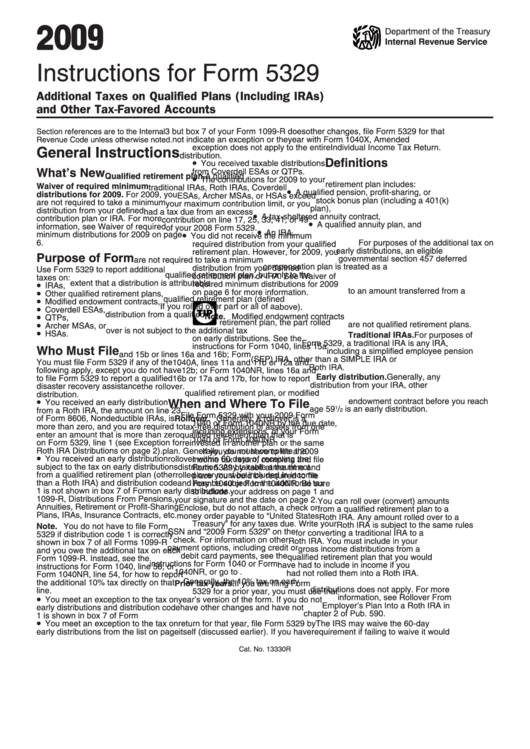

Instructions For Form 5329 - Additional Taxes On Qualified Plans (Including Iras) And Other Tax-Favored Accounts - 2009

ADVERTISEMENT

2 0 09

Department of the Treasury

Internal Revenue Service

Instructions for Form 5329

Additional Taxes on Qualified Plans (Including IRAs)

and Other Tax-Favored Accounts

3 but box 7 of your Form 1099-R does

other changes, file Form 5329 for that

Section references are to the Internal

Revenue Code unless otherwise noted.

not indicate an exception or the

year with Form 1040X, Amended U.S.

exception does not apply to the entire

Individual Income Tax Return.

General Instructions

distribution.

•

Definitions

You received taxable distributions

What’s New

from Coverdell ESAs or QTPs.

•

Qualified retirement plan. A qualified

The contributions for 2009 to your

retirement plan includes:

Waiver of required minimum

traditional IRAs, Roth IRAs, Coverdell

•

A qualified pension, profit-sharing, or

distributions for 2009. For 2009, you

ESAs, Archer MSAs, or HSAs exceed

stock bonus plan (including a 401(k)

are not required to take a minimum

your maximum contribution limit, or you

plan),

distribution from your defined

had a tax due from an excess

•

A tax-sheltered annuity contract,

contribution plan or IRA. For more

contribution on line 17, 25, 33, 41, or 49

•

A qualified annuity plan, and

information, see Waiver of required

of your 2008 Form 5329.

•

•

An IRA.

minimum distributions for 2009 on page

You did not receive the minimum

6.

For purposes of the additional tax on

required distribution from your qualified

early distributions, an eligible

retirement plan. However, for 2009, you

Purpose of Form

governmental section 457 deferred

are not required to take a minimum

compensation plan is treated as a

distribution from your defined

Use Form 5329 to report additional

qualified retirement plan, but only to the

contribution plan or IRA. See Waiver of

taxes on:

•

extent that a distribution is attributable

required minimum distributions for 2009

IRAs,

•

to an amount transferred from a

on page 6 for more information.

Other qualified retirement plans,

•

qualified retirement plan (defined

Modified endowment contracts,

•

If you rolled over part or all of a

above).

Coverdell ESAs,

TIP

•

distribution from a qualified

Note. Modified endowment contracts

QTPs,

•

retirement plan, the part rolled

are not qualified retirement plans.

Archer MSAs, or

•

over is not subject to the additional tax

HSAs.

Traditional IRAs. For purposes of

on early distributions. See the

Form 5329, a traditional IRA is any IRA,

instructions for Form 1040, lines 15a

Who Must File

including a simplified employee pension

and 15b or lines 16a and 16b; Form

(SEP) IRA, other than a SIMPLE IRA or

You must file Form 5329 if any of the

1040A, lines 11a and 11b or 12a and

Roth IRA.

following apply, except you do not have

12b; or Form 1040NR, lines 16a and

Early distribution. Generally, any

to file Form 5329 to report a qualified

16b or 17a and 17b, for how to report

distribution from your IRA, other

disaster recovery assistance

the rollover.

qualified retirement plan, or modified

distribution.

•

endowment contract before you reach

You received an early distribution

When and Where To File

age 59

1

/

is an early distribution.

from a Roth IRA, the amount on line 23

2

File Form 5329 with your 2009 Form

of Form 8606, Nondeductible IRAs, is

Rollover. Generally, a rollover is a

1040 or Form 1040NR by the due date,

more than zero, and you are required to

tax-free distribution of assets from one

including extensions, of your Form

enter an amount that is more than zero

qualified retirement plan that is

1040 or Form 1040NR.

on Form 5329, line 1 (see Exception for

reinvested in another plan or the same

Roth IRA Distributions on page 2).

plan. Generally, you must complete the

If you do not have to file a 2009

•

You received an early distribution

rollover within 60 days of receiving the

income tax return, complete and file

subject to the tax on early distributions

distribution. Any taxable amount not

Form 5329 by itself at the time and

from a qualified retirement plan (other

rolled over must be included in income

place you would be required to file

than a Roth IRA) and distribution code

and may be subject to the additional tax

Form 1040 or Form 1040NR. Be sure

1 is not shown in box 7 of Form

on early distributions.

to include your address on page 1 and

1099-R, Distributions From Pensions,

your signature and the date on page 2.

You can roll over (convert) amounts

Annuities, Retirement or Profit-Sharing

Enclose, but do not attach, a check or

from a qualified retirement plan to a

Plans, IRAs, Insurance Contracts, etc.

money order payable to “United States

Roth IRA. Any amount rolled over to a

Treasury” for any taxes due. Write your

Roth IRA is subject to the same rules

Note. You do not have to file Form

SSN and “2009 Form 5329” on the

for converting a traditional IRA to a

5329 if distribution code 1 is correctly

check. For information on other

Roth IRA. You must include in your

shown in box 7 of all Forms 1099-R

payment options, including credit or

gross income distributions from a

and you owe the additional tax on each

debit card payments, see the

qualified retirement plan that you would

Form 1099-R. Instead, see the

instructions for Form 1040 or Form

have had to include in income if you

instructions for Form 1040, line 58, or

1040NR, or go to

had not rolled them into a Roth IRA.

Form 1040NR, line 54, for how to report

Generally, the 10% tax on early

the additional 10% tax directly on that

Prior tax years. If you are filing Form

distributions does not apply. For more

line.

5329 for a prior year, you must use that

•

information, see Rollover From

You meet an exception to the tax on

year’s version of the form. If you do not

Employer’s Plan Into a Roth IRA in

early distributions and distribution code

have other changes and have not

chapter 2 of Pub. 590.

1 is shown in box 7 of Form 1099-R.

previously filed a federal income tax

•

You meet an exception to the tax on

return for that year, file Form 5329 by

The IRS may waive the 60-day

early distributions from the list on page

itself (discussed earlier). If you have

requirement if failing to waive it would

Cat. No. 13330R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6