RESET

PRINT

SAVE

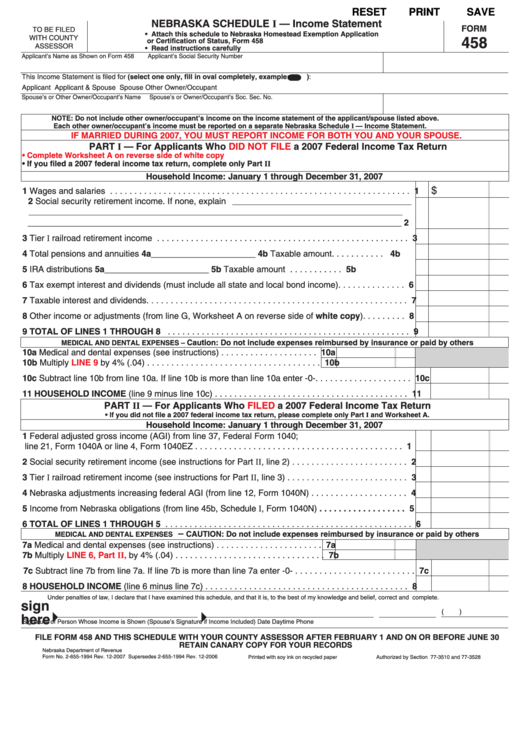

NEBRASKA SCHEDULE I — Income Statement

FORM

TO BE FILED

• Attach this schedule to Nebraska Homestead Exemption Application

458

WITH COUNTY

or Certification of Status, Form 458

ASSESSOR

• Read instructions carefully

Applicant’s Name as Shown on Form 458

Applicant’s Social Security Number

This Income Statement is filed for (select one only, fill in oval completely, example:

):

Applicant

Applicant & Spouse

Spouse

Other Owner/Occupant

Spouse’s or Other Owner/Occupant’s Name

Spouse’s or Owner/Occupant’s Soc. Sec. No.

NOTE: Do not include other owner/occupant’s income on the income statement of the applicant/spouse listed above.

Each other owner/occupant’s income must be reported on a separate Nebraska Schedule I — Income Statement.

IF MARRIED DURING 2007, YOU MUST REPORT INCOME FOR BOTH YOU AND YOUR SPOUSE.

PART I — For Applicants Who

DID NOT FILE

a 2007 Federal Income Tax Return

• Complete Worksheet A on reverse side of white copy

• If you filed a 2007 federal income tax return, complete only Part II

Household Income: January 1 through December 31, 2007

$

1 Wages and salaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Social security retirement income. If none, explain

______________________________________________

________________________________________________________________________________________________

2

________________________________________________________________________________________________

3 Tier I railroad retirement income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Total pensions and annuities 4a______________________

4b Taxable amount . . . . . . . . . . . 4b

5 IRA distributions

5a______________________

5bTaxable amount . . . . . . . . . . . 5b

6 Tax exempt interest and dividends (must include all state and local bond income) . . . . . . . . . . . . . .

6

7 Taxable interest and dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Other income or adjustments (from line G, Worksheet A on reverse side of white copy). . . . . . . . .

8

9 TOTAL OF LINES 1 THROUGH 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Caution: Do not include expenses reimbursed by insurance or paid by others

MEDICAL AND DENTAL EXPENSES –

10a Medical and dental expenses (see instructions) . . . . . . . . . . . . . . . . . . . . 10a

10b Multiply

LINE 9

by 4% (.04) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10b

10c Subtract line 10b from line 10a. If line 10b is more than line 10a enter -0-. . . . . . . . . . . . . . . . . . . . 10c

11 HOUSEHOLD INCOME (line 9 minus line 10c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

PART II — For Applicants Who

FILED

a 2007 Federal Income Tax Return

• If you did not file a 2007 federal income tax return, please complete only Part I and Worksheet A.

Household Income: January 1 through December 31, 2007

1 Federal adjusted gross income (AGI) from line 37, Federal Form 1040;

1

line 21, Form 1040A or line 4, Form 1040EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Social security retirement income (see instructions for Part II, line 2) . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Tier I railroad retirement income (see instructions for Part II, line 3) . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Nebraska adjustments increasing federal AGI (from line 12, Form 1040N) . . . . . . . . . . . . . . . . . . . .

4

5 Income from Nebraska obligations (from line 45b, Schedule I, Form 1040N) . . . . . . . . . . . . . . . . . .

5

6 TOTAL OF LINES 1 THROUGH 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

–

CAUTION: Do not include expenses reimbursed by insurance or paid by others

MEDICAL AND DENTAL EXPENSES

7a Medical and dental expenses (see instructions) . . . . . . . . . . . . . . . . . . . . . . 7a

LINE 6, Part II,

7b Multiply

by 4% (.04). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

7c Subtract line 7b from line 7a. If line 7b is more than line 7a enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . 7c

8 HOUSEHOLD INCOME (line 6 minus line 7c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Under penalties of law, I declare that I have examined this schedule, and that it is, to the best of my knowledge and belief, correct and complete.

sign

(

)

here

Signature of Person Whose Income is Shown

(Spouse’s Signature if Income Included)

Date

Daytime Phone

FILE FORM 458 AND THIS SCHEDULE WITH YOUR COUNTY ASSESSOR AFTER FEBRUARY 1 AND ON OR BEFORE JUNE 30

RETAIN CANARY COPY FOR YOUR RECORDS

Nebraska Department of Revenue

Form No. 2-655-1994 Rev. 12-2007 Supersedes 2-655-1994 Rev. 12-2006

Printed with soy ink on recycled paper

Authorized by Section 77-3510 and 77-3528

1

1 2

2