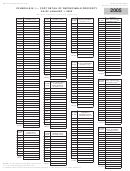

BOE-517-WT (S2F) REV. 9 (12-04)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

2005

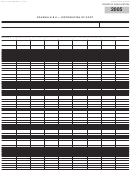

SCHEDULE A — Comparative Balance Sheet

(Do not net depreciation reserve from original cost)

COMPANY NAME

SBE NO.

ASSETS

BALANCE AT BEGINNING OF 2004

BALANCE AT END OF 2004

$

$

Plant and equipment ...........................................

a

Miscellaneous physical property .......................

a

Investments in securities ...........................................................................

Other investments ......................................................................................

Sinking and other funds .............................................................................

Other utility plant .................................................

Construction Work In Progress ...........................

a

Cash and working funds ............................................................................

Temporary cash investments and special deposits ..................................

Notes receivable ........................................................................................

Accounts receivable ...................................................................................

Interest, dividends, and rents receivable ...........

Materials and supplies .......................................

a

Inventory held for sale or lease in ordinary

course of business .............................................

a

Discount on capital stock ...........................................................................

Discount and expense on funded dept. .....................................................

Prepayments ..............................................................................................

All other deferred debits (describe) ...........................................................

.............................................................................

Future Use Property ............................................

a

$

$

TOTAL ASSETS AND OTHER DEBITS

LIABILITIES

$

$

Capital stock ...............................................................................................

Premiums and assessments on capital stock ...........................................

Funded debt unmatured ............................................................................

Capital stock expense ................................................................................

Other long term debt ..................................................................................

....................................................................................................................

Loans and notes payable ..........................................................................

Accounts payable .......................................................................................

Matured interest and dividends .................................................................

Taxes accrued ............................................................................................

Customer deposits and advances .............................................................

Other current and accrued liabilities ..........................................................

....................................................................................................................

Premium on long term debt ...................................

Depreciation reserve nontaxable property ........

a

a

Depreciation reserve other plant and eq. ..........

Depreciation reserve nonoperative prop. ..........

a

Deferred income taxes ...............................................................................

Other reserves ...........................................................................................

Employees’ provident reserve ...................................................................

Other deferred and unadjusted credits ......................................................

....................................................................................................................

Retained earnings ......................................................................................

....................................................................................................................

$

$

TOTAL LIABILITIES AND OTHER CREDITS

NOTE:

a

Interstate companies show California end-of-year amount in box.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9