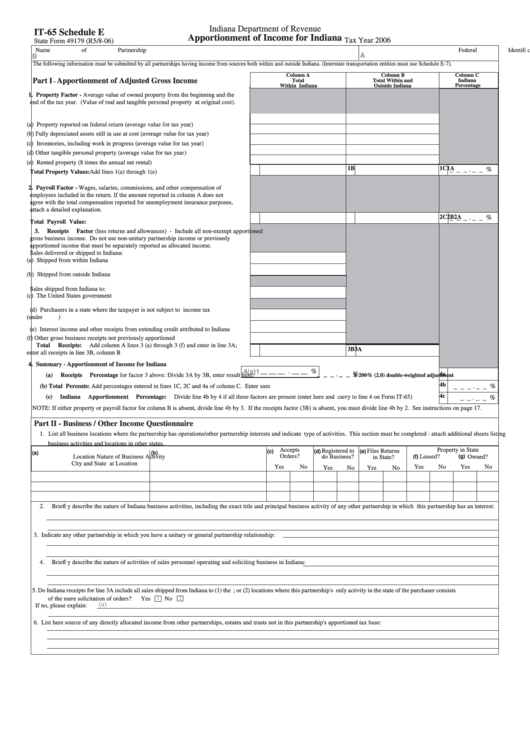

Form It-65 Schedule E - Apportionment Of Income For Indiana

ADVERTISEMENT

Indiana Department of Revenue

IT-65 Schedule E

Apportionment of Income for Indiana

Tax Year 2006

State Form 49179 (R5/8-06)

Name of Partnership

Federal Identifi cation Number

A

B

The following information must be submitted by all partnerships having income from sources both within and outside Indiana. (Interstate transportation entities must use Schedule E-7).

Column C

Column A

Column B

Part I

Apportionment of Adjusted Gross Income

Indiana

Total

Total Within and

-

Within Indiana

Outside Indiana

Percentage

1. Property Factor - Average value of owned property from the beginning and the

end of the tax year. (Value of real and tangible personal property at original cost).

(a) Property reported on federal return (average value for tax year) .....................

(b) Fully depreciated assets still in use at cost (average value for tax year) ..........

(c) Inventories, including work in progress (average value for tax year) ..............

(d) Other tangible personal property (average value for tax year) .........................

(e) Rented property (8 times the annual net rental) ...............................................

1A

1B

1C

_ _ _ . _ _ %

Total Property Values: Add lines 1(a) through 1(e) .............................................

2. Payroll Factor - Wages, salaries, commissions, and other compensation of

employees included in the return. If the amount reported in column A does not

agree with the total compensation reported for unemployment insurance purposes,

attach a detailed explanation.

2A

2B

2C

_ _ _ . _ _ %

Total Payroll Value: ............................................................................................

3. Receipts Factor (less returns and allowances) - Include all non-exempt apportioned

gross business income. Do not use non-unitary partnership income or previously

apportioned income that must be separately reported as allocated income.

Sales delivered or shipped to Indiana:

(a) Shipped from within Indiana ............................................................................

(b) Shipped from outside Indiana ..........................................................................

Sales shipped from Indiana to:

(c) The United States government .........................................................................

(d) Purchasers in a state where the taxpayer is not subject to income tax

(under P.L. 86-272) ...........................................................................................

(e) Interest income and other receipts from extending credit attributed to Indiana

(f) Other gross business receipts not previously apportioned ...............................

Total Receipts: Add column A lines 3 (a) through 3 (f) and enter in line 3A;

3A

3B

enter all receipts in line 3B, column B ....................................................................

4. Summary - Apportionment of Income for Indiana

4(a)1

__ __ __ . __ __ %

4a

_ _ _ . _ _ %

(a) Receipts Percentage for factor 3 above: Divide 3A by 3B, enter result here:

X 200% (2.0) double-weighted adjustment

4b

_ _ _ . _ _ %

(b) Total Percents: Add percentages entered in lines 1C, 2C and 4a of column C. Enter sum ..........................................................................................................

4c

(c) Indiana Apportionment Percentage: Divide line 4b by 4 if all three factors are present (enter here and carry to line 4 on Form IT-65) ...................................

_ _ . _ _ %

NOTE: If either property or payroll factor for column B is absent, divide line 4b by 3. If the receipts factor (3B) is absent, you must divide line 4b by 2. See instructions on page 17.

Part II - Business / Other Income Questionnaire

1. List all business locations where the partnership has operations/other partnership interests and indicate type of activities. This section must be completed - attach additional sheets listing

business activities and locations in other states.

Accepts

Property in State

Registered to

Files Returns

(e)

(c)

(d)

(a)

(b)

Orders?

Location

Nature of Business Activity

(g)

do Business?

in State?

(f)

Leased?

Owned?

City and State

at Location

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

2. Briefl y describe the nature of Indiana business activities, including the exact title and principal business activity of any other partnership in which this partnership has an interest:

3. Indicate any other partnership in which you have a unitary or general partnership relationship:

4. Briefl y describe the nature of activities of sales personnel operating and soliciting business in Indiana:

5. Do Indiana receipts for line 3A include all sales shipped from Indiana to (1) the U.S. government; or (2) locations where this partnership's only activity in the state of the purchaser consists

of the mere solicitation of orders?

1

Yes

2

No

(a)

If no, please explain:

6. List here source of any directly allocated income from other partnerships, estates and trusts not in this partnership's apportioned tax base:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1