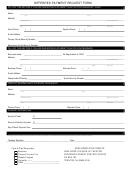

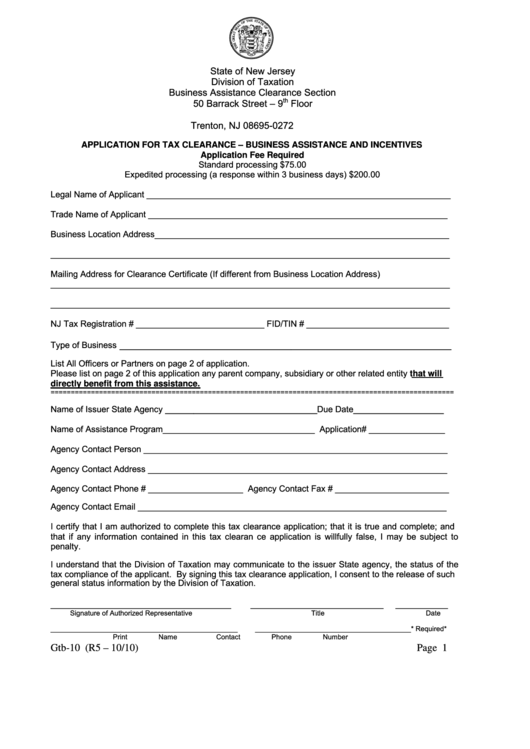

State of New Jersey

Division of Taxation

Business Assistance Clearance Section

th

50 Barrack Street – 9

Floor

P.O. Box 272

Trenton, NJ 08695-0272

APPLICATION FOR TAX CLEARANCE – BUSINESS ASSISTANCE AND INCENTIVES

Application Fee Required

Standard processing $75.00

Expedited processing (a response within 3 business days) $200.00

Legal Name of Applicant ________________________________________________________________

Trade Name of Applicant _______________________________________________________________

Business Location Address______________________________________________________________

____________________________________________________________________________________

Mailing Address for Clearance Certificate (If different from Business Location Address)

____________________________________________________________________________________

____________________________________________________________________________________

NJ Tax Registration # ___________________________ FID/TIN # ______________________________

__________________________________________________________

Type of Business

List All Officers or Partners on page 2 of application.

Please list on page 2 of this application any parent company, subsidiary or other related entity that will

directly benefit from this assistance.

====================================================================================================

Name of Issuer State Agency ________________________________Due Date___________________

Name of Assistance Program________________________________ Application# ________________

Agency Contact Person ________________________________________________________________

Agency Contact Address _______________________________________________________________

Agency Contact Phone # ____________________ Agency Contact Fax # ________________________

Agency Contact Email _________________________________________________________________

I certify that I am autho rized to complete this tax clearance application; that it is true and complete; and

that if any informatio n contained in this tax clearan ce application is willfully false, I may be subje ct to

penalty.

I understand that the Division of Taxation may communicate to the issuer Stat e agency, the status of th e

tax compliance of the applicant. By signing this tax clearance application, I consent to the release of such

general status information by the Division of Taxation.

______________________________________

____________________________

___________

Signature of Authorized Representative

Title

Date

________________________________________________

________________________________________* Required*

Print Name

Contact

Phone Number

Gtb-10 (R5 – 10/10)

Page 1

1

1 2

2