Form Ot-3 - Occupation Tax - City Of Pittsburgh - 2001

ADVERTISEMENT

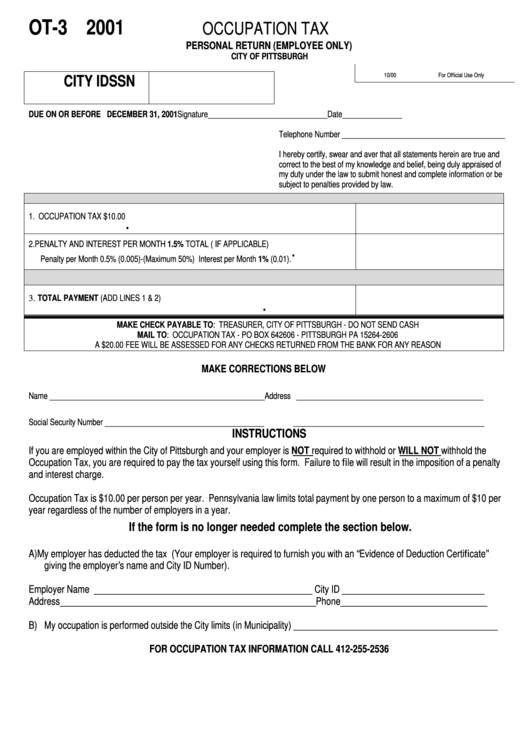

OT-3 2001

OCCUPATION TAX

PERSONAL RETURN (EMPLOYEE ONLY)

CITY OF PITTSBURGH

CITY ID

SSN

10/00

For Official Use Only

DUE ON OR BEFORE DECEMBER 31, 2001

Signature______________________________Date_______________

Telephone Number _________________________________________

I hereby certify, swear and aver that all statements herein are true and

correct to the best of my knowledge and belief, being duly appraised of

my duty under the law to submit honest and complete information or be

subject to penalties provided by law.

1. OCCUPATION TAX $10.00

.

2. PENALTY AND INTEREST PER MONTH 1.5% TOTAL ( IF APPLICABLE)

.

Penalty per Month 0.5% (0.005)-(Maximum 50%) Interest per Month 1% (0.01).

3. TOTAL PAYMENT (ADD LINES 1 & 2)

.

MAKE CHECK PAYABLE TO: TREASURER, CITY OF PITTSBURGH - DO NOT SEND CASH

MAIL TO: OCCUPATION TAX - PO BOX 642606 - PITTSBURGH PA 15264-2606

A $20.00 FEE WILL BE ASSESSED FOR ANY CHECKS RETURNED FROM THE BANK FOR ANY REASON

MAKE CORRECTIONS BELOW

Name ______________________________________________________

Address _______________________________________________

Social Security Number ________________________________________

________________________________________________

INSTRUCTIONS

If you are employed within the City of Pittsburgh and your employer is NOT required to withhold or WILL NOT withhold the

Occupation Tax, you are required to pay the tax yourself using this form. Failure to file will result in the imposition of a penalty

and interest charge.

Occupation Tax is $10.00 per person per year. Pennsylvania law limits total payment by one person to a maximum of $10 per

year regardless of the number of employers in a year.

If the form is no longer needed complete the section below.

A) My employer has deducted the tax (Your employer is required to furnish you with an “ Evidence of Deduction Certificate”

giving the employer’ s name and City ID Number).

Employer Name ______________________________________________ City ID ______________________________

Address______________________________________________________Phone_______________________________

B) My occupation is performed outside the City limits (in Municipality) ___________________________________________

FOR OCCUPATION TAX INFORMATION CALL 412-255-2536

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1