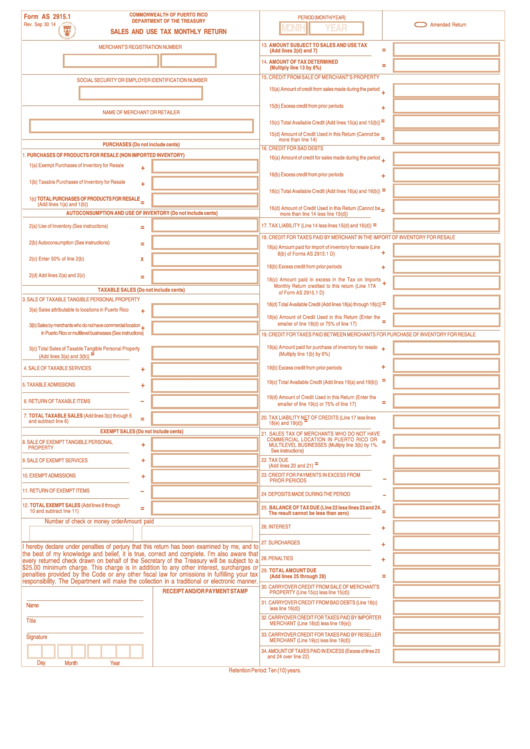

COMMONWEALTH OF PUERTO RICO

Form AS 2915.1

PERIOD (MONTH/YEAR)

DEPARTMENT OF THE TREASURY

Rev. Sep 30 14

Amended Return

MONTH

YEAR

SALES AND USE TAX MONTHLY RETURN

13. AMOUNT SUBJECT TO SALES AND USE TAX

MERCHANT’S REGISTRATION NUMBER

=

(Add lines 2(d) and 7)

14. AMOUNT OF TAX DETERMINED

=

(Multiply line 13 by 6%)

15. CREDIT FROM SALE OF MERCHANT’S PROPERTY

SOCIAL SECURITY OR EMPLOYER IDENTIFICATION NUMBER

15(a) Amount of credit from sales made during the period

+

15(b) Excess credit from prior periods

+

NAME OF MERCHANT OR RETAILER

=

15(c) Total Available Credit (Add lines 15(a) and 15(b))

15(d) Amount of Credit Used in this Return (Cannot be

=

more than line 14)

PURCHASES (Do not include cents)

16. CREDIT FOR BAD DEBTS

1. PURCHASES OF PRODUCTS FOR RESALE (NON IMPORTED INVENTORY)

16(a) Amount of credit for sales made during the period

+

1(a) Exempt Purchases of Inventory for Resale

+

+

16(b) Excess credit from prior periods

1(b) Taxable Purchases of Inventory for Resale

+

=

16(c) Total Available Credit (Add lines 16(a) and 16(b))

1(c) TOTAL PURCHASES OF PRODUCTS FOR RESALE

=

(Add lines 1(a) and 1(b))

16(d) Amount of Credit Used in this Return (Cannot be

=

AUTOCONSUMPTION AND USE OF INVENTORY (Do not include cents)

more than line 14 less line 15(d))

=

=

17. TAX LIABILITY (Line 14 less lines 15(d) and 16(d))

2(a) Use of Inventory (See instructions)

18. CREDIT FOR TAXES PAID BY MERCHANT IN THE IMPORT OF INVENTORY FOR RESALE

=

2(b) Autoconsumption (See instructions)

18(a) Amount paid for import of inventory for resale (Line

+

8(b) of Forms AS 2915.1 D)

2(c) Enter 50% of line 2(b)

X

+

18(b) Excess credit from prior periods

=

2(d) Add lines 2(a) and 2(c)

18(c) Amount paid in excess in the Tax on Imports

+

Monthly Return credited to this return (Line 17A

TAXABLE SALES (Do not include cents)

of Form AS 2915.1 D)

3. SALE OF TAXABLE TANGIBLE PERSONAL PROPERTY

=

18(d) Total Available Credit (Add lines 18(a) through 18(c))

+

3(a) Sales attributable to locations in Puerto Rico

18(e) Amount of Credit Used in this Return (Enter the

=

smaller of line 18(d) or 75% of line 17)

3(b) Sales by merchants who do not have commercial location

+

in Puerto Rico or multilevel businesses (See instructions)

19. CREDIT FOR TAXES PAID BETWEEN MERCHANTS FOR PURCHASE OF INVENTORY FOR RESALE

19(a) Amount paid for purchase of inventory for resale

+

3(c) Total Sales of Taxable Tangible Personal Property

=

(Multiply line 1(b) by 6%)

(Add lines 3(a) and 3(b))

+

+

19(b) Excess credit from prior periods

4. SALE OF TAXABLE SERVICES

=

19(c) Total Available Credit (Add lines 19(a) and 19(b))

+

5. TAXABLE ADMISSIONS

19(d) Amount of Credit Used in this Return (Enter the

=

6. RETURN OF TAXABLE ITEMS

smaller of line 19(c) or 75% of line 17)

7. TOTAL TAXABLE SALES (Add lines 3(c) through 5

=

20. TAX LIABILITY NET OF CREDITS (Line 17 less lines

=

and subtract line 6)

18(e) and 19(d))

EXEMPT SALES (Do not include cents)

21. SALES TAX OF MERCHANTS WHO DO NOT HAVE

COMMERCIAL LOCATION IN PUERTO RICO OR

=

8. SALE OF EXEMPT TANGIBLE PERSONAL

+

MULTILEVEL BUSINESSES (Multiply line 3(b) by 1%.

PROPERTY

See instructions)

+

9. SALE OF EXEMPT SERVICES

22. TAX DUE

=

(Add lines 20 and 21)

+

23. CREDIT FOR PAYMENTS IN EXCESS FROM

10. EXEMPT ADMISSIONS

PRIOR PERIODS

11. RETURN OF EXEMPT ITEMS

24. DEPOSITS MADE DURING THE PERIOD

12. TOTAL EXEMPT SALES (Add lines 8 through

=

25. BALANCE OF TAX DUE (Line 22 less lines 23 and 24.

=

10 and subtract line 11)

The result cannot be less than zero)

Number of check or money order

Amount paid

+

26. INTEREST

+

27. SURCHARGES

I hereby declare under penalties of perjury that this return has been examined by me, and to

the best of my knowledge and belief, it is true, correct and complete. I’m also aware that

+

28. PENALTIES

every returned check drawn on behalf of the Secretary of the Treasury will be subject to a

$25.00 minimum charge. This charge is in addition to any other interest, surcharges or

29. TOTAL AMOUNT DUE

penalties provided by the Code or any other fiscal law for omissions in fulfilling your tax

=

(Add lines 25 through 28)

responsibility. The Department will make the collection in a traditional or electronic manner.

30. CARRYOVER CREDIT FROM SALE OF MERCHANT’S

RECEIPT AND/OR PAYMENT STAMP

PROPERTY (Line 15(c) less line 15(d))

31. CARRYOVER CREDIT FROM BAD DEBTS (Line 16(c)

Name

less line 16(d))

32. CARRYOVER CREDIT FOR TAXES PAID BY IMPORTER

Title

MERCHANT (Line 18(d) less line 18(e))

33. CARRYOVER CREDIT FOR TAXES PAID BY RESELLER

Signature

MERCHANT (Line 19(c) less line 19(d))

34. AMOUNT OF TAXES PAID IN EXCESS (Excess of lines 23

and 24 over line 22)

Day

Month

Year

Retention Period: Ten (10) years.

1

1 2

2 3

3 4

4 5

5