a lessee or lessor of personal property not reported in Schedule A of this return?

Yes

No

If “Yes”, complete Schedule D-1 or D-2 as appropriate. If you are a certified QHTC

complete Schedule D-3 or D-4 (see Publication FR-399 for schedules D-3 and D-4) as

appropriate.

Yes

No

E. Are there other companies doing business from your address under a lease, sublease or

concession? If “Yes”, attach a separate schedule listing the name of each company

Office building owners must attach a list of tenants as of July 1, 2007.

Include the building address, their taxpayer ID and room number.

2008 FP-31 P1

l

l

Rev. 04/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3