Instructions For Form 940 - Employer'S Annual Federal Unemployment (Futa) Tax Return - 2003

ADVERTISEMENT

03

2 0

Department of the Treasury

Internal Revenue Service

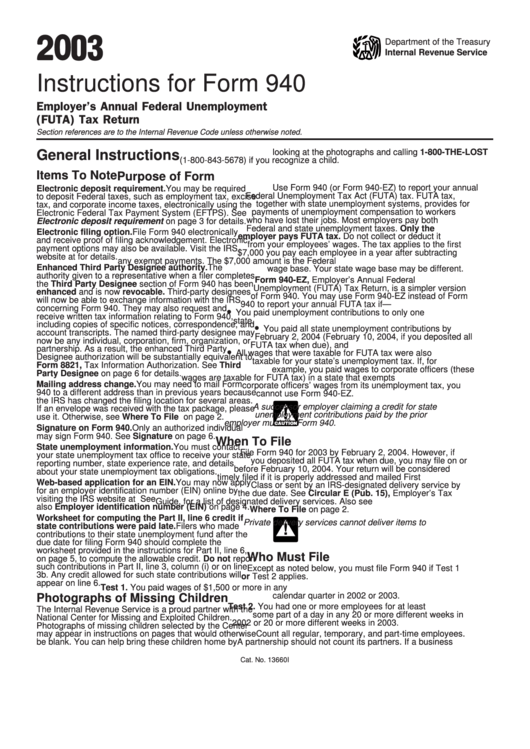

Instructions for Form 940

Employer’s Annual Federal Unemployment

(FUTA) Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

looking at the photographs and calling 1-800-THE-LOST

General Instructions

(1-800-843-5678) if you recognize a child.

Items To Note

Purpose of Form

Use Form 940 (or Form 940-EZ) to report your annual

Electronic deposit requirement. You may be required

Federal Unemployment Tax Act (FUTA) tax. FUTA tax,

to deposit Federal taxes, such as employment tax, excise

together with state unemployment systems, provides for

tax, and corporate income taxes, electronically using the

payments of unemployment compensation to workers

Electronic Federal Tax Payment System (EFTPS). See

who have lost their jobs. Most employers pay both

Electronic deposit requirement on page 3 for details.

Federal and state unemployment taxes. Only the

Electronic filing option. File Form 940 electronically

employer pays FUTA tax. Do not collect or deduct it

and receive proof of filing acknowledgement. Electronic

from your employees’ wages. The tax applies to the first

payment options may also be available. Visit the IRS

$7,000 you pay each employee in a year after subtracting

website at for details.

any exempt payments. The $7,000 amount is the Federal

Enhanced Third Party Designee authority. The

wage base. Your state wage base may be different.

authority given to a representative when a filer completes

Form 940-EZ, Employer’s Annual Federal

the Third Party Designee section of Form 940 has been

Unemployment (FUTA) Tax Return, is a simpler version

enhanced and is now revocable. Third-party designees

of Form 940. You may use Form 940-EZ instead of Form

will now be able to exchange information with the IRS

940 to report your annual FUTA tax if —

concerning Form 940. They may also request and

•

You paid unemployment contributions to only one

receive written tax information relating to Form 940,

state,

including copies of specific notices, correspondence, and

•

You paid all state unemployment contributions by

account transcripts. The named third-party designee may

February 2, 2004 (February 10, 2004, if you deposited all

now be any individual, corporation, firm, organization, or

FUTA tax when due), and

partnership. As a result, the enhanced Third Party

•

All wages that were taxable for FUTA tax were also

Designee authorization will be substantially equivalent to

taxable for your state’s unemployment tax. If, for

Form 8821, Tax Information Authorization. See Third

example, you paid wages to corporate officers (these

Party Designee on page 6 for details.

wages are taxable for FUTA tax) in a state that exempts

Mailing address change. You may need to mail Form

corporate officers’ wages from its unemployment tax, you

940 to a different address than in previous years because

cannot use Form 940-EZ.

the IRS has changed the filing location for several areas.

A successor employer claiming a credit for state

If an envelope was received with the tax package, please

!

unemployment contributions paid by the prior

use it. Otherwise, see Where To File on page 2.

employer must file Form 940.

CAUTION

Signature on Form 940. Only an authorized individual

may sign Form 940. See Signature on page 6.

When To File

State unemployment information. You must contact

File Form 940 for 2003 by February 2, 2004. However, if

your state unemployment tax office to receive your state

you deposited all FUTA tax when due, you may file on or

reporting number, state experience rate, and details

before February 10, 2004. Your return will be considered

about your state unemployment tax obligations.

timely filed if it is properly addressed and mailed First

Web-based application for an EIN. You may now apply

Class or sent by an IRS-designated delivery service by

for an employer identification number (EIN) online by

the due date. See Circular E (Pub. 15), Employer’s Tax

visiting the IRS website at See

Guide, for a list of designated delivery services. Also see

also Employer identification number (EIN) on page 4.

Where To File on page 2.

Worksheet for computing the Part II, line 6 credit if

Private delivery services cannot deliver items to

state contributions were paid late. Filers who made

!

P.O. boxes.

contributions to their state unemployment fund after the

CAUTION

due date for filing Form 940 should complete the

worksheet provided in the instructions for Part II, line 6,

Who Must File

on page 5, to compute the allowable credit. Do not report

such contributions in Part II, line 3, column (i) or on line

Except as noted below, you must file Form 940 if Test 1

3b. Any credit allowed for such state contributions will

or Test 2 applies.

appear on line 6.

Test 1. You paid wages of $1,500 or more in any

calendar quarter in 2002 or 2003.

Photographs of Missing Children

Test 2. You had one or more employees for at least

The Internal Revenue Service is a proud partner with the

some part of a day in any 20 or more different weeks in

National Center for Missing and Exploited Children.

2002 or 20 or more different weeks in 2003.

Photographs of missing children selected by the Center

may appear in instructions on pages that would otherwise

Count all regular, temporary, and part-time employees.

be blank. You can help bring these children home by

A partnership should not count its partners. If a business

Cat. No. 13660I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6