Form It-65 - Indiana Partnership Return

ADVERTISEMENT

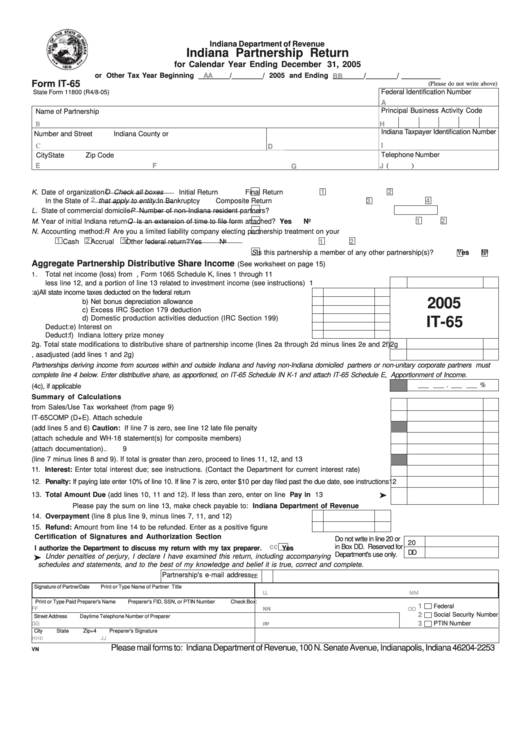

Indiana Department of Revenue

Indiana Partnership Return

for Calendar Year Ending December 31, 2005

or Other Tax Year Beginning ________/________/ 2005 and Ending ________/________/ __________

AA

BB

Form IT-65

(Please do not write above)

Federal Identification Number

State Form 11800 (R4/8-05)

A

Principal Business Activity Code

Name of Partnership

B

H

Indiana Taxpayer Identification Number

Number and Street

Indiana County or O.O.S.

I

C

D

Telephone Number

City

State

Zip Code

F

(

)

E

G

J

1

1

2

K. Date of organization

O Check all boxes

Initial Return

Final Return

2

In the State of

that apply to entity:

3

In Bankruptcy

4

Composite Return

L. State of commercial domicile

P Number of non-Indiana resident partners?

1

2

M. Year of initial Indiana return

Q Is an extension of time to file form attached?

Yes

No

N. Accounting method:

R Are you a limited liability company electing partnership treatment on your

1

2

3

1

2

Cash

Accrual

Other

federal return?

Yes

No

S Is this partnership a member of any other partnership(s)?

Yes

No

1

2

Aggregate Partnership Distributive Share Income

(See worksheet on page 15)

Total net income (loss) from U.S. Partnership return, Form 1065 Schedule K, lines 1 through 11

1.

less line 12, and a portion of line 13 related to investment income (see instructions) .........................................

1

2.

Add backs: a) All state income taxes deducted on the federal return .................................

2a

2005

b) Net bonus depreciation allowance ..........................................................

2b

c) Excess IRC Section 179 deduction ......................................................

2c

d) Domestic production activities deduction (IRC Section 199) ..............

2d

IT-65

Deduct:

e) Interest on U.S. Government obligations ..............................................

2e

Deduct:

f) Indiana lottery prize money ...................................................................

2f

2g. Total state modifications to distributive share of partnership income (lines 2a through 2d minus lines 2e and 2f)

2g

3.

Total partnership income, as adjusted (add lines 1 and 2g) ..................................................................................

3

Partnerships deriving income from sources within and outside Indiana and having non-Indiana domiciled partners or non-unitary corporate partners must

complete line 4 below. Enter distributive share, as apportioned, on IT-65 Schedule IN K-1 and attach IT-65 Schedule E, Apportionment of Income.

___ ___ . ___ ___ %

4.

Enter average percentage for Indiana apportioned adjusted gross income from IT-65 Schedule E line (4c), if applicable

4

Summary of Calculations

5.

Sales/use tax due on purchases subject to use tax from Sales/Use Tax worksheet (from page 9) ..................

5

6.

Total composite tax from completed Schedule IT-65COMP (D+E). Attach schedule .............................................

6

7.

Total tax (add lines 5 and 6) Caution: If line 7 is zero, see line 12 late file penalty ............................................

7

8.

Total composite tax return credits (attach schedule and WH-18 statement(s) for composite members) ............

8

9.

Other payments/credits belonging to the partnership (attach documentation) .....................................................

9

10. Subtotal (line 7 minus lines 8 and 9). If total is greater than zero, proceed to lines 11, 12, and 13 .....................

10

11. Interest: Enter total interest due; see instructions. (Contact the Department for current interest rate) ............

11

12. Penalty: If paying late enter 10% of line 10. If line 7 is zero, enter $10 per day filed past the due date, see instructions

12

13. Total Amount Due (add lines 10, 11 and 12). If less than zero, enter on line 14 ..... Pay in U.S. Funds

13

Please pay the sum on line 13, make check payable to: Indiana Department of Revenue

14. Overpayment (line 8 plus line 9, minus lines 7, 11, and 12) .......................................

14

15. Refund: Amount from line 14 to be refunded. Enter as a positive figure ....................

15

Certification of Signatures and Authorization Section

Do not write in line 20 or

20

in Box DD. Reserved for

I authorize the Department to discuss my return with my tax preparer.

CC

Yes

DD

Department's use only.

Under penalties of perjury, I declare I have examined this return, including accompanying

schedules and statements, and to the best of my knowledge and belief it is true, correct and complete.

Partnership's e-mail address

EE

Signature of Partner

Date

Print or Type Name of Partner

Title

MM

LL

Print or Type Paid Preparer's Name

Preparer's FID, SSN, or PTIN Number

Check Box:

1

Federal I.D. Number

FF

NN

OO

2

Social Security Number

Street Address

Daytime Telephone Number of Preparer

3

PTIN Number

GG

PP

City

State

Zip+4

Preparer's Signature

HH

II

JJ

Please mail forms to: Indiana Department of Revenue, 100 N. Senate Avenue, Indianapolis, Indiana 46204-2253

VN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1